- New wallet acquired $199.6M in Ethereum

- Smart money is buying the dip

- ETH accumulation hints at bullish outlook

In the past 48 hours, a newly created crypto wallet has made headlines by purchasing a staggering $199.6 million worth of Ethereum ( ETH ). This large-scale acquisition is not just a random move—it reflects a growing trend of smart money accumulating ETH during the market dip.

Ethereum, the second-largest cryptocurrency by market cap, has seen price corrections recently, but major investors are treating it as a buying opportunity. The wallet’s actions suggest confidence in Ethereum’s long-term value and utility in the crypto ecosystem.

Ethereum Accumulation in a Bearish Market

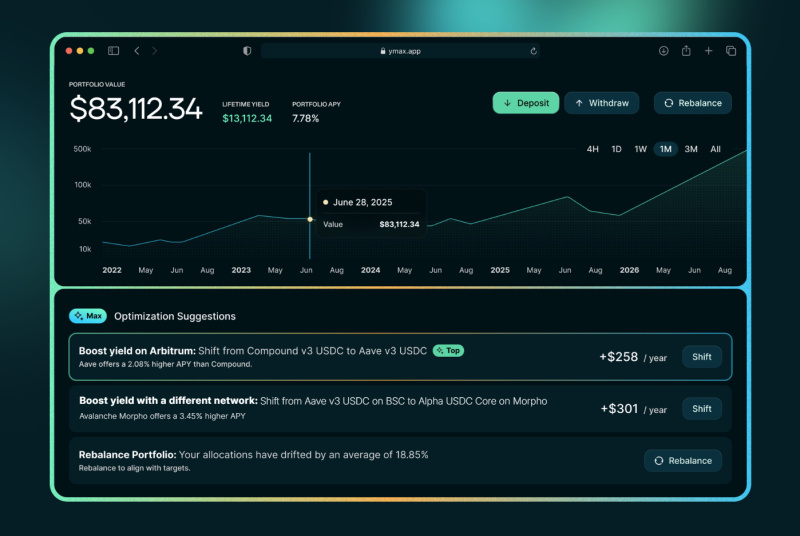

While many retail investors are cautious or even selling off their holdings, large wallets—often referred to as “smart money”—are taking a different approach. Buying nearly $200 million worth of ETH in just two days is no small move. These actions typically indicate inside confidence, potential institutional backing, or preparation for long-term staking or DeFi engagement.

This level of Ethereum accumulation can often precede a market reversal. Historically, when smart money enters during a downturn, it’s often a bullish signal for the broader market. If this trend continues, ETH could be poised for a strong comeback.

What This Means for Retail Investors

Retail traders often look to smart money for clues about market direction. This latest accumulation could serve as a wake-up call. While the broader market might still be shaky, Ethereum continues to attract capital from high-stakes investors who view the current dip as temporary.

As always, investors should do their own research, but it’s hard to ignore the message being sent by nearly $200 million in ETH purchases.

Read Also :

- BlackRock Holds Over $5B in Ethereum Reserves

- BlackRock, Fidelity Ark Buy $1B in Bitcoin

- Altcoins Breakout Looms as $1T Market Cap Nears

- 7 Best Cryptos to Watch in 2025 Before This Bull Run Breaks Loose

- PEPE Hits $5B Market Cap After 14% Daily Surge