Bitget goes live at MotoGP Germany with immersive Web3 racing zone

Bitget’s partnership with MotoGP gave it a presence at a major German Grand Prix racing event.

Crypto firms are once again spending millions on mainstream sports partnerships. On Monday, July 14, crypto exchange Bitget unveiled the latest initiative in its multi-million dollar partnership with MotoGP. Over the weekend, the firm was present at the latest German Grand Prix racing event in Sachsenring.

At the event, Bitget set up an interactive fan zone booth with a MotoGP bike simulator. Bitget also gave out merchandise, promoting its trading platform to tens of thousands of attendees at the racing event. According to Bitget CEO Gracy Chen, the exchange plans to use this partnership to tap into 50 million of MotoGP’s fanbase.

“Our presence at MotoGP Germany is about bringing crypto closer to people who seek the finer adventures of life,” said Gracy Chen, CEO of Bitget. “From on-track adrenaline to on-chain innovation, we’re helping users explore how trading can be as thrilling and rewarding as a world-class race.”

Along with this partnership, Bitget is also launching a Smarter Speed Challenge, a racing minigame tied to rewards on its platform. According to the platform, traders who engage with the minigame will receive exclusive rewards.

Crypto firms increase sports spend to $565m

Bitget is just one of the major crypto exchanges leveraging sports partnerships to reach a mainstream audience. The crypto industry increased its spending by 20% various sports partnerships during the 2024–2025 season. Total spending during that period reached $565 million, with Crypto.com as the biggest spender.

The most popular recipients were the UEFA Champions League and Formula One, totaling $213 million. Still, despite a steady increase in spending over the years, the industry has yet to surpass its record spend during the 2022–2023 season. At that time, just before the collapse of FTX , the industry spent a total of $685 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

She became part of Block to work on AI projects. Just a few weeks after, AI led to her losing her position.

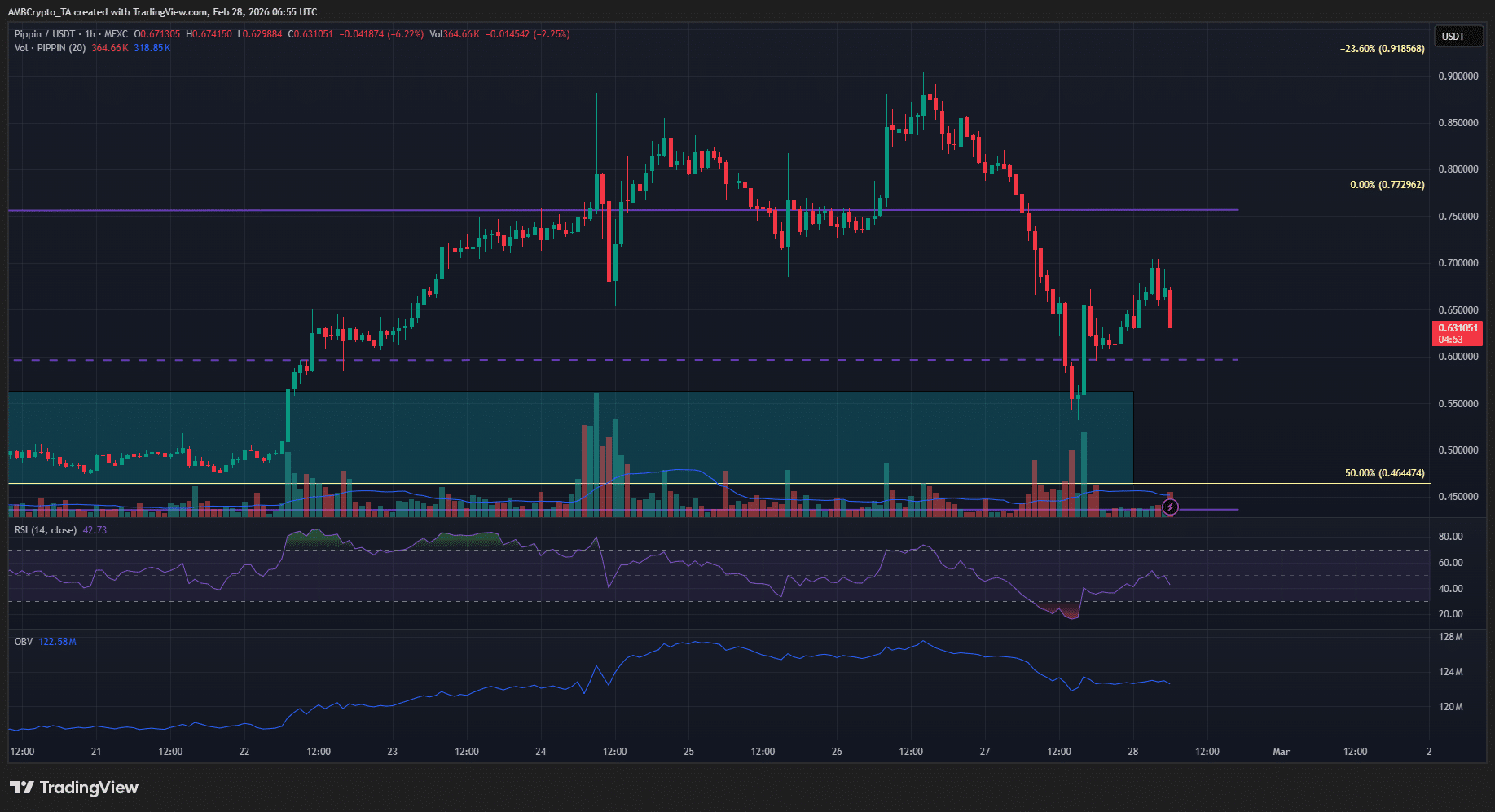

PIPPIN retraces after false breakout: Should traders buy or sell?

5年涨超20倍!比特币影子股MicroStrategy飙涨背后暗藏什么玄机?

What are the Implications for Oil Markets Following Trump’s Actions Against Iran