SEC Delays Trump Media’s Bitcoin ETF Alongside Solana and Litecoin Filings

The SEC continues to delay several altcoin ETF applications, including Truth Social's Bitcoin ETF and Grayscale's Solana fund. Despite setbacks, approval for these products could still be on the horizon.

The SEC is delaying several ETF applications today, including Truth Social’s Bitcoin ETF. Other products in the queue include Grayscale’s Solana ETF and Canary Capital’s Litecoin fund.

Additionally, VanEck’s AVAX ETF faces another deadline, but further setbacks seem likely. The Commission appears sympathetic to creating these new products, but is trying to buy as much time as possible.

New Wave of ETF Delays

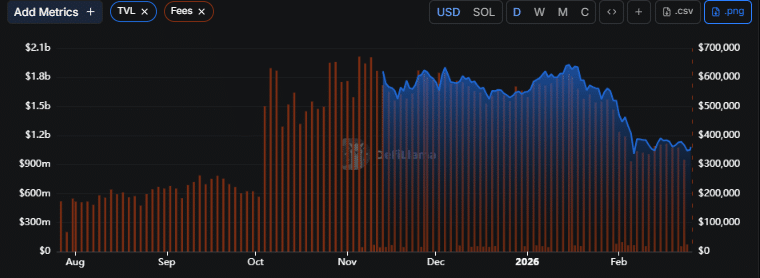

Although the SEC is currently under new management, it hasn’t necessarily led to a bonanza of altcoin ETFs. Dozens of fresh ETF filings are waiting approval, but the Commission has consistently delayed a wide swath of applications. Today, it’s postponing two more, including Truth Social’s Bitcoin ETF, a Solana ETF from Grayscale, and Canary’s Litecoin ETF.

Unverified reports first came through social media, but SEC documents confirmed the facts. The Commission is delaying Trump Media’s Truth Social BTC ETF, which it first pursued in early June. This is the first of several Trump-themed crypto ETFs in the making, but more have followed. The SEC set a new deadline, which may get pushed back again:

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein. Accordingly, the Commission…designates September 18, 2025, as the date by which the Commission shall either approve or disapprove, or institute proceedings to determine whether to disapprove, the proposed rule change,” the SEC claimed.

Recently, the Commission has been in a noticeable pattern of delaying fresh altcoin ETFs. However, experts have theorized that the SEC is ultimately sympathetic to approving them. Nonetheless, it’s implementing as many delays as possible to buy time to establish a proper legal framework.

Case in point, the Commission recently approved a multicoin basket product from Grayscale. However, it imposed another delay on this ETF the following day. The SEC used up its maximum number of extensions but employed this unorthodox move to buy more time. If the Commission wanted to reject this product outright, it could’ve done so easily.

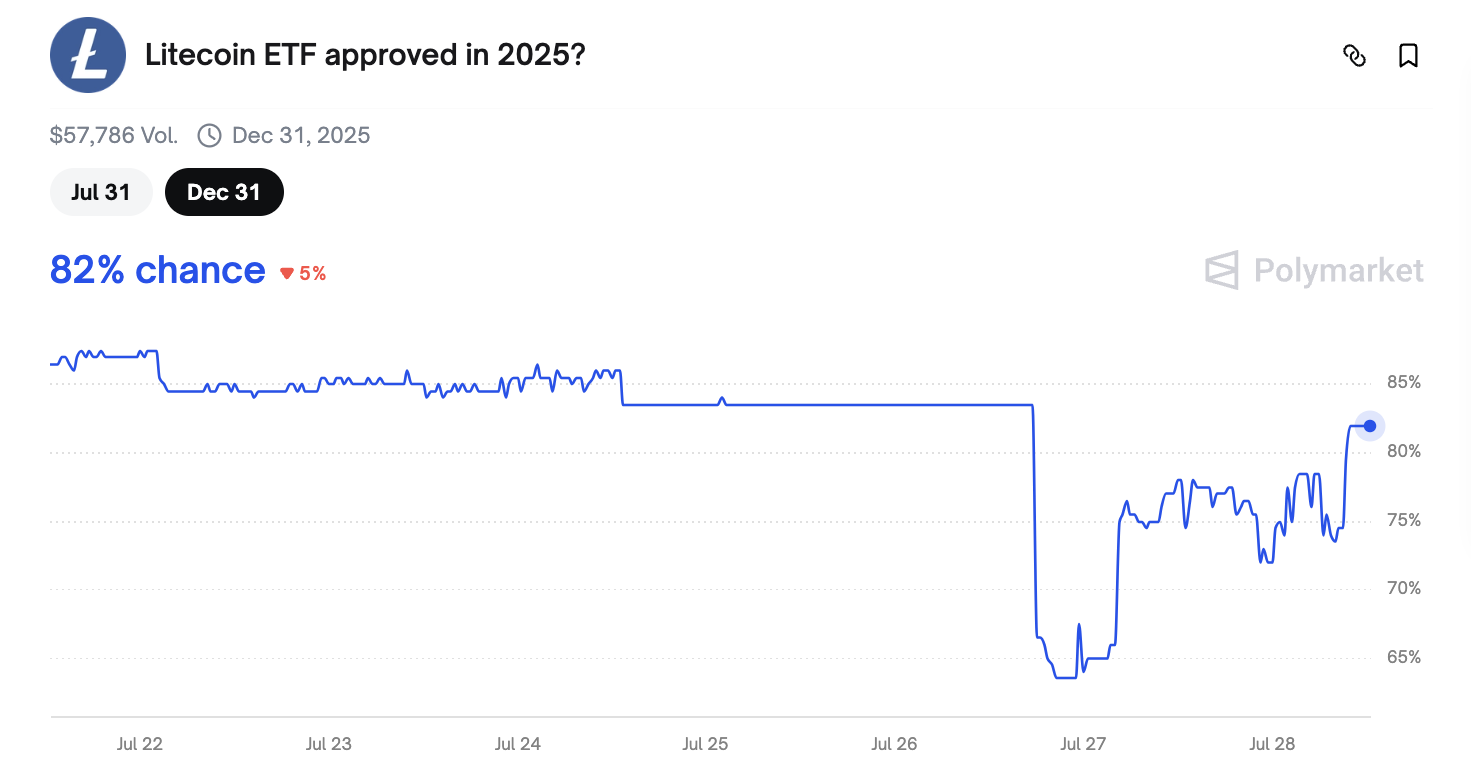

In other words, altcoin ETF fans shouldn’t treat these delays as a major setback. Community optimism about future approval is still high, especially because the SEC is actively considering streamlined application processes. Despite today’s Litecoin ETF setback, Polymarket approval odds remain high.

Odds of Litecoin ETF Approval. Source:

Polymarket

Odds of Litecoin ETF Approval. Source:

Polymarket

The SEC has another deadline today, regarding VanEck’s AVAX ETF. This product could win approval soon, or it could be the fourth such asset to face another setback. Either way, in the long run, the odds of success are still looking quite bullish.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DoubleZero gains 11% – Analyzing if 2Z can hold above $0.08

Barrick Mining Shares Edge Up 0.20% on Strong Earnings Beat Despite 323rd-Ranked Volume