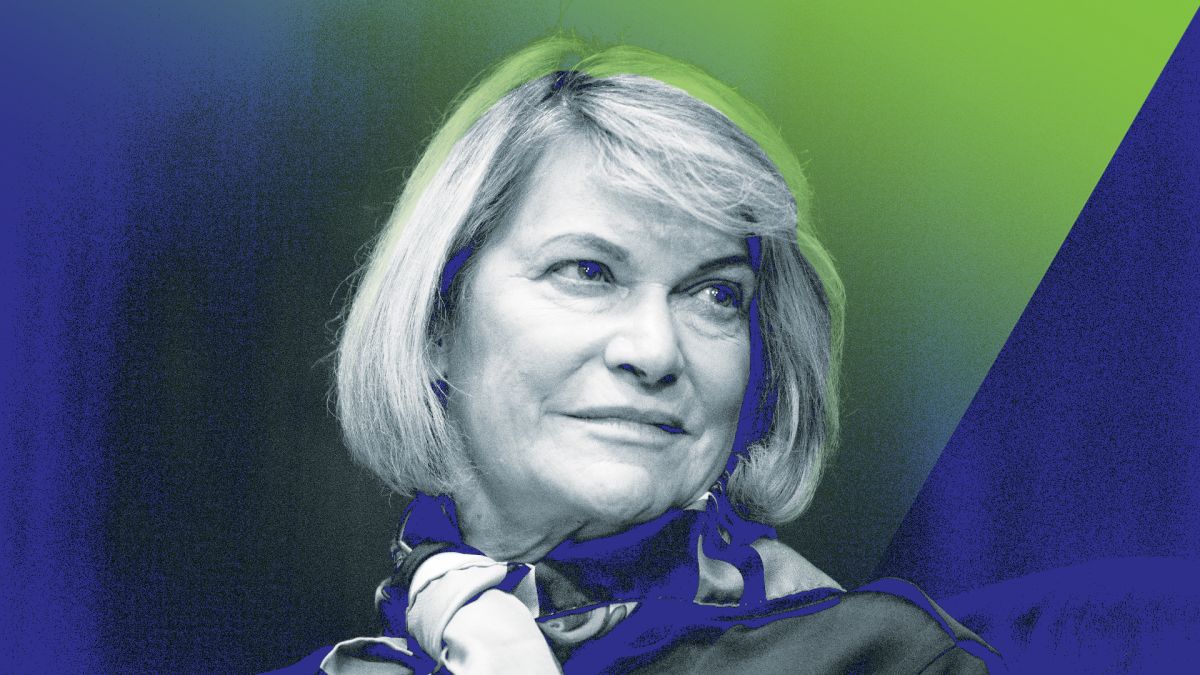

Sen. Lummis introduces bill requiring Fannie Mae and Freddie Mac to consider crypto as an asset for mortgages

Quick Take The Wyoming Senator said her legislation, the 21st Century Mortgage Act, would help people build wealth, in a statement on Tuesday. The crypto-friendly lawmaker pointed to younger Americans struggling to buy homes and their use of cryptocurrency.

Republican Sen. Cynthia Lummis introduced a bill that would put into law an order from a U.S. housing agency directing Fannie Mae and Freddie Mac to evaluate cryptocurrency as an asset for mortgages.

The Wyoming Senator said her legislation, the 21st Century Mortgage Act, would help people build wealth, in a statement on Tuesday.

"This legislation embraces an innovative path to wealth-building keeping in mind the growing number of young Americans who possess digital assets," Lummis said. "We’re living in a digital age, and rather than punishing innovation, government agencies must evolve to meet the needs of a modern, forward-thinking generation.”

Last month, U.S. Federal Housing Finance Agency Director William Pulte ordered both Fannie Mae and Freddie Mac to "prepare a proposal for consideration of cryptocurrency as an asset for reserves in their respective single-family mortgage loan risk assessments." Fannie Mae and Freddie Mac were created by Congress and are tasked with providing liquidity and stability to the mortgage market in part by buying mortgages from lenders.

Lummis said her bill would require Fannie Mae and Freddie Mac to include crypto "recorded on a cryptographically-secured distributed ledger" for assessing mortgage risk for single-family home loans. The legislation also prohibits the forced conversion of cryptocurrency holdings into U.S. dollars.

However, the proposal has sparked pushback from Democratic lawmakers concerned about the volatility of digital assets. In a letter to Director Pulte last week, Sen. Elizabeth Warren, other Democrats and Independent Sen. Bernie Sanders warned that incorporating cryptocurrencies into mortgage underwriting could be risky for the broader financial system.

"Expanding underwriting criteria to include the consideration of unconverted cryptocurrency assets could pose risks to the stability of the housing market and the financial system," they said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know