Standard Chartered Sees Ethereum Hitting $4K by 2025

- Standard Chartered forecasts Ethereum to hit $4,000 by late 2025, driven by institutional demand.

- Institutions drive Ethereum adoption as treasury allocations and corporate interest surge.

- Technicals show ETH is overbought, and bullish MACD supports upward potential.

Standard Chartered has projected that Ethereum (ETH) could reach the $4,000 mark by late 2025, driven by sustained institutional interest and increasing adoption by treasury-heavy public firms. The bank’s outlook aligns with the ongoing trend of corporate entities accumulating ETH as part of their digital asset strategy. Currently, these firms are estimated to hold approximately 1% of Ethereum’s total supply, surpassing Bitcoin holdings among similar entities.

This shift signals a growing preference for Ethereum among institutions seeking blockchain exposure through balance sheet diversification. Restrictions on direct crypto investments in several jurisdictions have prompted investors to turn to public companies with significant ETH reserves as a proxy. The bank’s projection underscores the role of Ethereum as a preferred vehicle for institutional crypto exposure in the near term.

On-Chain and Technical Indicators Reflect Heightened Market Activity

Ethereum’s market performance showed mixed signals over the past 24 hours. The asset experienced a modest 0.92% decline, with its price dropping from approximately $3,878 to $3,849. Despite the minor decrease, trading activity surged notably. The 24-hour trading volume rose by 14.82%, reaching $36.52 billion, indicating sustained investor interest and higher transaction throughput.

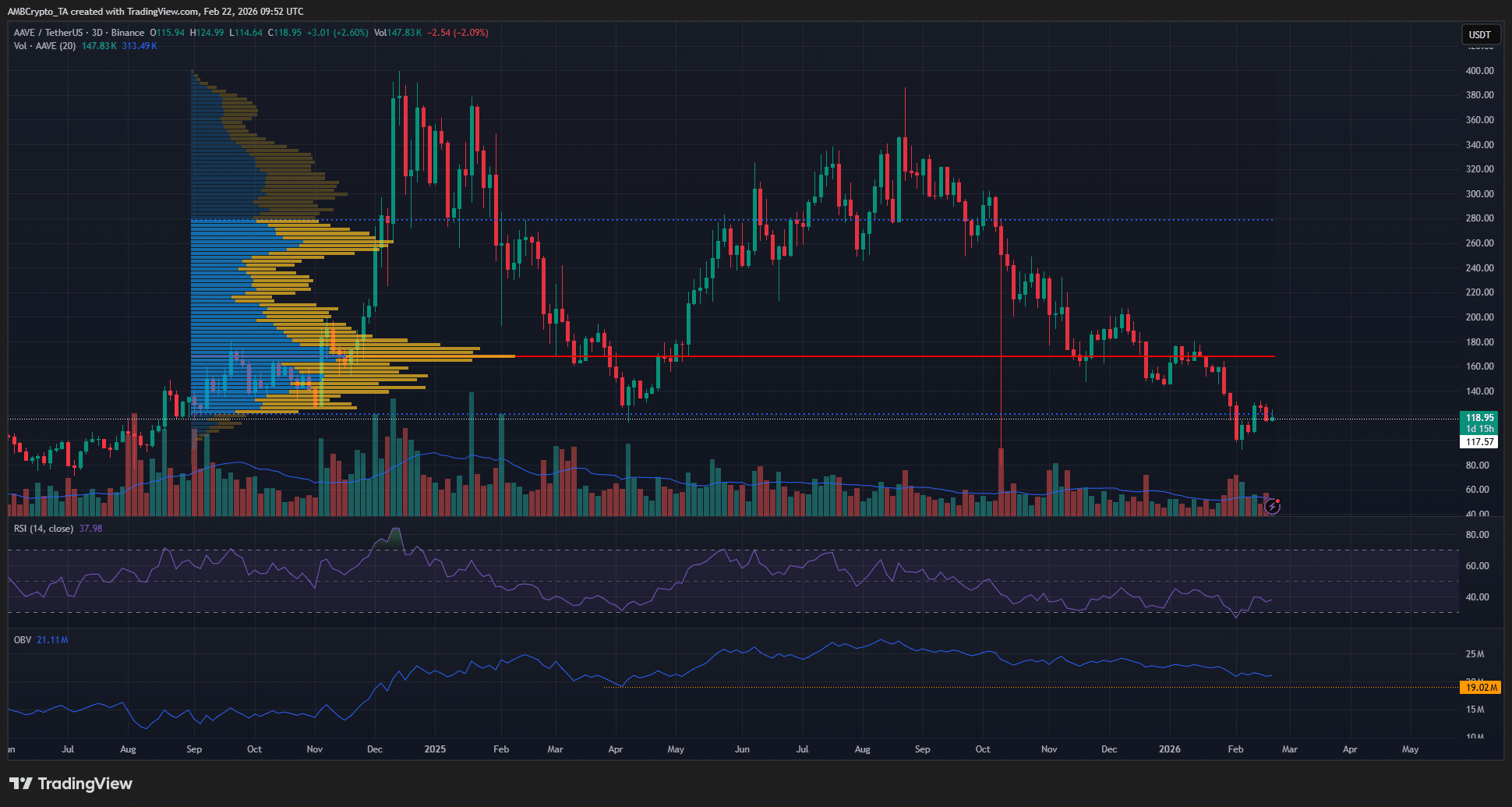

Source:

Tradingview

Source:

Tradingview

From a technical perspective, the Relative Strength Index (RSI) currently stands at 77.03, placing ETH in the overbought range. This could suggest a near-term pullback or consolidation period. However, the Moving Average Convergence Divergence (MACD) indicator remains bullish. Although the declining green histogram and the narrow gap between the MACD and signal lines indicate a possibility of a bearish crossover.

Related: BTCS Raises $10M Through Convertible Offerings, Increases Ethereum Holdings

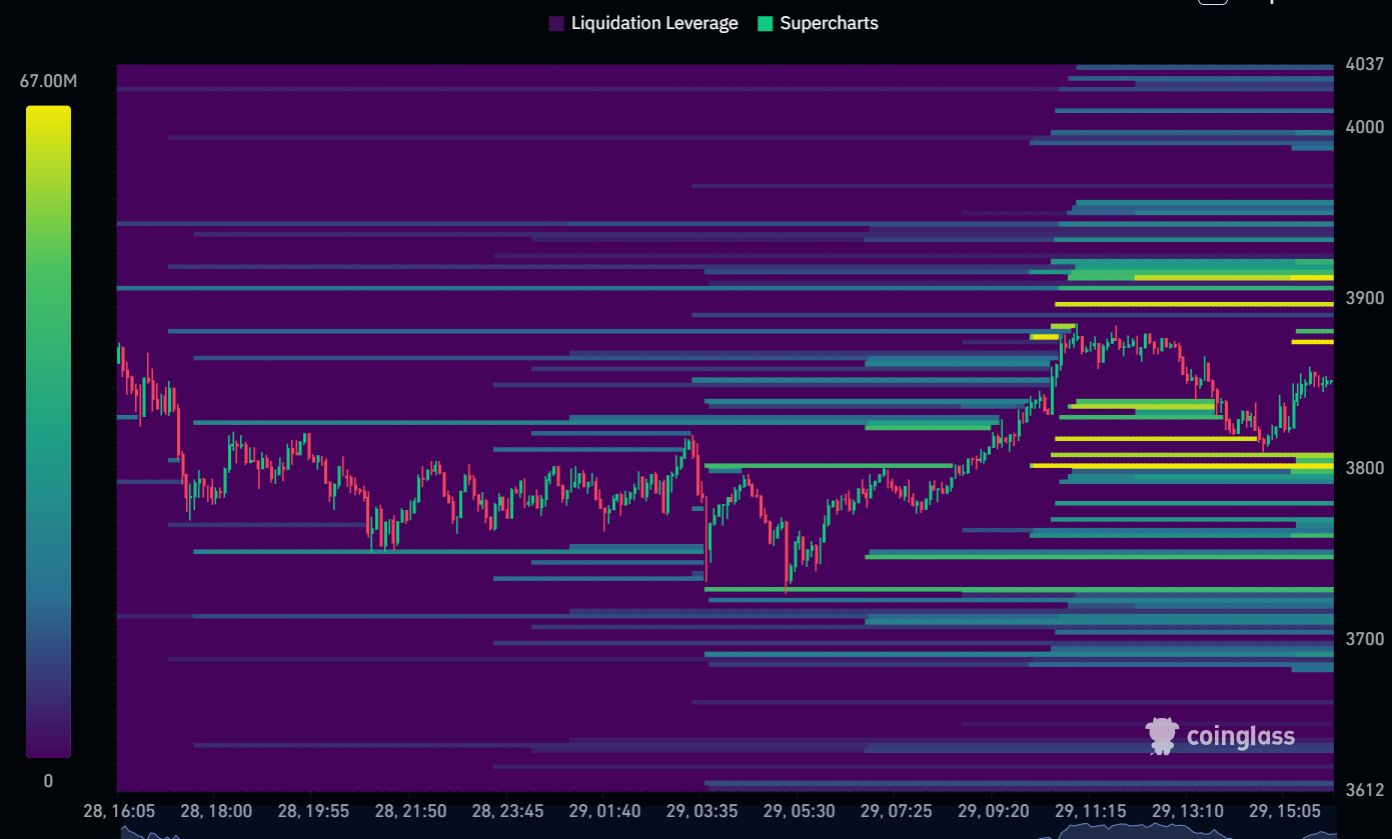

Volume Surge and Liquidation Zones Indicate Market Sensitivity

The trading volume of Ethereum has been experiencing an increase in volatility due to the massive price surge. On July 29, the volume has gone up to $109.70 billion with the price hitting $3,797.91. The sharp uptick in volume also suggests heightened speculation and momentum trading, as traders respond to Ethereum’s breakout above key resistance levels.

Source:

Coinglass

Source:

Coinglass

There is a huge amount of liquidation in the range of $3,780 to $3,900. This cluster indicates the existence of many leveraged positions, which can inject volatility as prices trade through these thresholds.

Source:

Coinglass

Source:

Coinglass

Ethereum is solidifying its position as a key crypto asset in corporate strategies, as institutional investment continues to grow. This increasing presence of publicly traded treasury-heavy companies could play a major role in shaping price and market form in the next several months.

Could ETH Hit $4K? Momentum Builds as Institutions Fuel the Rally

As interest grows among institutions, trading volumes reach new records, and technical indicators are healthy, Ethereum is at a critical inflection point. Although short-term volatility and overbought indicators indicate that ETH may be about to enter periods of decline, the overall movement suggests that the cryptocurrency may be about to take one more step towards the upside, possibly reaching the $4000 area sooner than anticipated.

The post Standard Chartered Sees Ethereum Hitting $4K by 2025 appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Lies Ahead for Ripple (XRP) and Dogecoin (DOGE)? Analysis Firm Says They Are at a Critical Turning Point

Is Aave’s 29% bounce bull trap? Decoding the long-term bearish pressure

Michael Burry Says He 'Slept' on Bitcoin After Early 2013 Buying Opportunity

After the Supreme Court Blocks Tariff Blow, Trump Opens a New Path