- XRP price holds at $2.86 after a 10% weekly drop, with support at $2.75 and resistance at $2.97.

- RSI at 48.91 and MACD mixed readings indicate a neutral but uncertain short-term market direction.

- Persistent rejection at $2.97 continues to limit upside momentum despite steady support near $2.75.

XRP’s market price continues to experience downward pressure after a sharp decline over the past week. The cryptocurrency now trades at $2.86, reflecting a 10.0% decrease within the last seven days. Typically, its value relative to Bitcoin stands at 0.00002512 BTC, reflecting a 3.7% movement.

Ironically, notwithstanding this change, the market remains intent on two essential levels: support at about $2.75 and resistance around $2.97. These levels now set the short-term range and are gaining much attention from market analysts tracking price stability.

Technical Indicators Show Mixed Momentum

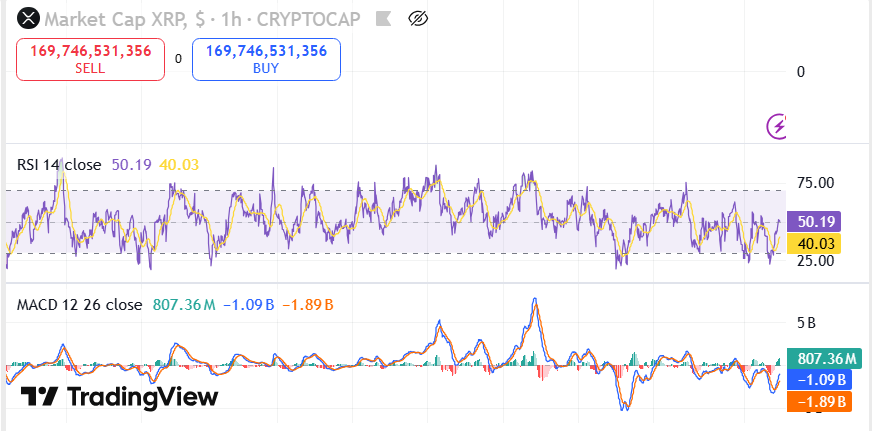

On the hourly chart, the Relative Strength Index (RSI) stands at 50.19 readings, with its signal line at 39.94. Such levels make XRP fall under neutral zones, implying no oversold/overbought state. However, the Moving Average Convergence Divergence (MACD) reflects a more divided picture.

Source: TradingView

Source: TradingView

The indicator shows a positive histogram at 785.03 million, offset by selling pressure near -1.11 billion and stronger negative flows of -1.9 billion. This balance between opposing forces underscores the market’s indecisive behavior within the current range.

XRP Trapped Between Support and Resistance

Although XRP trades closer to the middle of its defined range, $2.75 continues to serve as a firm support level. This zone has repeatedly attracted buying interest whenever price weakness emerges. On the other hand, $2.97 remains the immediate ceiling for bullish attempts.

Notably, each time XRP approached this level, sellers managed to push the price lower. This repeated rejection has reinforced $2.97 as a critical barrier, limiting upward momentum in recent sessions.

Consolidation Persists Amid Mixed Technical Signals

These technical signals remain tightly linked, with price action consolidating between the observed support and resistance levels. The RSI movement around its mid-range supports this consolidation view, while MACD readings emphasize the struggle between buyers and sellers.

Besides, the weekly 10% fall of XRP underscores the importance of consistent demand to recover lost momentum. Until price is outside these limits, the immediate trend in the market is likely to be limited within this sideways trading range pattern