TradFi giant SBI Holdings floats first-ever Bitcoin, XRP ETF launch in Japan

Key Takeaways

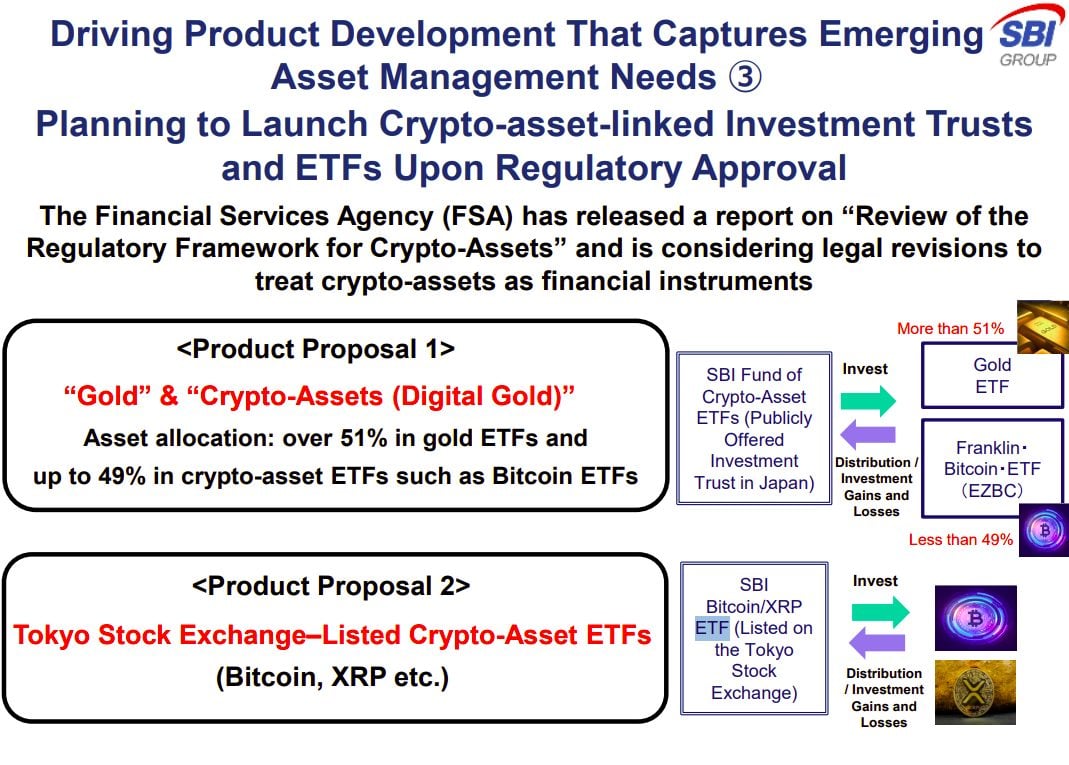

- SBI Holdings expects to launch Japan's first crypto ETFs, focusing on XRP, Bitcoin, and a blended 'Digital Gold' ETF.

- The crypto ETF will provide investors with direct exposure to both XRP and Bitcoin via traditional financial instruments.

SBI Holdings, Japan’s financial conglomerate with active operations in banking, securities, asset management, and fintech, has floated plans to introduce Bitcoin and XRP exchange-traded funds (ETFs) on the Tokyo Stock Exchange, subject to forthcoming regulatory changes.

In its latest financial results presentation , SBI has outlined two proposals designed to capture the growing demand for digital asset management and take advantage of potential legal revisions currently under review by Japan’s Financial Services Agency (FSA).

The first is a hybrid investment trust combining traditional gold ETFs with crypto-asset ETFs like Franklin’s Bitcoin ETF (EZBC), with up to 49% allocated to crypto.

The second is a crypto ETF proposed for listing on the Tokyo Stock Exchange. The SBI Bitcoin/XRP ETF is cited as an example, signaling readiness to launch pending regulatory approval. These ETFs would trade like any listed security, targeting wider retail and institutional access.

Earlier this year, the FSA released a discussion paper on revising the crypto regulatory framework, proposing to reclassify crypto assets as financial instruments, balancing innovation with investor protection and closing regulatory gaps.

The proposal would pave the way for the legalization and regulation of crypto ETFs, meaning these products could be officially offered in Japan under strict regulatory oversight comparable to traditional securities.

SBI’s move could increase the institutional adoption of XRP and other digital assets in Japan’s regulated investment market. Japan has maintained a relatively structured approach to crypto regulation compared to other major economies.

SBI Holdings has shown interest in crypto assets and blockchain technology through various business ventures and partnerships.

In April 2024, Franklin Templeton and SBI Holdings entered into a partnership to form a new crypto ETF management company in Japan. The parties have signed a Memorandum of Understanding to provide young investors with greater access to diversified investment vehicles, including crypto-based ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know