Are Public Companies Buying Bitcoin, or Just Diluting Shares to Get It?

Satsuma Technology's $217 million fundraising round revealed an opaque BTC-for-stock exchange that could impact Bitcoin market dynamics and dilute retail investors' shares.

Satsuma Technology, a British Bitcoin treasury firm, concluded a $217 million fundraising round today. More than half of these funds, however, consisted of direct BTC donations, which Satsuma exchanged for company stock.

By avoiding the open market, these trades become difficult to measure through BTC demand and may dilute retail investors’ own shares. It’s unknown how many companies engage in the practice, but it could introduce market instability.

Treasury Firm Trades Bitcoin for Shares

Companies around the world are building massive Bitcoin treasuries, led by firms like Strategy, which are fiercely committed to the plan.

However, a growing rumor in the community suggests that many of these firms aren’t actually buying BTC in the way investors assume. Instead, they may be acquiring it through direct trades.

Many bitcoin treasury companies aren't buying BTC. They are gifted BTC in exchange for discounted shares. pic.twitter.com/RsRrvGhiKa

— Pledditor (@Pledditor) August 6, 2025

Earlier today, Satsuma Technology, a British firm, announced a $217 million fundraising round to fuel a Bitcoin treasury.

However, a closer look at company documents reveals a more complicated story. The majority of this fundraising round, $128 million, consisted of direct BTC donations. In other words, fiat currency didn’t change hands in these deals.

Could This Dilute Retail Holdings?

So, why would this matter to the crypto market? Essentially, most companies with Bitcoin treasuries are trading at significant premiums to their net BTC assets.

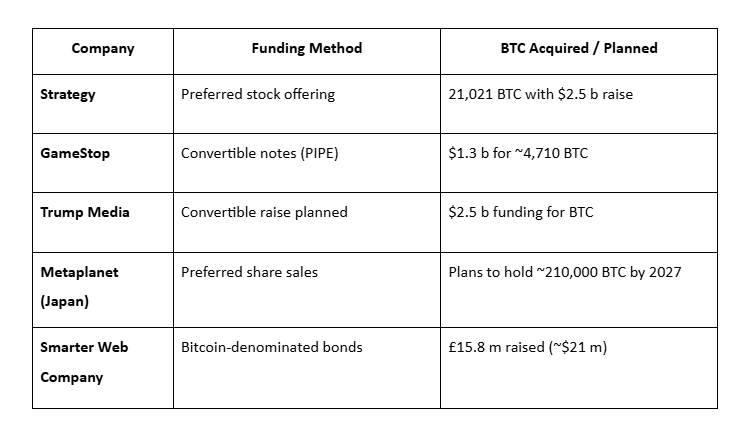

Strategy (formerly MicroStrategy), Metaplanet, and GameStop have raised billions through stock dilution to buy Bitcoin, inflating BTC-per-share while eroding equity value.

Corporate Bitcoin Funding. Source:

BeInCrypto

Corporate Bitcoin Funding. Source:

BeInCrypto

But what if these companies didn’t need to buy BTC on the open market? Building these corporate treasuries might not increase the demand for Bitcoin.

Moreover, the process is very opaque, leading some to compare it to premined tokens. If these companies offer a discount for shares purchased in this manner, it could dilute retail investors’ holdings.

The lack of transparency is at the heart of the issue here. To be clear, Satsuma’s press release didn’t directly claim that it traded shares at a discount for Bitcoin. That will retroactively be true if the share prices go up soon, since retail investors didn’t have access to this fundraising round.

Nonetheless, this is a case of clever financial engineering. The situation is very ambiguous, and it’s hard to make definitive claims without more information.

Investors seem less concerned with earnings or fundamentals and more with a new benchmark—BTC-per-share yield. Companies that can increase the amount of Bitcoin backing each share often see their stock outperform peers.

It’s a feedback loop: raise capital, buy BTC, increase BTC/share, watch the stock climb, repeat.

However, this only works in a rising BTC market. If Bitcoin corrects sharply, these same companies could face significant equity drawdowns, while shareholders are left holding diluted stock and paper losses.

Overall, there is a lot of misunderstanding about how quickly some companies raise capital and deploy it into BTC, creating the appearance of “instant” BTC ownership. But the dilution is real, and clearly documented in regulatory filings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know