Hong Kong’s first HKD stablecoin race begins as Standard Chartered files early

Standard Chartered has partnered with Animoca Brands and Hong Kong telecom group HKT to establish Anchorpoint Financial, a joint venture applying for a license to issue a Hong Kong dollar-backed stablecoin under the city’s new regulatory regime.

As Reuters reported, the venture formally notified the Hong Kong Monetary Authority (HKMA) of its intent just days after the law governing fiat-referenced stablecoins took effect on August 1.

The move follows more than a year of collaboration between the three firms in the HKMA’s stablecoin issuer sandbox, which began last year. Standard Chartered is contributing banking infrastructure and governance frameworks, Animoca brings blockchain ecosystem expertise, and HKT is providing telecommunications and mobile payments integration. The partners announced their plan to form a licensed stablecoin issuer in February, contingent on the finalization of the legislation.

Hong Kong’s Legislative Council passed the Stablecoin Issuers Bill on May 21, establishing licensing requirements for entities issuing fiat-pegged digital tokens. The framework mandates full reserve backing, redemption rights, and risk management standards, with the HKMA as the licensing authority. Per Reuters, the first batch of licenses is expected in early 2026, and industry participants anticipate only a small number will be granted initially.

Hong Kong stablecoin rules

Under the new law, issuers must verify the identity of each stablecoin holder, a requirement the HKMA says is necessary for anti-money laundering compliance. As Reuters reported, some industry participants have warned that such rules could reduce adoption by limiting the ability to use tokens in unhosted wallets or privacy-preserving applications.

The HKD-backed stablecoin proposed by Anchorpoint would be issued and redeemed under HKMA oversight, operating within a fully regulated environment. The partners have positioned the token as both a settlement instrument for cross-border trade and a gateway for Web3 applications within Animoca’s ecosystem, leveraging HKT’s existing mobile payment reach to connect to retail users in Hong Kong and beyond.

The licensing regime represents a rare meeting of traditional finance, technology, and telecom infrastructure in a single digital asset initiative. Anchorpoint’s early filing positions it among the first to attempt compliance with the city’s stringent standards, competing with other sandbox participants such as Jingdong Coinlink and RD InnoTech. The HKMA has said its review process will evaluate technical resilience, reserve management, and compliance readiness before approving any issuance.

While market reception will depend on factors such as transaction costs, integration with existing payment systems, and regulatory interpretation of the identity verification rules, the filing marks a step toward regulated, fiat-pegged digital currencies entering mainstream circulation in Hong Kong.

With licensing decisions expected early next year, the venture’s progress will be shaped by the pace and outcome of the HKMA’s evaluation process.

The post Hong Kong’s first HKD stablecoin race begins as Standard Chartered files early appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cheniere Energy: An Institutional Conviction Buy Amidst Sector Rotation

又一美联储理事呼吁:谨慎对待进一步降息!

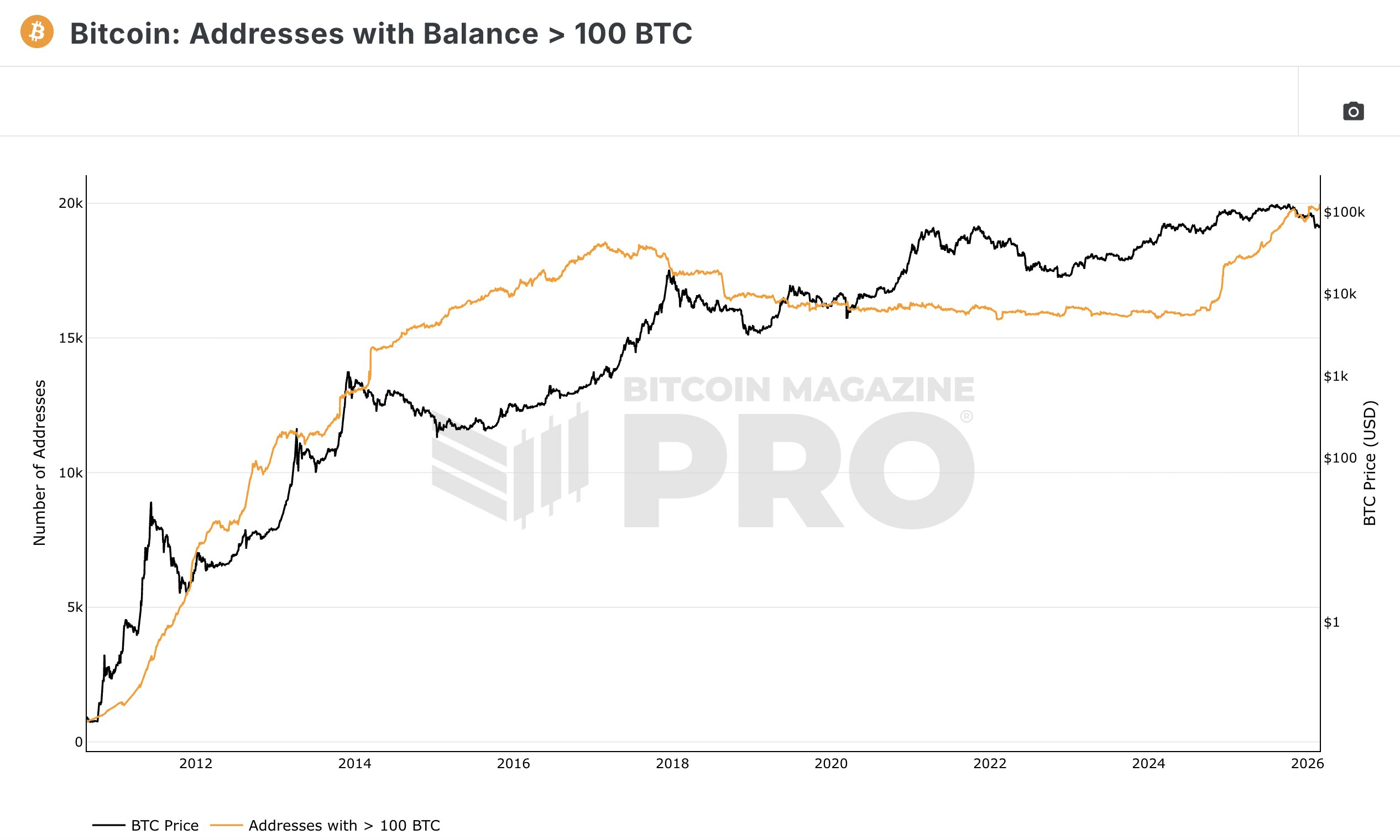

Bitcoin whale addresses holding 100 BTC hit ATH – Strategic play for H2 rally?