XRP price is projected to reach $4.50 in the coming months as it breaks out of a bullish pattern, supported by a significant increase in trading volume.

-

XRP futures volumes surged over 200% in the last 24 hours.

-

XRP’s price chart indicates a bull flag targeting $4.50 by September or October.

-

Open interest in XRP futures climbed 15%, reflecting heightened trader interest.

XRP price is on the rise, potentially reaching $4.50 as trading volumes increase significantly, driven by recent legal developments.

| $12.4 billion | Over 200% increase | Surpassed Solana’s $9.6 billion |

What is Driving XRP’s Price Surge?

XRP price is climbing due to a breakout from a bullish continuation pattern, which is supported by a significant increase in trading volume. The recent agreement between Ripple and the SEC has also contributed to this positive momentum.

How Are Futures Volumes Impacting XRP?

XRP futures trading volume spiked over 200% in the past 24 hours, reaching $12.4 billion. This surge indicates heightened trader interest, especially following the conclusion of the SEC lawsuit against Ripple.

Frequently Asked Questions

What factors are influencing XRP’s price?

The recent legal developments between Ripple and the SEC, along with increased trading volumes, are key factors driving XRP’s price upward.

How does XRP’s trading volume compare to other cryptocurrencies?

XRP’s trading volume has recently surpassed Solana’s, indicating a strong interest from traders and potential for further price increases.

Key Takeaways

- XRP’s price is on the rise: Anticipated to reach $4.50 due to bullish patterns.

- Futures volume has surged: Over 200% increase indicates strong trader interest.

- Legal clarity boosts confidence: The resolution of the SEC lawsuit has positively impacted XRP’s market sentiment.

Conclusion

XRP’s recent price movements reflect a strong bullish sentiment, driven by increased trading volumes and positive legal outcomes. As traders remain optimistic, the price could potentially reach $4.50 in the coming months, making it a cryptocurrency to watch closely.

-

XRP price could continue to climb toward $4.50 over the next few months as it breaks out of a classic bullish continuation pattern.

-

XRP futures volumes have popped by over 200% in the last 24 hours.

-

XRP price chart bull flag targets $4.50 by September or October.

XRP price is on the rise, potentially reaching $4.50 as trading volumes increase significantly, driven by recent legal developments.

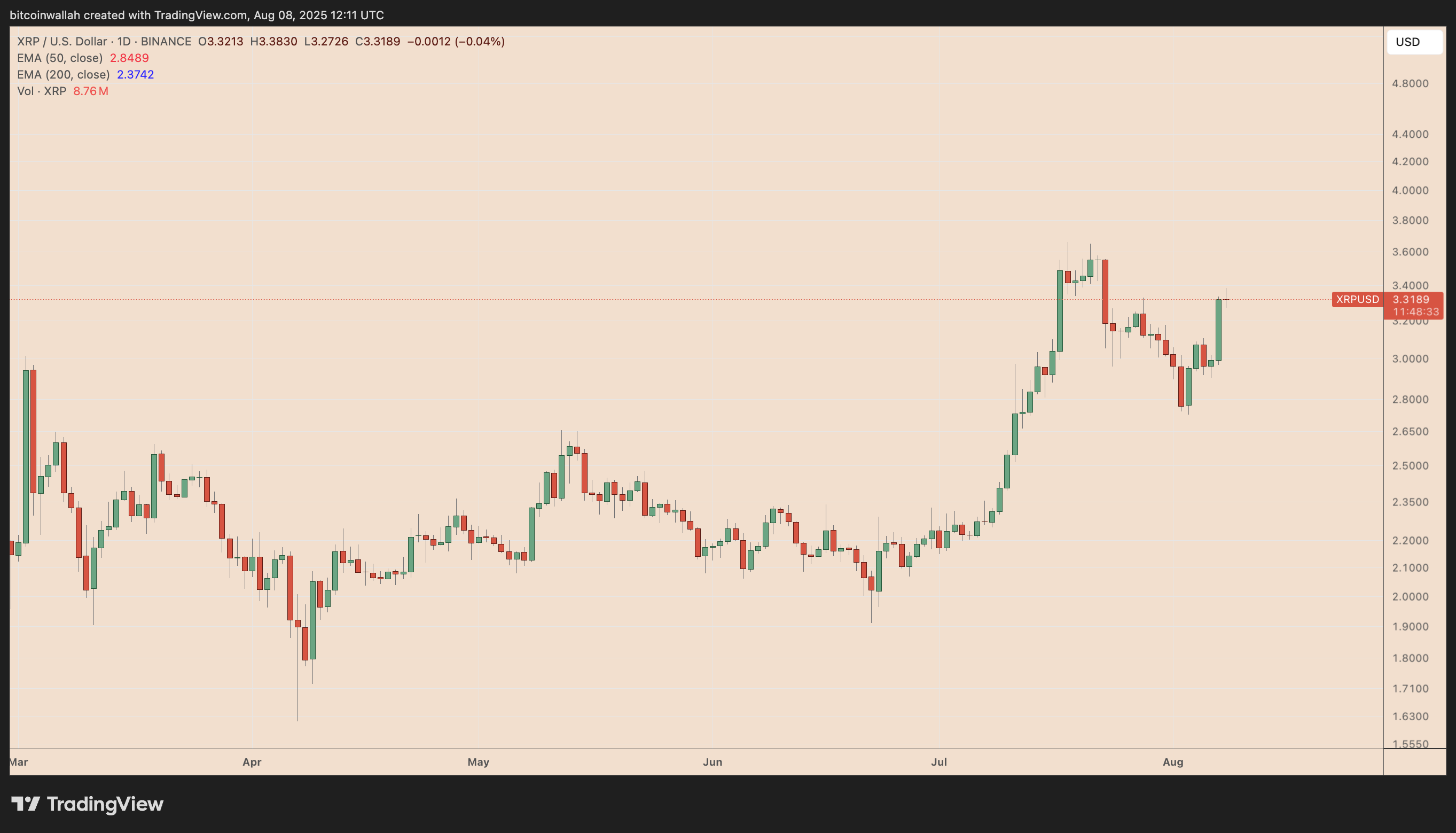

XRP/USD daily price chart. Source: TradingView

XRP/USD daily price chart. Source: TradingView

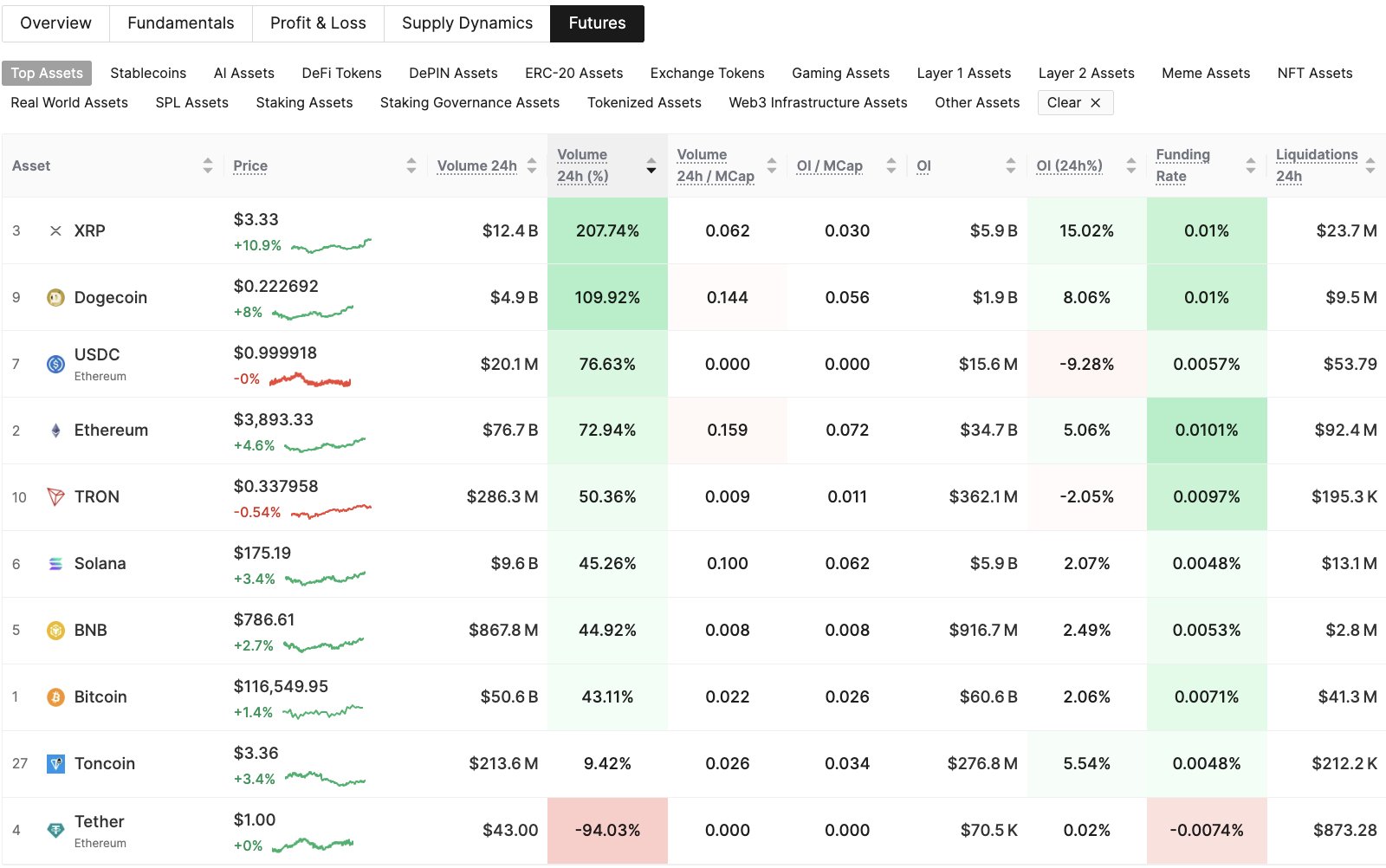

XRP futures volume surpasses Solana

XRP futures trading volume spiked over 200% in the past 24 hours to $12.4 billion, overtaking Solana’s $9.6 billion, according to onchain data resource Glassnode.

XRP vs. other cryptocurrencies’ futures data as of Friday. Source: Glassnode

XRP vs. other cryptocurrencies’ futures data as of Friday. Source: Glassnode

Rising futures volume often reflects heightened trader interest and speculative positioning, especially after major news events. In XRP’s case, it’s the end of the long-running SEC vs. Ripple lawsuit.

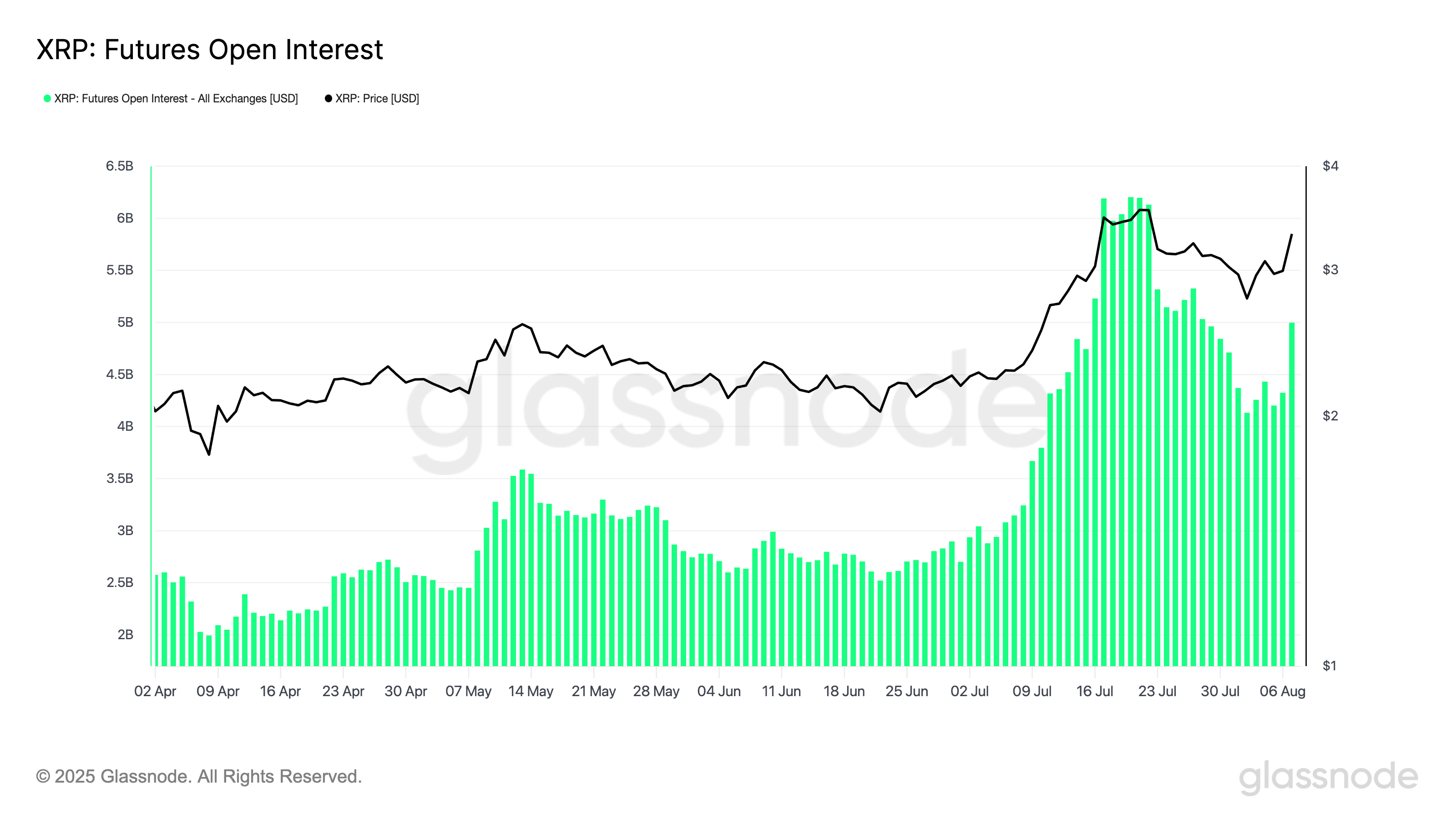

Open interest, which shows the value of unsettled futures contracts, also climbed 15% to around $5 billion.

XRP open interest chart. Source: Glassnode

XRP open interest chart. Source: Glassnode

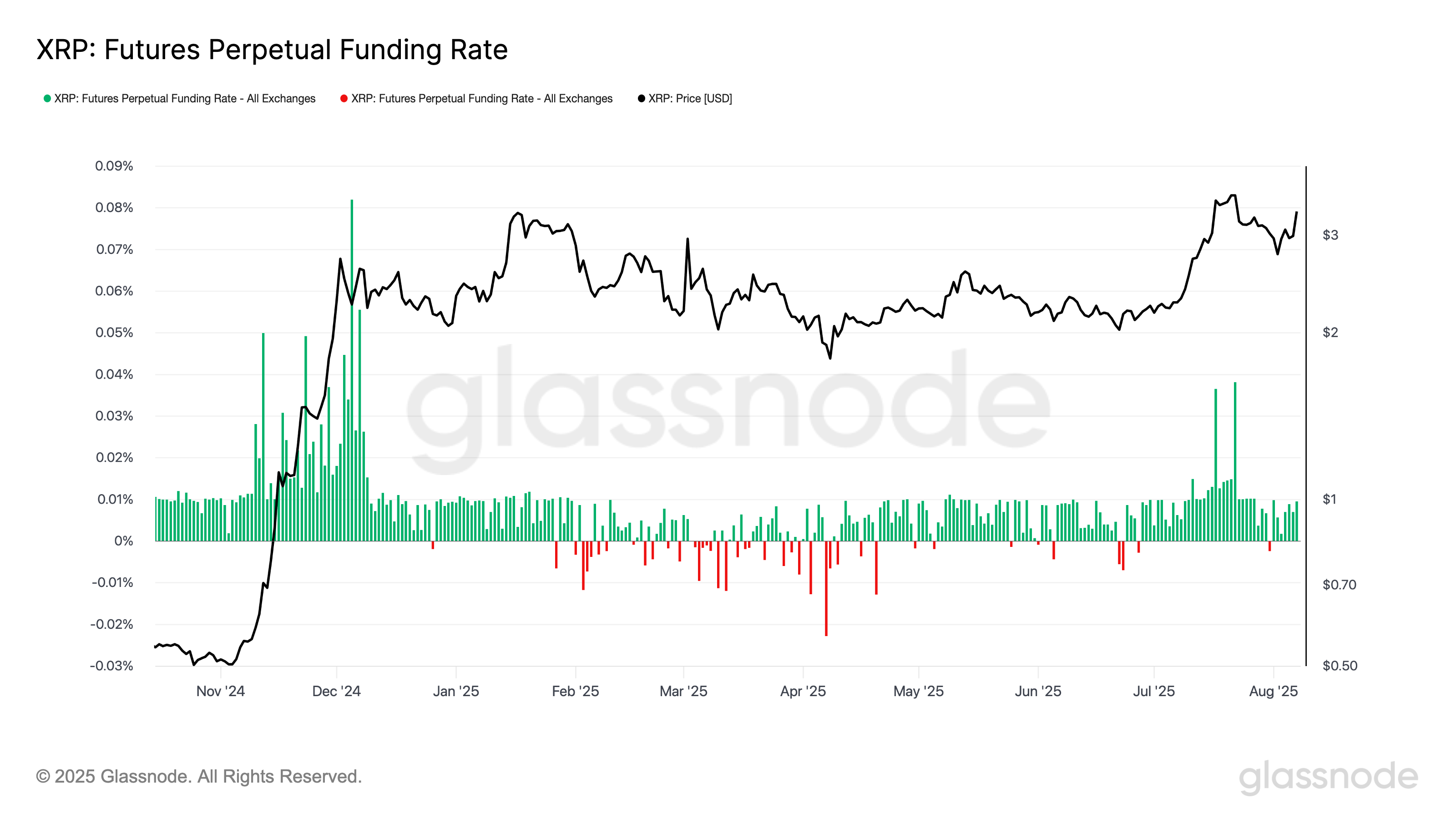

At 0.01%, XRP’s positive daily funding rate suggests that most traders are taking long positions, anticipating further upside.

XRP futures perpetual funding rate. Source: Glassnode

XRP futures perpetual funding rate. Source: Glassnode

Heavy long positioning can also increase downside risk, warned Glassnode. That suggests overleveraged traders could face liquidations, potentially accelerating a correction, if the price turns lower from current levels.

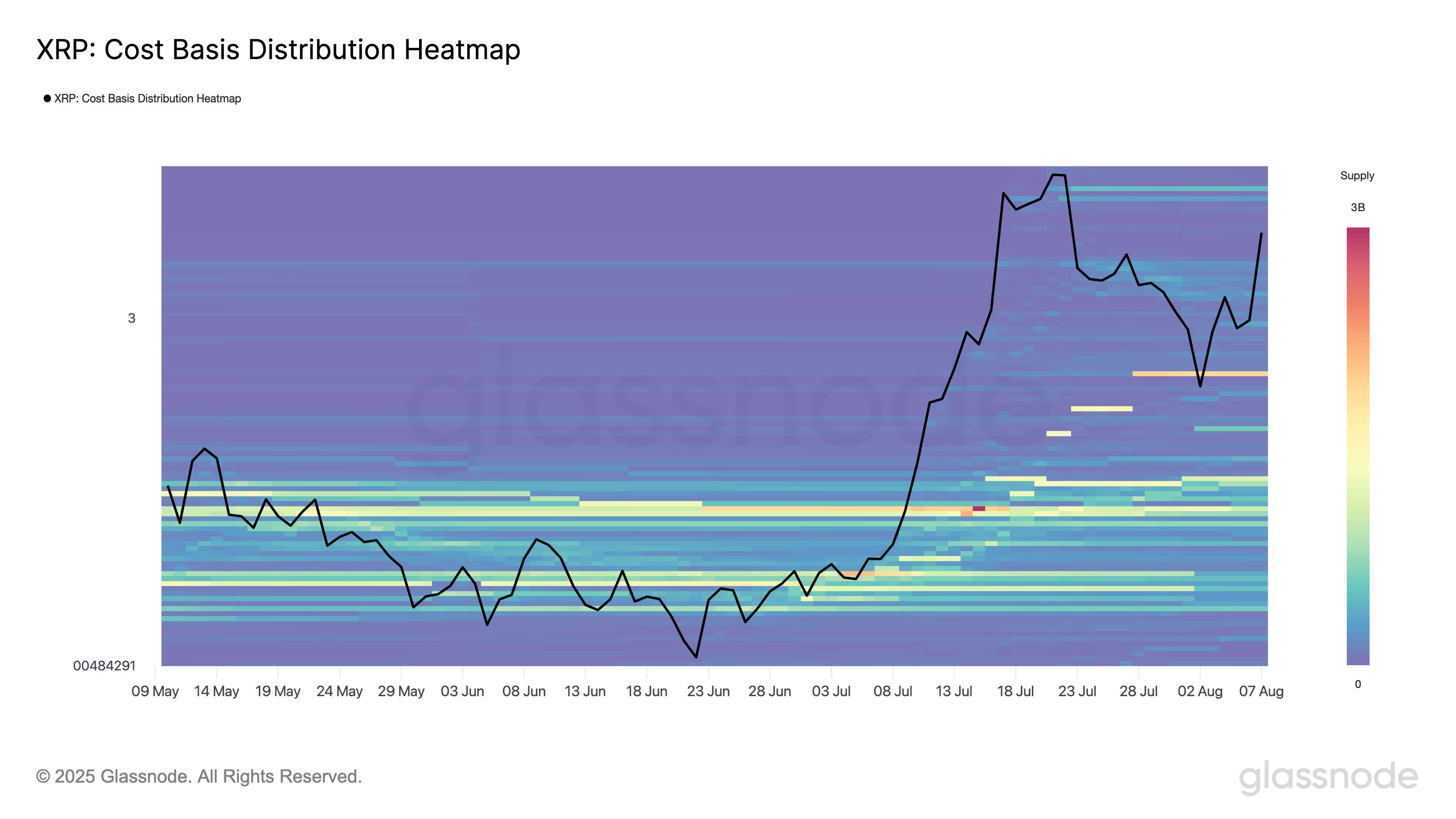

XRP’s cost basis distribution data shows that the $2.80–$2.82 range holds the largest cluster of supply, with over 1.70 billion tokens acquired at those prices.

XRP cost basis distribution heatmap. Source: Glassnode

XRP cost basis distribution heatmap. Source: Glassnode

This concentration of holders could act as a key support level if prices pull back, as many traders in profit may defend their entries.

XRP price technicals hint at 35% gains ahead

XRP’s rise further caused its price to break above the upper trendline of a bull flag chart pattern. Its volumes rose alongside, confirming momentum behind the breakout.

XRP/USD daily price chart. Source: TradingView

XRP/USD daily price chart. Source: TradingView

Traditional analysts measure a bull flag’s upside target by adding the height of the previous uptrend to the breakout point.

For XRP, this points to a target above $4.50, about 35% higher than current levels, by September or October.

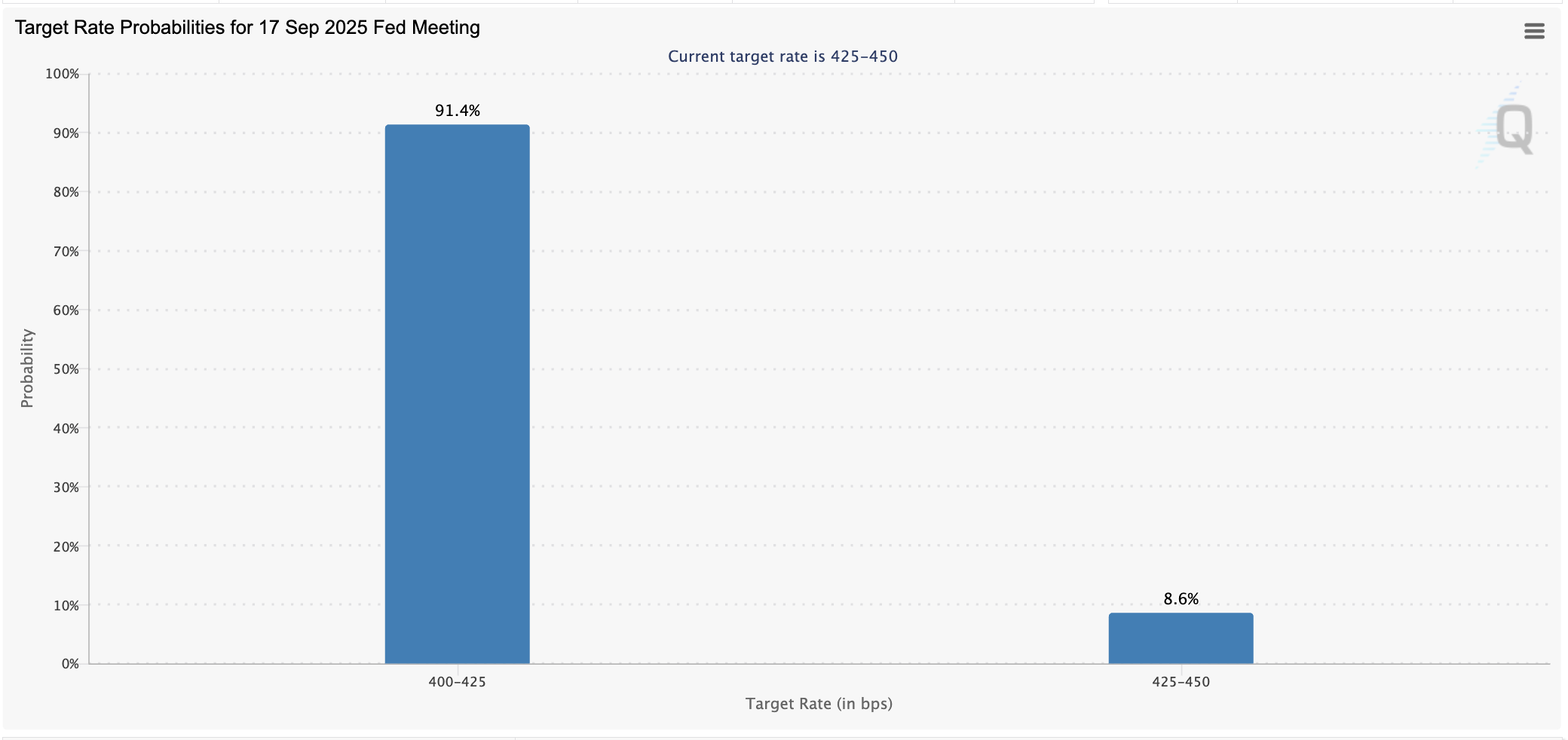

A potential Federal Reserve rate cut in September could further fuel appetite for riskier assets like XRP.

Target rate probabilities for the September Fed meeting. Source: CME

Target rate probabilities for the September Fed meeting. Source: CME

The $4.50 target echoes multiple analysts in recent weeks.

That includes Milkybull Crypto, who predicts the XRP price will climb to $5-8 by 2025’s end, and Dom, who projects $10.