Bitcoin proxy Strategy makes smallest BTC purchase since March

Key Takeaways

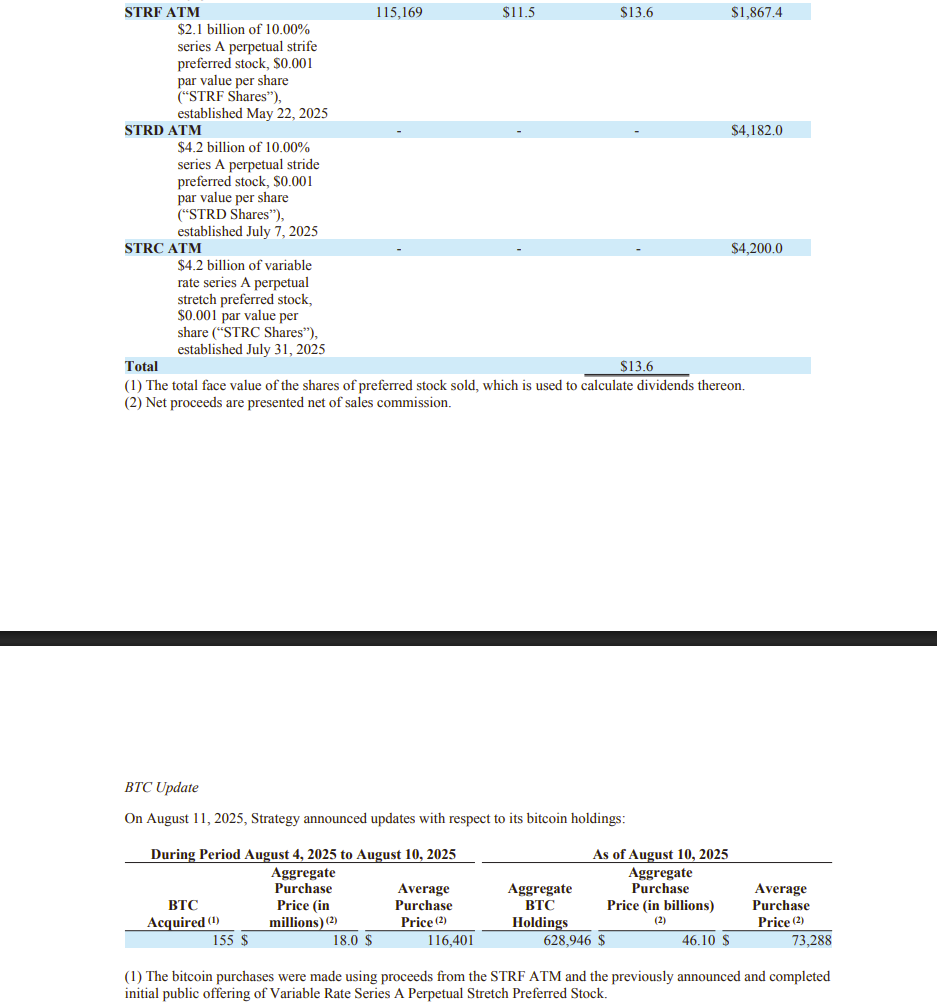

- Strategy purchased 155 additional Bitcoin for $18 million, increasing its digital asset holdings.

- The acquisition price equates to over $116,000 per Bitcoin.

Strategy, the world’s largest Bitcoin corporate holder, has resumed its BTC acquisition. The company announced Monday it had added 155 BTC to its treasury last week, its smallest purchase since mid-March.

Michael Saylor, the company’s Executive Chairman, dropped a hint about the acquisition yesterday. When Saylor puts out the Bitcoin tracker, it is often followed by an announcement within a few days.

The latest purchase, disclosed in an SEC filing , was made at an average price of $116,401 per BTC. Bitcoin briefly reclaimed $122,000 earlier today, according to TradingView.

Following the purchase, Strategy’s BTC holdings have grown to 628,791 BTC. With BTC now trading at around $119,500, the stash is valued at more than $75 billion, giving the company unrealized gains of about $29 billion.

Strategy financed its latest acquisition with proceeds from selling Series A Perpetual Strife Preferred Stock (STRF) and from the completed IPO of Variable Rate Series A Perpetual Stretch Preferred Stock. Between August 4 and 10, it sold more than 115,000 STRF shares, bringing in over 13 million dollars in net proceeds.

Strategy could potentially accumulate up to 7% of the global Bitcoin supply , as stated by Saylor. However, he insists on not aiming for total dominance, emphasizing a model that promotes decentralized participation in Bitcoin.

Saylor ardently supports the growth of Bitcoin corporate adoption and the decentralization ethos of the crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know