Bitcoin to $144,000? BTC Faces Next Big Test at This Key Level

Bitcoin rose as high as $124,533 on Aug. 14 before taking a hit following July’s hotter-than-expected wholesale inflation data.

The July consumer price index was broadly in line with market expectations, though the core reading that excludes food and energy edged higher to 3.1%, slightly over Wall Street estimates. However, the July producer price index, which measures wholesale items, showed a surprise strong 0.9% monthly gain, the most in nearly three years.

Around the time of writing, BTC was trading down 0.77% in the last 24 hours to $117,741, following Friday's drop to a low of $116,859.

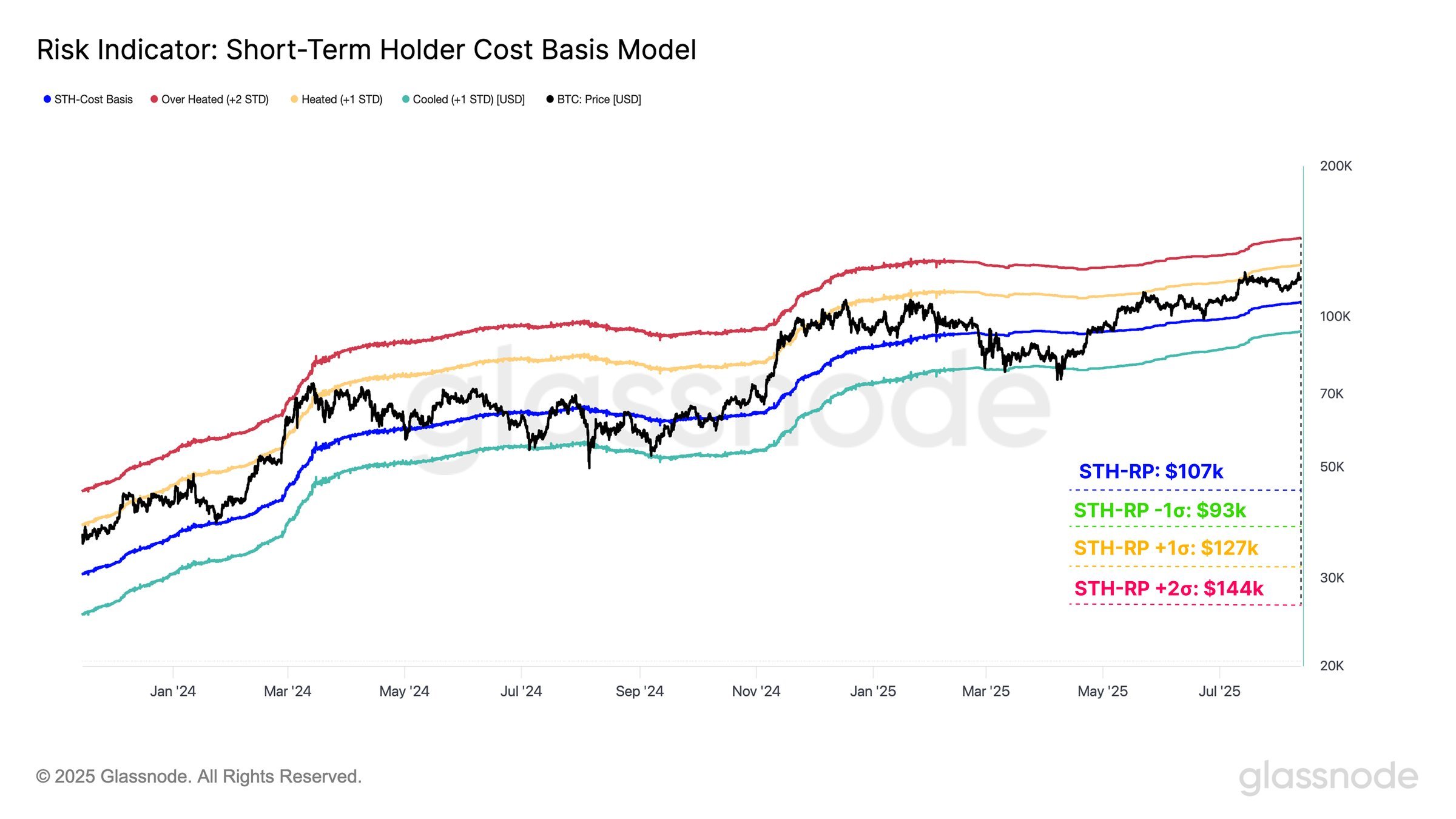

On what comes next, BTC’s average entry price for newer investors and its standard deviation bands can help to identify overheated zones.

According to Glassnode data, the short-term holder realized price (STH RP) for Bitcoin (BTC) currently sits at $107,000, which represents the average on-chain acquisition price of Bitcoin (BTC).

The STH RP +1σ level is at $127,000, and it is a major key resistance for Bitcoin to surmount, with a breakout opening the path to $144,000, which coincides with the short-term holder realized price +2σ, a level where prior market tops saw increased selling pressure. Short-term holder realized price standard deviation bands +1σ and +2σ coincide with heated and overheated zones, respectively.

Bitcoin has not yet reached these levels, suggesting that the current rally might still have room to run.

Fed signals closely watched

Federal Reserve President Austan Goolsbee spoke on Friday about mixed inflation numbers, with the ongoing instability showing doubts for reduced rates.

The Fed’s annual meeting of the world’s central bankers in Jackson Hole, Wyoming, from Aug. 21-23, has historically been used for the Fed to signal policy shifts and will be watched closely by investors next week.

Markets expect the FOMC to vote to decrease the benchmark federal funds rate by a quarter percentage point in September, from 4.25% to 4.50%. However, there are concerns about what happens next, with 55% odds of another cut in October and only a 43% chance of a third move in December.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know