This Missing Catalyst Is What’s Preventing Bitcoin From Blowing Past All-Time High With Conviction, According to Analytics Firm

One key ingredient is missing for Bitcoin (BTC) to soar well past its all-time highs, according to crypto analytics platform Swissblock.

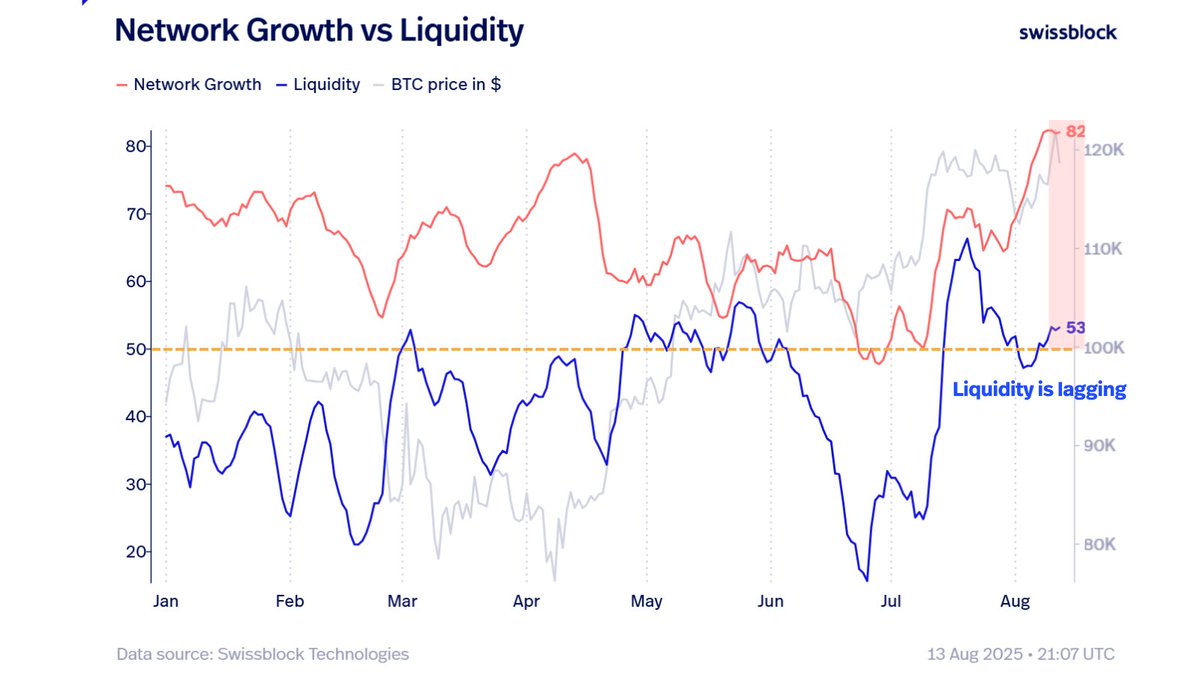

The analytics platform says that the on-chain liquidity metric needs to increase to trigger a convincing Bitcoin breakout.

On-chain liquidity refers to how easily and efficiently Bitcoin can be bought or sold without significantly impacting BTC’s price. A low liquidity environment suggests there are not enough buyers to absorb sell orders, triggering price declines.

“BTC’s structure is strong, but liquidity is the missing catalyst for a breakout beyond ATH (all-time high) with conviction. Meanwhile, capital rotation into ETH and alts is in full motion, setting the stage for late-cycle altcoin outperformance. The next big move will be decided by where new investor flows choose to land.”

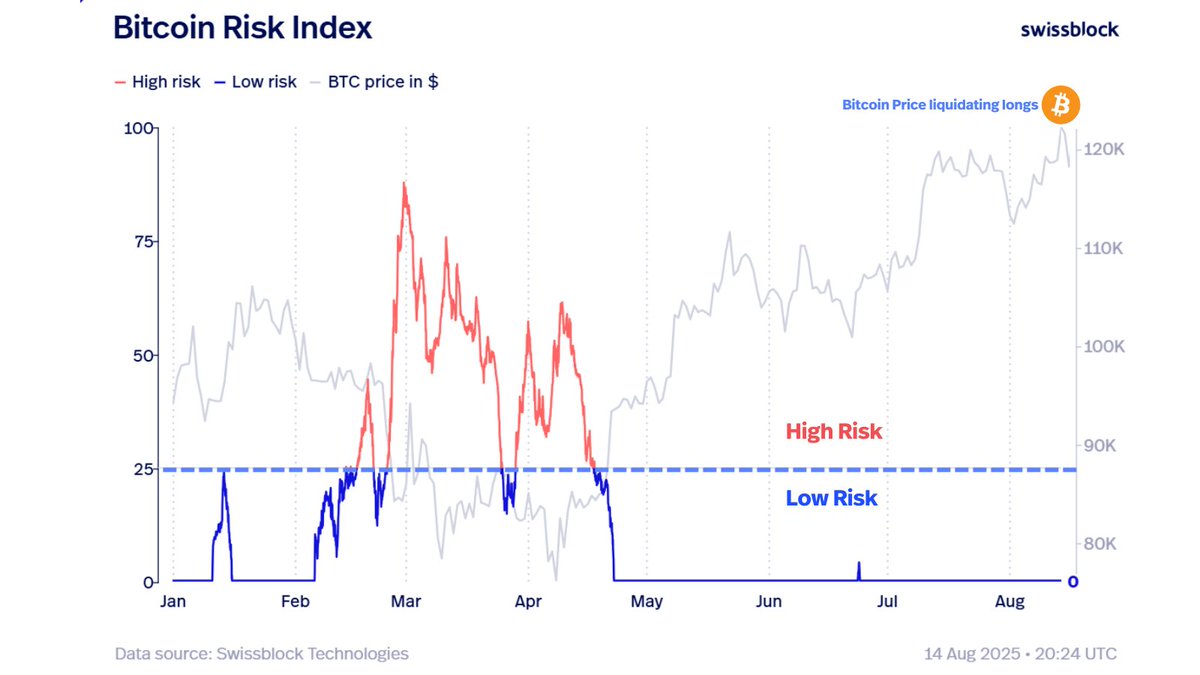

Swissblock also says that, based on the Bitcoin Risk Index, the flagship crypto asset remains in a bull market and short-term corrections are golden opportunities for investors.

The metric aims to evaluate Bitcoin’s current risk environment by aggregating various data points, including on-chain valuation and cost-basis metrics.

“As long as risk stays low, this is a buy-the-dip environment. Bitcoin punishes the over-leveraged in the short term, and downside volatility is rising – but structural risk remains contained. Low-risk regime: dips are opportunities.”

Bitcoin is trading for $117,422 at time of writing, down marginally on the day.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?