XLM Eyes Bullish Continuation After Rising From Support

XLM traded in a narrow band between $0.39 and $0.41 over a 24-hour stretch ending Aug. 21, reflecting a consolidation phase ahead of a potential move. Sellers repeatedly capped upside at $0.41, while buyers defended support at $0.40, keeping volatility subdued. A gradual dip in volume suggested traders were positioning for a breakout attempt.

That breakout came in the final hour of trading, when XLM rallied from $0.396 to $0.399. Strong buying momentum pushed through the $0.398 resistance level, accompanied by a sharp spike in volume exceeding 1.5 million tokens traded. The push set fresh intraday highs, reinforcing a short-term bullish setup.

Broader market currents also support rising demand for payment-focused tokens. Shifting trade dynamics, evolving stablecoin frameworks, and heightened inflation risks tied to supply chain pressures are reshaping the global payments landscape. Against this backdrop, XLM’s recent strength reflects growing interest in blockchain-based settlement alternatives.

Technical Indicators Signal Bullish Momentum

- Price action broke through key $0.398 resistance level with strong volume confirmation.

- Trading range of $0.01 or 3% indicates contained volatility before breakout.

- Volume spike exceeding 1.55 million during final hour suggests institutional interest.

- Support established around $0.40 level with multiple successful bounces.

- Declining volume trend reversed during breakout, indicating renewed conviction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is Marriott International Shares Beating the S&P 500 Index?

特朗普团队拟取消7500美元电动汽车税收抵免,电动汽车股大跌

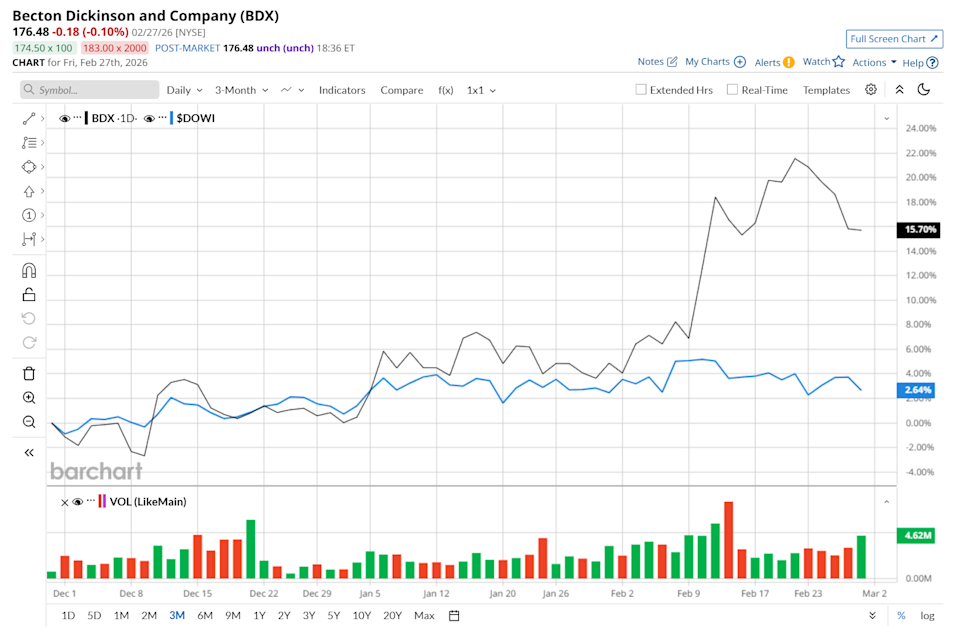

Is Becton, Dickinson and Company Shares Beating the Dow's Performance?

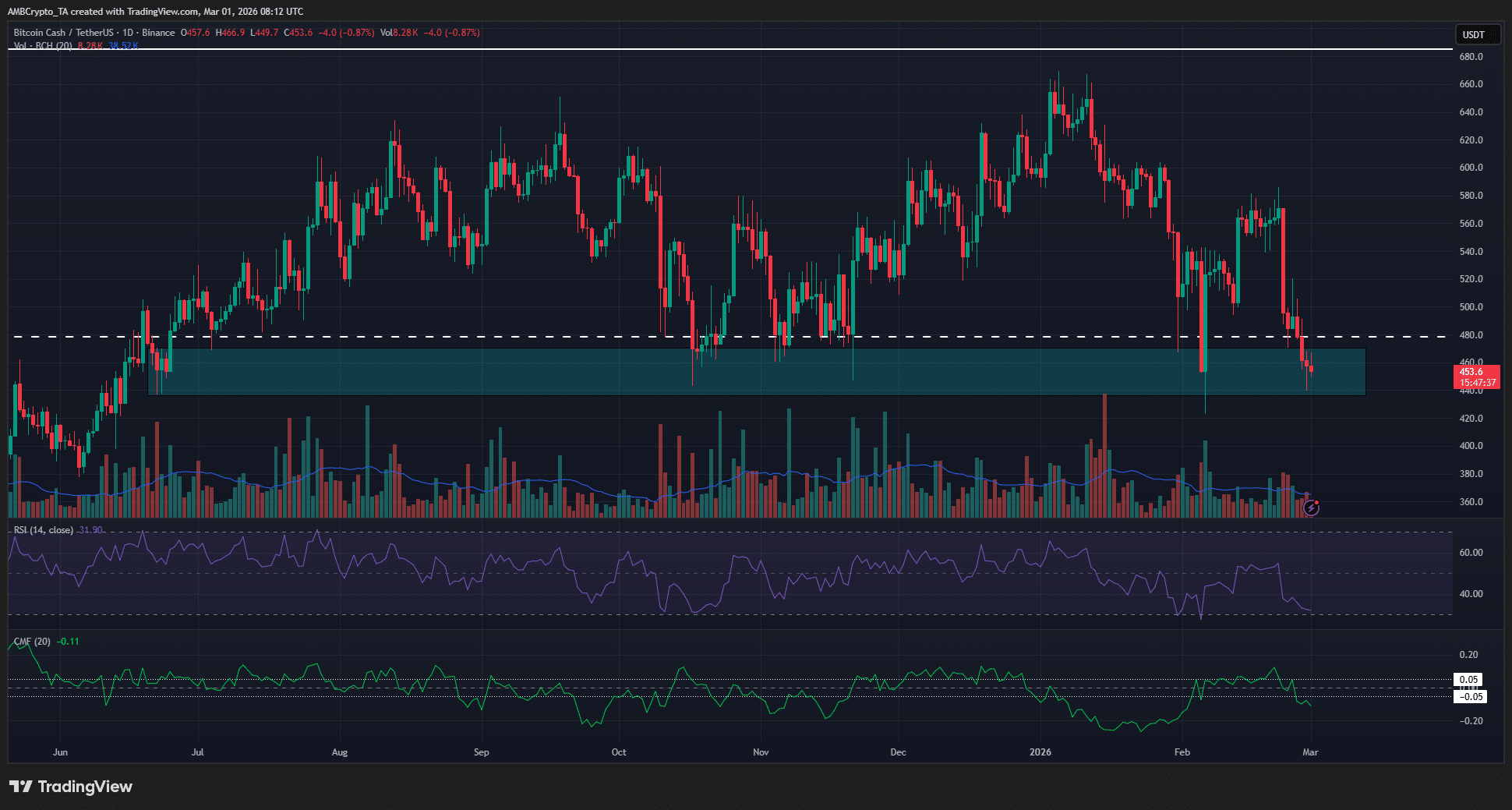

Crypto market’s weekly winners and losers – DOT, NEAR, BCH, PEPE