Cardano Price Holds Bullish Pattern—But a 90% Drop in Key Metric May Spell Trouble

Cardano’s price still looks technically bullish, but buyer strength is thinning fast. One on-chain metric just fell 90%, raising new downside risk.

The Cardano price is up 2.9% in the past 24 hours, showing surprising strength while most top altcoins remain flat. But on the 7-day chart, ADA is still down over 12%.

ADA’s short-term chart shows a strong bullish pattern with upside potential. But if we zoom out or check on-chain data, there’s a visible weakness forming beneath the surface. A bullish pattern alone isn’t enough—especially when key support metrics are vanishing. Cardano may be holding structure, but it’s losing critical ground.

Cardano’s 90% Drop in Outflow Hints at Buyer Weakness

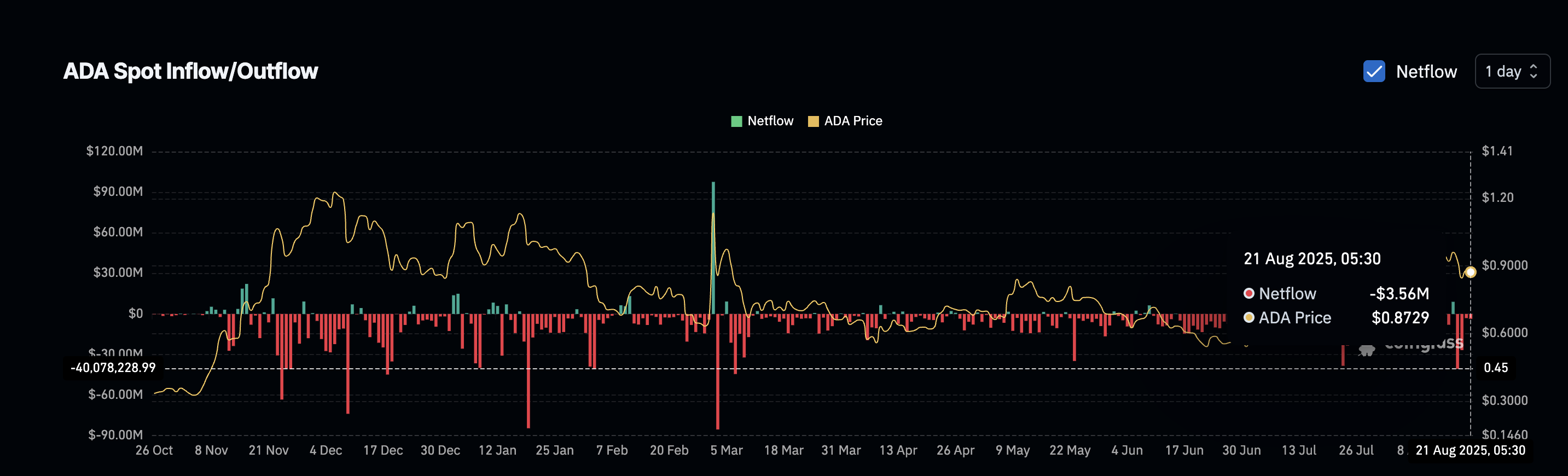

Over the past few days, net outflows from ADA spot exchanges have slowed drastically. At its local peak, Cardano recorded $40.07 million in daily outflows: a clear sign of strong buying conviction, as traders were pulling coins off exchanges.

Cardano buyers are backing out:

Coinglass

Cardano buyers are backing out:

Coinglass

That conviction has faded. By August 21, ADA’s net outflow dropped to just $3.56 million. That’s a 91% decline from peak demand. While this still represents net outflow, the plunge in size suggests buyers are stepping aside. There’s still no aggressive inflow, but momentum has stalled.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Too Many Longs? Leverage Stack Could Add Fuel to the Fire

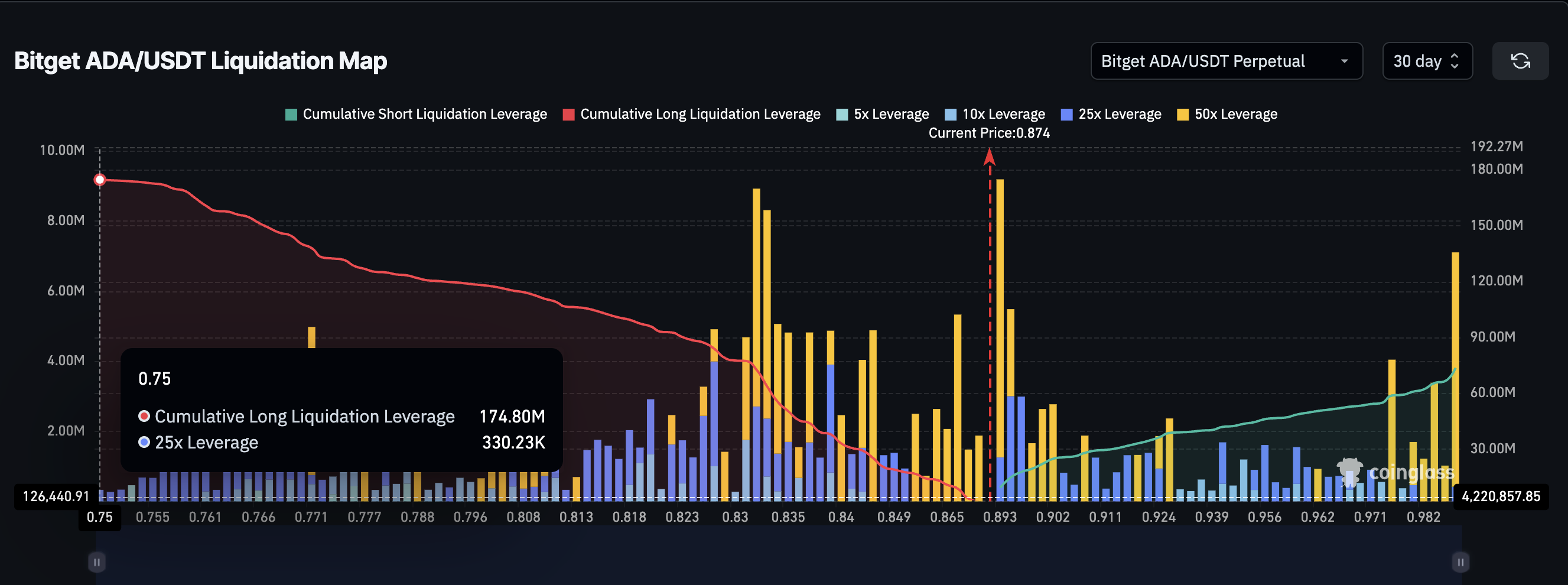

Liquidation map data shows ADA’s long positions are stacked dangerously tight. On Bitget, over $174.80 million in long leverage is built up, compared to just $73.56 million in shorts.

The biggest leveraged cluster sits near $0.83 to $0.85, meaning if the Cardano price drops to that range, liquidations could snowball. Even though too many Long positions signify positive bias but an imbalance as this can lead to a long squeeze.

Cardano derivatives favor a long squeeze:

Coinglass

Cardano derivatives favor a long squeeze:

Coinglass

With most of the market betting long, a dip below the key support level could cause fast unwinding and volatility.

It’s a classic overload setup. Bullish traders may unknowingly be fueling a sudden move down, especially since the price is sitting right on top of key long clusters, and sellers are starting to gain strength.

Cardano Price Pattern Remains Intact, But Pressure Points Are Building

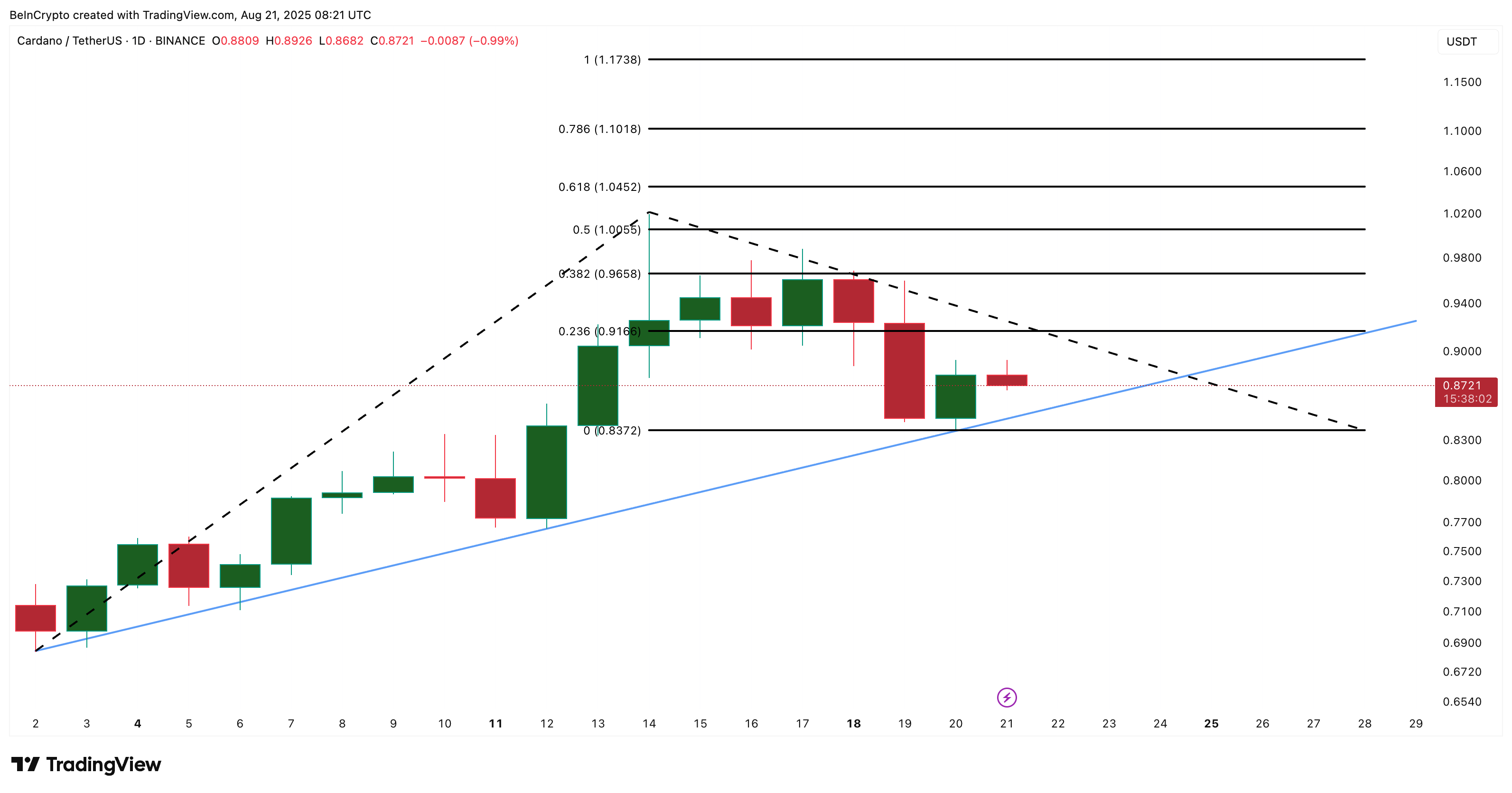

On the daily chart, the Cardano price continues to trade within an ascending triangle. The immediate breakout level sits at $0.91. If that clears, ADA could run toward $1.01–$1.10, backed by the most important 0.5 and 0.618 Fibonacci extension levels.

ADA price analysis:

TradingView

ADA price analysis:

TradingView

But the support line at $0.83 is now critical. If the ADA price breaks below this, the triangle pattern breaks down, and all bullish setups become invalidated.

With reduced outflow support and leverage imbalance, this level is no longer well-defended. The Cardano price may look bullish structurally, but it’s leaning on weakening legs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.