Date: Fri, Aug 22, 2025 | 02:55 PM GMT

The cryptocurrency market turned bullish in the last hour after Jerome Powell hinted at potential rate cuts in September during today’s Jackson Hole event. Following the remarks, Ethereum (ETH) surged over 7% past $4,600, fueling strong momentum across altcoins, including Render (RENDER).

RENDER jumped by nearly 7% in the past hour, and its latest chart structure suggests that more upside may be on the way.

Source: Coinmarketcap

Source: Coinmarketcap

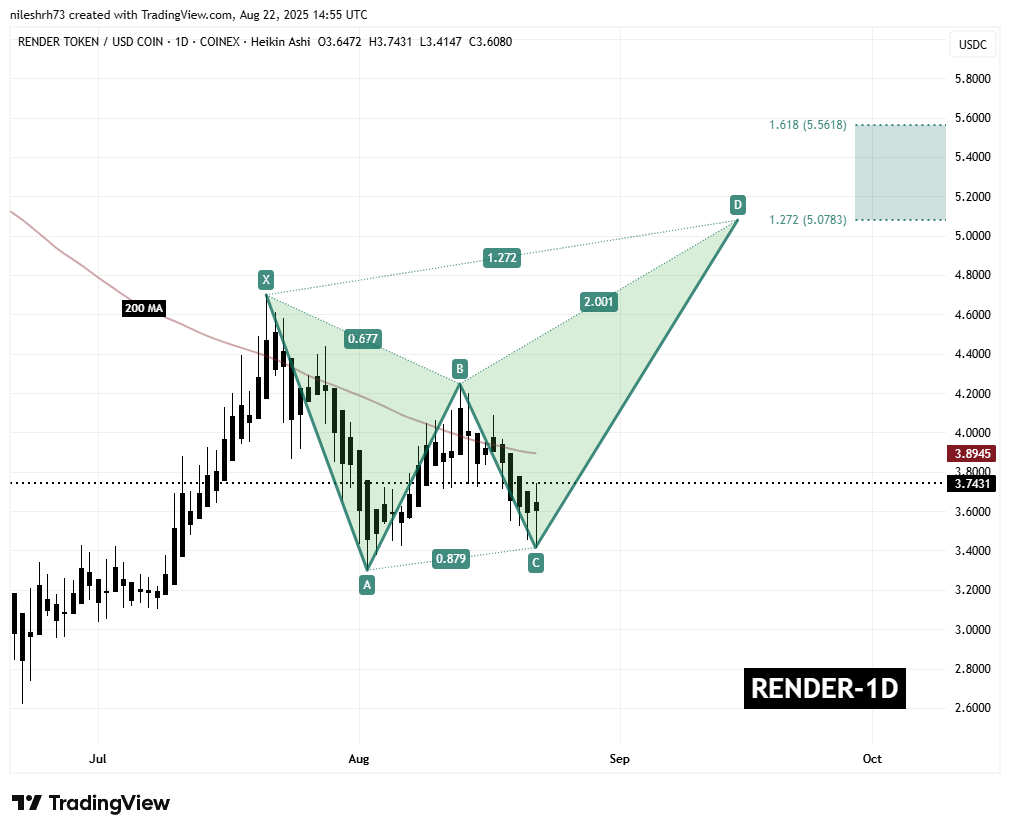

Harmonic Pattern Hints at Potential Upside

On the daily chart, RENDER is forming a Bearish Butterfly harmonic pattern. While the name sounds bearish, the final CD leg of this formation often signals a strong bullish continuation, especially as the price enters the Potential Reversal Zone (PRZ).

The pattern began at point X ($3.30), dropped to A, rebounded to B, and then corrected to point C near $3.41. Since then, RENDER has staged a recovery and is currently trading around $3.74, showing signs of strengthening momentum.

Render (RENDER) Daily Chart/Coinsprobe (Source: Tradingview)

Render (RENDER) Daily Chart/Coinsprobe (Source: Tradingview)

Importantly, RENDER is trading just below its 200-day moving average ($3.89) — a critical level. A successful reclaim of this zone could flip it into strong support and accelerate bullish momentum.

What’s Next for RENDER?

If buyers defend the C-point support ($3.41) and push the price decisively above the 200-day MA, RENDER could rally into the PRZ between $5.07 (1.272 Fibonacci extension) and $5.56 (1.618 extension). These levels are historically significant zones where the Butterfly pattern tends to complete.