Bitcoin holds steady at $115 after Powell's speech; highlights of the day include ETH, ARB, and AAVE

- Bitcoin rises today after Fed speech;

- Jerome Powell boosts cryptocurrencies with expectations of cut;

- Polymarket points to a 78% chance of interest rates falling;

Bitcoin's price is trading near $114.945 this Friday (23), after registering a significant increase of 4% the previous day. The cryptocurrency reached $117, driven by the repercussion of statements by Federal Reserve Chairman Jerome Powell.

During his speech at the annual Jackson Hole Symposium, Powell adopted a more moderate tone on U.S. monetary policy. Although he did not confirm a specific timetable, his remarks were interpreted as a signal that a rate cut could occur as early as the next FOMC meeting in September.

Featured Cryptocurrencies: ETH, ARB, and AAVE

Besides Bitcoin, Ethereum also reacted strongly, rising nearly 11% to $4.718,90. Other notable tokens in the top 100 include Arbitrum (ARB), Aave (AAVE), and Pudgy Penguins (PENGU), which have all gained more than 20% in the last 24 hours.

The intense movement in altcoins follows investors' reaction to possible monetary easing in the US, which tends to favor risk assets such as cryptocurrencies.

Polymarket reinforces its commitment to interest rate cuts

The odds of an interest rate cut were also reflected in bets on Polymarket, one of the industry's most closely followed forecasting platforms. Following positive economic data in early August, the chance of a cut rose from 35% to nearly 80%. However, following the release of better-than-expected PPI data, that chance dropped to 57% before Powell's speech.

With the Fed chairman's speech, sentiment strengthened again: bets on a 25 basis point cut in September jumped again to 78%.

Market Impact and Focus on the FOMC Meeting

The markets' response was immediate. Bitcoin jumped from below $112 to above $117 in just a few hours, before correcting to its current level. Expectations now focus on the next FOMC meeting, where it will be decided whether interest rate policy will actually begin to ease—something that current US President Donald Trump has been publicly advocating.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Daily Mirror-owner faces largest loss in ten years as Google traffic declines

Target’s newly appointed CEO reveals his strategy for revitalizing the company

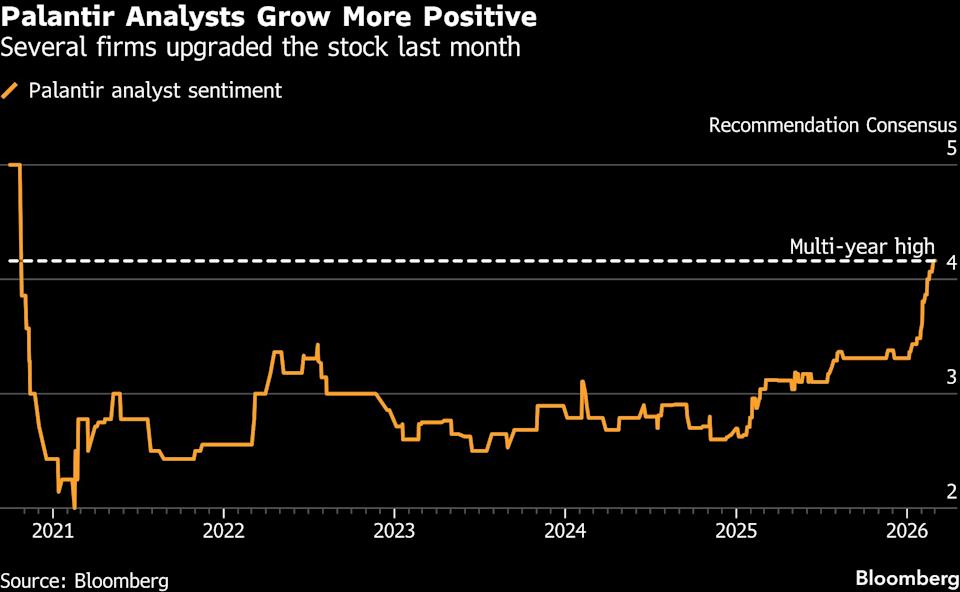

Palantir Returns to Wall Street’s Recommended Stocks Following a 38% Drop

Options Income Daily: MU, SOFI, CRWV and More