Barclays, BNP Paribas shift predictions to a September Fed rate cut

Barclays and BNP Paribas expect the Fed to cut interest rates by 25 basis points in September, citing a shift in Fed Chairman Powell's attitude towards rising risks in the job market at the Jackson Hole meeting. Barclays now expects two 25 basis point rate cuts in September and December this year, saying Powell's speech introduced a "dovish bias" and raised the threshold for not cutting rates. BNP Paribas has also changed its long-standing view of the Fed staying put, predicting rate cuts in both September and December. "Powell clearly stated that the Fed intends to make 'fine-tuning' rate cuts in September, unless data indicates otherwise."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysis-Investors make a dash for cash as Iran crisis upends markets

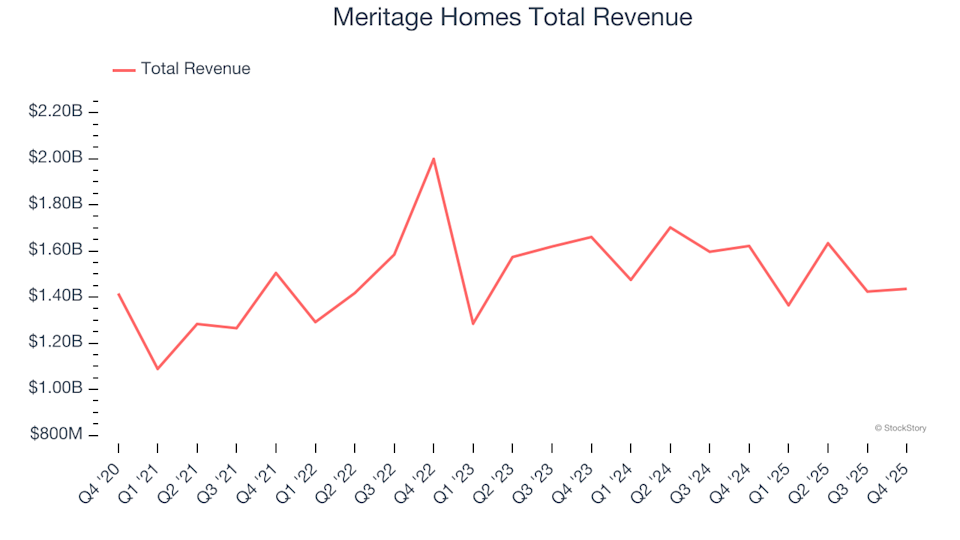

Home Construction Stocks Q4 Overview: Comparing Meritage Homes (NYSE:MTH)

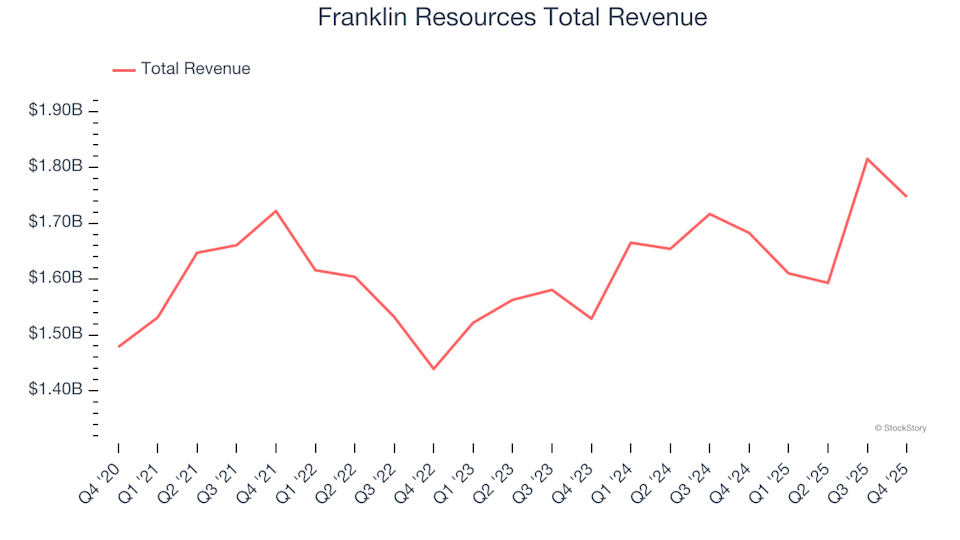

Reflecting on the fourth quarter financial results of custody banks: Franklin Resources (NYSE:BEN)

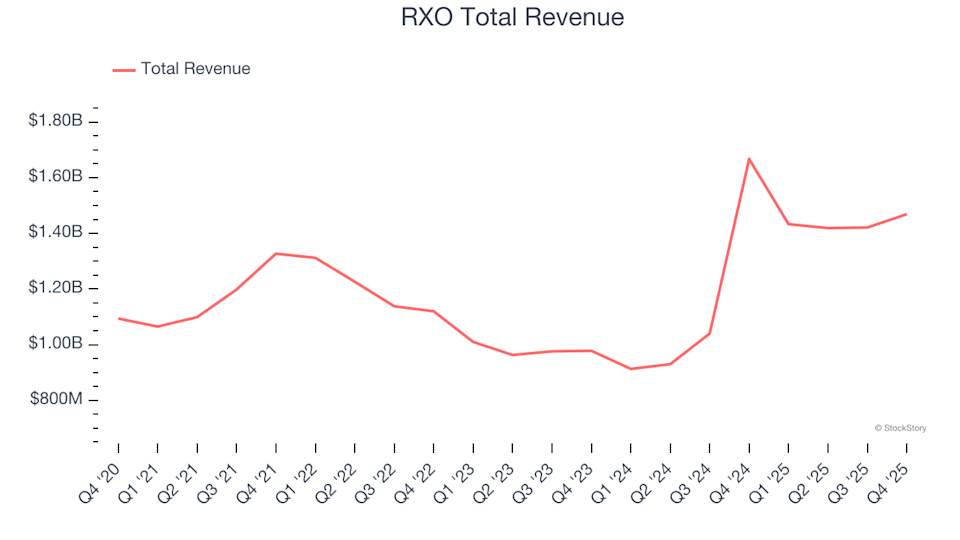

Ground Transportation Shares Q4 Overview: Comparing RXO (NYSE:RXO) Performance