Ethereum News Today: Investors Score Automatic Rewards as Mirror Chain R.E.M. Ramps Up Passive Income

- Mirror Chain, an Ethereum-based Layer 2 platform, leverages ZK Rollups and "Mirrored Virtual Machines" to enable scalable, low-cost cross-chain transactions with automatic 1% fee redistribution to $MIRROR holders via its R.E.M. mechanism. - The public presale has raised $791k of its $1.01m target, offering $MIRROR at $0.0496 with projected 156% APY returns, supported by a 1B token supply split across sales, rewards, and development. - A four-phase roadmap includes security audits, AI tool integration, an

Mirror Chain has positioned itself as a novel blockchain platform designed to transform the concept of passive income in the crypto space. Built as a Layer 2 solution on Ethereum , the platform utilizes Zero-Knowledge Rollups and a proprietary “Mirrored Virtual Machines” architecture to ensure scalability, low transaction costs, and seamless cross-chain compatibility. Its standout feature is the Repetitive Earning Mechanism (R.E.M.), which automatically redistributes a 1% transaction fee from every activity on the network to $MIRROR holders. This system eliminates the need for staking, yield farming, or third-party intermediaries, enabling investors to earn multi-token rewards continuously and effortlessly.

The platform’s R.E.M. system is designed to grow in proportion to the network’s transaction volume. If Mirror Chain achieves transaction volumes comparable to networks like Ethereum or Solana , early investors may experience significant returns as the network scales. This model aligns incentives between network growth and holder profitability, making it a compelling long-term investment opportunity for those seeking sustained, automatic income from crypto activity.

Mirror Chain’s development is guided by a four-phase roadmap, starting with foundational partnerships and progressing toward ecosystem expansion and institutional adoption. The project has already completed a Coinsult audit to ensure institutional-grade security and compliance, a critical factor for attracting both retail and institutional investors. The platform also plans to integrate AI-powered tools and support for real-world decentralized applications (dApps), further enhancing its utility and appeal to developers and end-users.

From a market perspective, Mirror Chain is gaining traction in the crowded Layer 2 and passive income blockchain space. Its focus on infrastructure, scalability, and automatic returns distinguishes it from projects that rely solely on speculative hype or complex staking models. The platform’s emphasis on developer-friendly tools and mirrored assets positions it as a potential hub for innovative dApps and governance models.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Up 37% Over the Last 6 Months, Does This Popular Networking Stock Still Have Room to Grow?

Ripple CEO Stuns XRP Army With Bombshell Statement for Banks

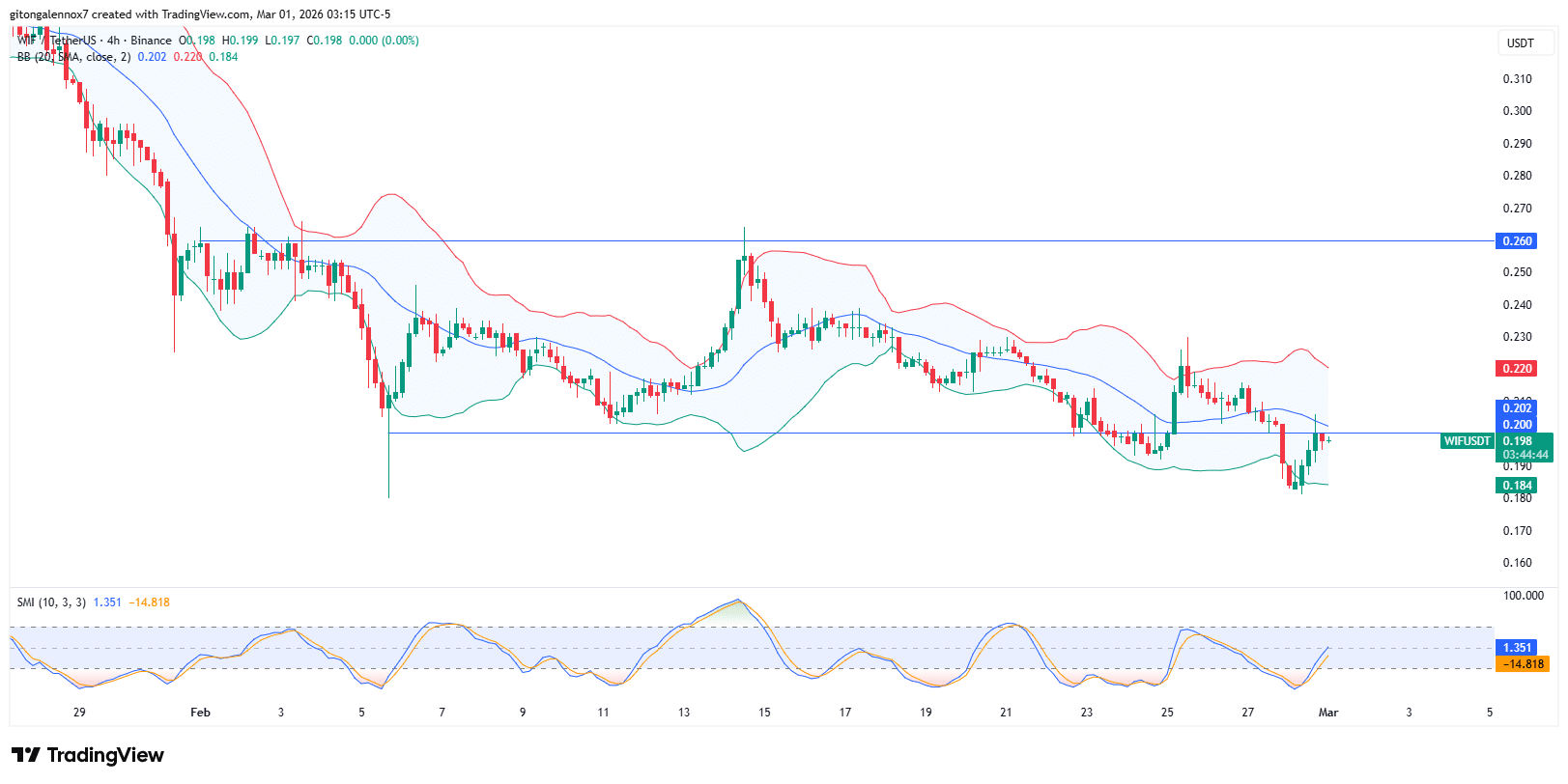

dogwifhat at $0.20: Reversal or further drop, what’s next for WIF?

"A sharp divide": Wall Street assesses the gains and losses as AI-fueled tech stocks tumble