HBAR Eyes Fresh Decline as Hedera’s Stablecoin Market Cap Plummets 30%

Hedera faces a liquidity crunch as its stablecoin market cap drops sharply, fueling bearish pressure on HBAR. With support levels at risk, the token could see deeper losses unless demand rebounds.

The Hedera Hashgraph network has recorded a decline in on-chain liquidity, reflected by a sharp drop in its stablecoin market capitalization.

This decline reflects a broader slowdown in user activity across the network, which could put additional pressure on HBAR’s price.

Liquidity Crunch Hits Hedera

According to DefiLlama, Hedera’s stablecoin market cap has fallen by over 30% in the past week, highlighting weakening user demand on the network.

As of this writing, the stablecoin market cap on the Hedera Hashgraph network totals $70.02 million.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Hedera Stablecoins Market Cap. Source:

Hedera Stablecoins Market Cap. Source:

Hedera Stablecoins Market Cap. Source:

Hedera Stablecoins Market Cap. Source:

A decline in a network’s stablecoin market cap signals reduced liquidity and lower user engagement. Stablecoins are a key measure of on-chain activity, as they facilitate trading, payments, and other decentralized financial operations.

When their market capitalization drops, it suggests fewer participants are interacting with the network, which could translate into slower growth and lower transaction volumes.

For Hedera, this reduced demand on the network may put downward pressure on its token’s price, as liquidity dries up and investor sentiment cools.

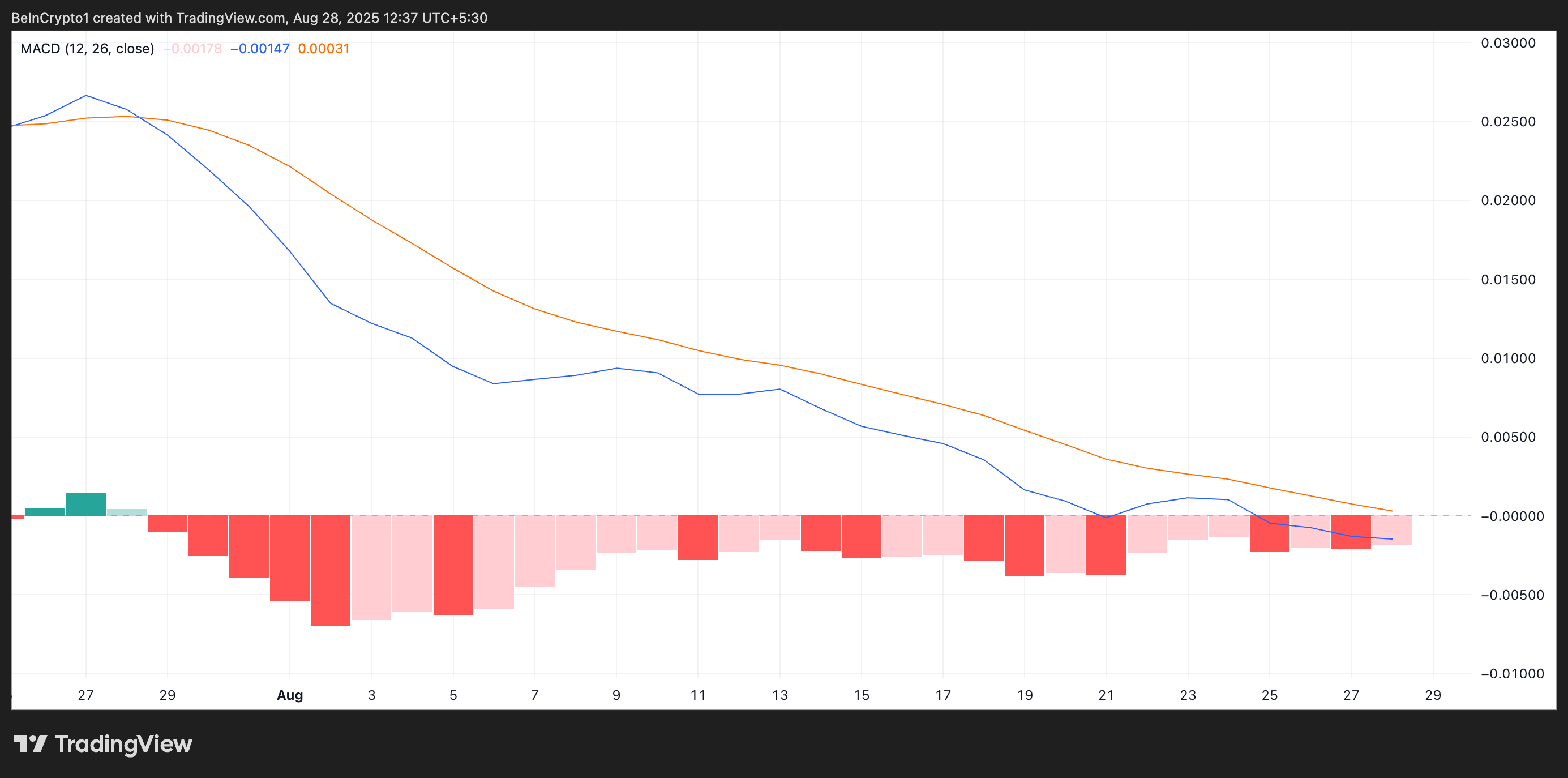

Moreover, on the daily chart, HBAR’s Moving Average Convergence Divergence (MACD) setup confirms the bearish outlook. At press time, HBAR’s MACD Line (blue) rests below its signal line, hinting at deeper losses in the near term.

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

HBAR MACD. Source:

The MACD indicator identifies trends and momentum in an asset’s price movement, helping traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

When an asset’s MACD line (blue) falls below its signal line (orange), it indicates a breakdown in the market’s bullish structure. If this remains, HBAR could leave its narrow range and break downward.

Liquidity Slide on Hedera Could Push HBAR Toward $0.1963

HBAR currently trades at $0.2403. If bearish sentiment strengthens, the token could fall toward its immediate support level at $0.2279. HBAR’s price may dip further to $0.1963 if this support fails to hold.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

On the other hand, an uptick in accumulation could invalidate the current bearish outlook. In that scenario, HBAR could rebound and break past the resistance level at $0.2509.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor hints at next Bitcoin buy as BTC falls below $88K

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?