90% Drop in Solana DEX Traders Stuns Analysts — What’s Behind the Exit?

Solana DEX traders have dropped 90% in a year, yet trading volume remains strong. Analysts clash over whether this signals decline or a healthier market reset.

Recent on-chain data shows that the number of DEX traders on Solana has plummeted since October last year. Analysts have presented conflicting arguments to explain this sharp decline.

The bearish camp believes traders are abandoning the network, while the bullish side offers alternative explanations.

Solana DEX Traders Fall 90%

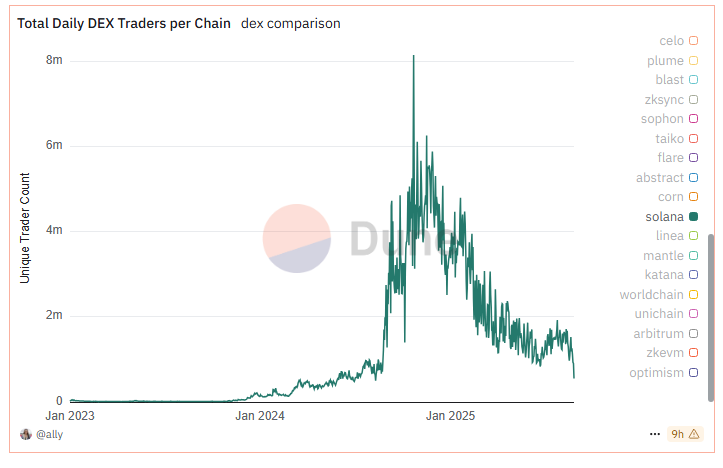

Data from Dune indicates that the daily number of DEX traders on Solana has dropped from over 8 million in October last year to below 1 million at press time.

The chart illustrates a nearly year-long, continuous 90% decline. It suggests that traders have left and no longer find opportunities for profit on the network.

Total Daily DEX Traders on Solana. Source:

Dune

Total Daily DEX Traders on Solana. Source:

Dune

“Everyone left the casino or lost it all. Insane chart,” investor Qwerty.

Logically, fewer traders should result in lower trading volume due to fewer participants. However, data from DefiLlama shows that Solana’s daily DEX trading volume has remained steady between $3 billion and $5 billion. This discrepancy has fueled suspicions about the dominance of trading bots on Solana.

“Looking at volume is way more misleading when we all know how many farms + volume bots are happening 24/7. Number of active traders falling off a cliff is horrible and can be felt even without a chart if you’re here every day,” investor NoCapMat.eth.

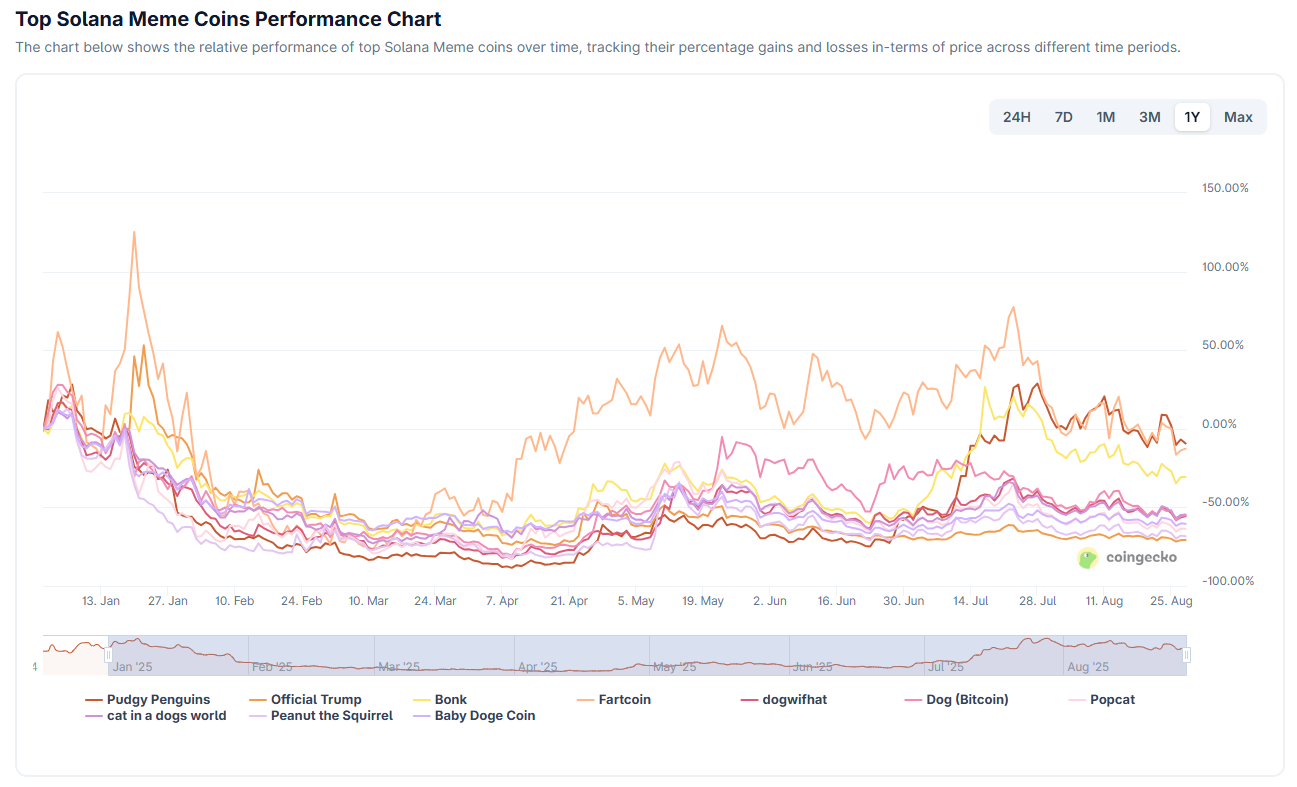

According to CoinGecko, the year-to-date performance of top meme coins on Solana is negative. Despite having the highest liquidity, these tokens have all posted losses ranging from 10% to 70%.

Top Solana Meme Coins Performance Chart. Source:

Coingecko

Top Solana Meme Coins Performance Chart. Source:

Coingecko

Analysts explain that traders have lost interest in meme trading on Solana following the launch of tokens such as TRUMP, MELANIA, LIBRA, and YZY. These tokens once sparked hype but later ended in rug pulls and mistrust, driving retail users to other chains or forcing them to exit altogether.

Another Explanation for the Exit of 7 Million Solana Wallets

However, bullish analysts argue that the sharp drop on the chart above could signal a bottom before a recovery, based on personal experience.

typically when a chart goes viral on ct it either signals the top or bottom of that trend like we saw with ai agentsgut tells me this solana dex traders chart puts in the onchain bottom for solana

— Baba

From a more positive perspective, some analysts suggest that the seven million-wallet drop may reflect the removal of bots rather than real users. They explain that bots inflated Solana’s past metrics. Now that bot addresses are unprofitable, regular users have a fairer environment. Analysts see this as a healthy sign for long-term growth.

Additionally, Matthew Nay, an analyst at Messari, disputed the accuracy of the shocking data. He argued that Solana’s on-chain health remains stable.

“…It’s just wrong—transactions, fee payers, and signers are all flat (not down as much as that chart says),” Nay stated.

The debate over the truth behind Solana’s on-chain data continues, reflecting the complexity of the network’s internal dynamics. Meanwhile, Solana’s price (SOL) has risen 35% in August, trading above $210, with bullish sentiment still dominating the altcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Manhattan Associates (MANH) Shares Rise, Here's the Reason

Why Bloom Energy (BE) Stock Is Dropping Sharply Today

Guidewire Software (GWRE) Stock Surges Dramatically, Essential Information You Should Be Aware Of

Why Park-Ohio (PKOH) Stock Is Down Today