Wage Garnishment Looms for Millions as Student Loan Collections Restart

- U.S. Education Department resumes student loan collections, risking wage garnishment for 4M borrowers in default after a multi-year pause. - Defaulted borrowers face 15% disposable income garnishment (minimum $217.50/week) with 30-day notice, while Social Security recipients retain at least $750/month. - Borrowers can challenge garnishment via hardship hearings or rehabilitation (9 on-time payments), but scams targeting distressed borrowers are expected to rise. - Policy shift prioritizes debt recovery o

Millions of federal student loan borrowers in default are preparing for the possibility of wage garnishment as the U.S. Department of Education resumes active collections after a multi-year pause. Under current rules, the government may garnish up to 15% of a borrower’s disposable income—after taxes—from their paycheck or Social Security benefits, provided the borrower has defaulted on their loans. Default occurs after 270 days of nonpayment, or about nine months, and is reported to credit bureaus after 90 days of delinquency. As of recent data, approximately 5.8 million borrowers are more than 90 days behind, representing 31% of all student loan borrowers in the U.S. [1].

The immediate impact is expected to affect nearly 2 million borrowers already in default, with an additional 1 million to 2 million potentially entering default in the coming months, pushing the total to as many as 4 million at risk. The U.S. Department of Education has not provided an exact date for the initiation of garnishment, stating only that it would begin “later this summer.” However, industry experts suggest it could take several weeks for the system to be operationalized, with some estimating a possible delay of up to a month before collections begin [1].

For those facing garnishment, the government is required to provide a 30-day notice before collections start. However, many borrowers may overlook or misunderstand these communications. The amount that can be garnished is limited by law to ensure that borrowers are left with at least $217.50 per week, equivalent to 30 times the federal minimum wage. Borrowers receiving Social Security benefits also receive protection, with the government required to leave them with at least $750 per month after deductions [2].

Borrowers who are notified of garnishment have options to challenge or avoid it. They can request a hearing if they believe the garnishment would cause financial hardship, such as in cases of recent unemployment or bankruptcy. Additionally, negotiating a payment plan, loan rehabilitation, or consolidation could help borrowers regain good standing and avoid wage garnishment. Loan rehabilitation, which requires nine on-time monthly payments over 10 months, is a one-time opportunity that removes a loan from default. However, it is not available to all borrowers, and eligibility depends on the type of loan and repayment history [1].

Experts warn that the resumption of collections could also lead to an increase in student loan-related scams. Fraudsters are likely to target borrowers in distress with offers to reduce debt in exchange for upfront fees. Borrowers are advised to be cautious of unsolicited communications and to seek assistance through official government resources like studentaid.gov, which offers free and legitimate options for repayment and forgiveness [2].

The potential for wage garnishment marks a significant shift in student loan policy, moving away from the Biden administration’s earlier emphasis on deferment and forgiveness. While the new approach aims to recover overdue funds, it raises concerns about the financial strain on borrowers, particularly those in low-income or high-debt situations. As the system adjusts, the Department of Education will likely face pressure to balance enforcement with support for borrowers facing economic hardship [1].

Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

又一美联储理事呼吁:谨慎对待进一步降息!

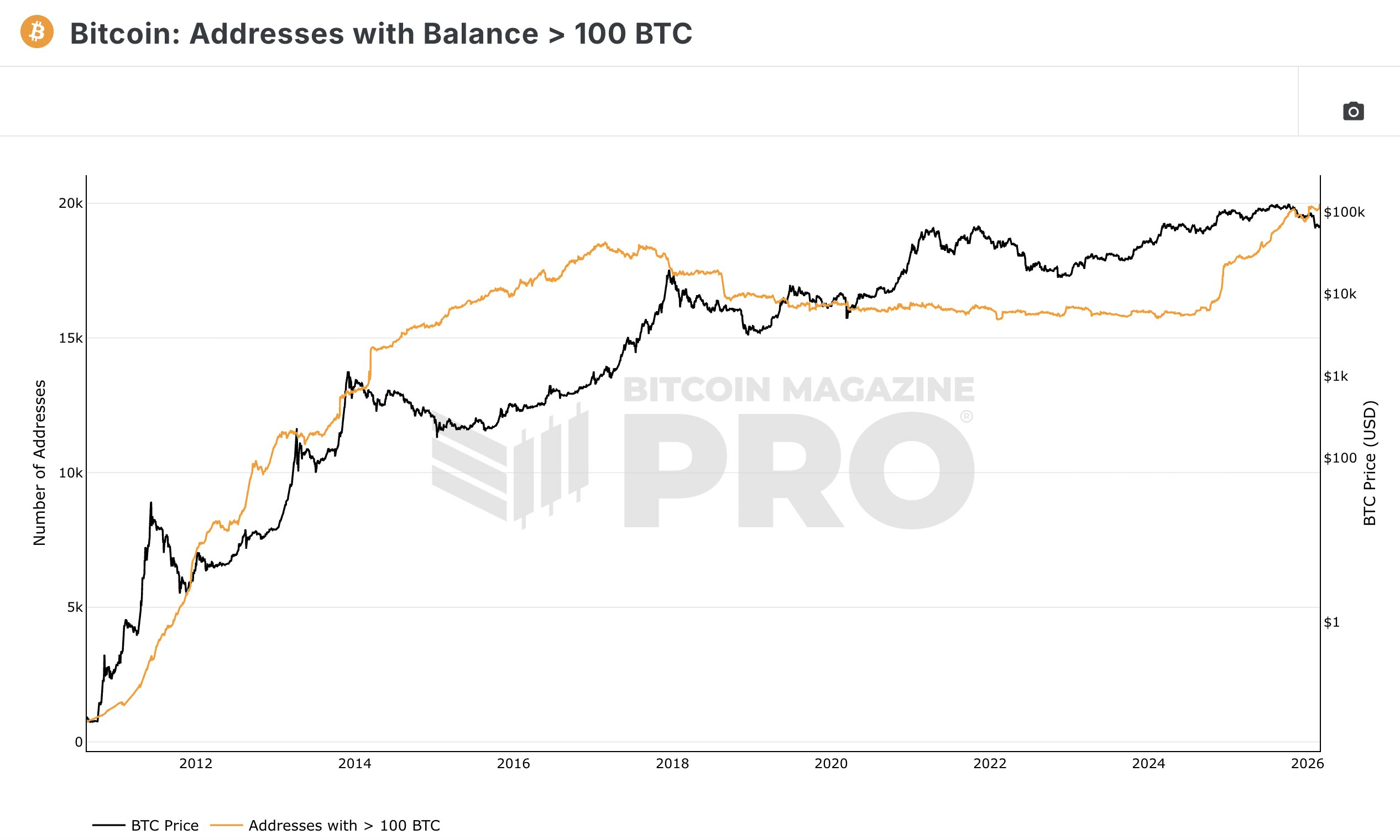

Bitcoin whale addresses holding 100 BTC hit ATH – Strategic play for H2 rally?

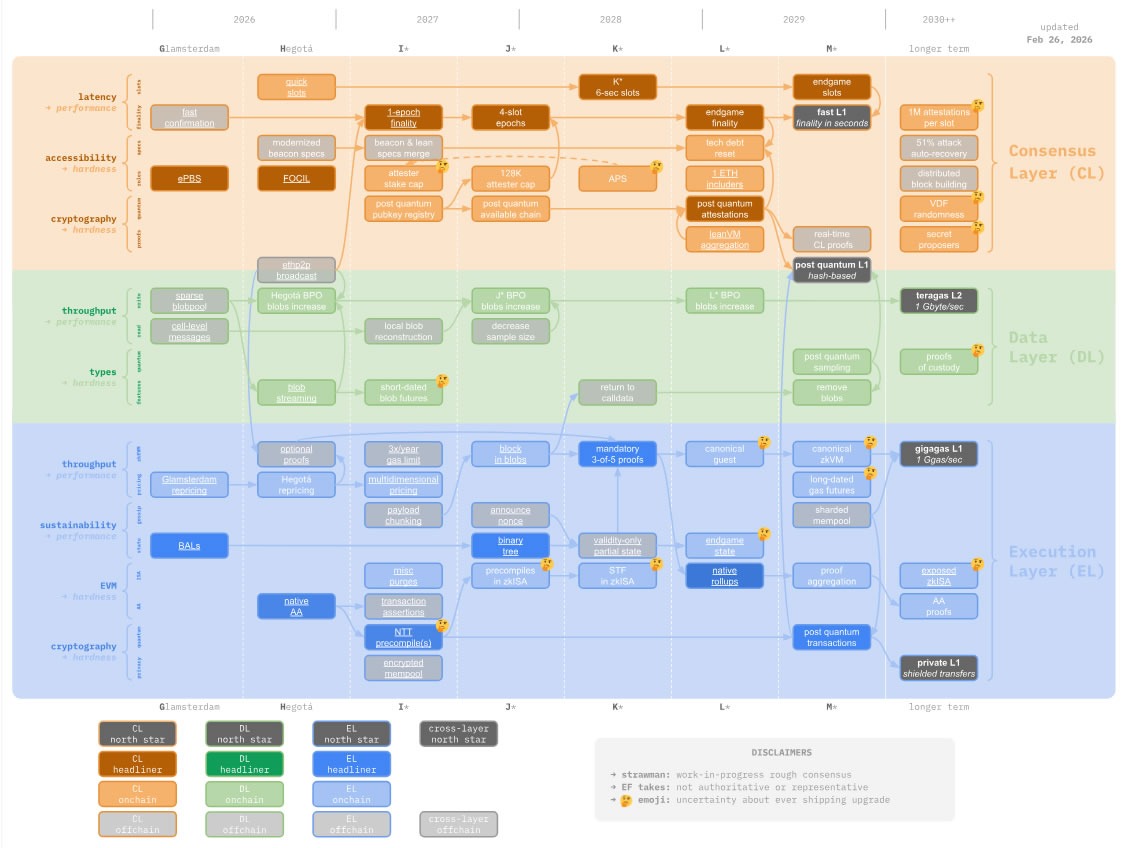

Ethereum smart accounts are finally coming 'within a year' — Vitalik Buterin