XRP Price in Trouble, Bollinger Bands Signal

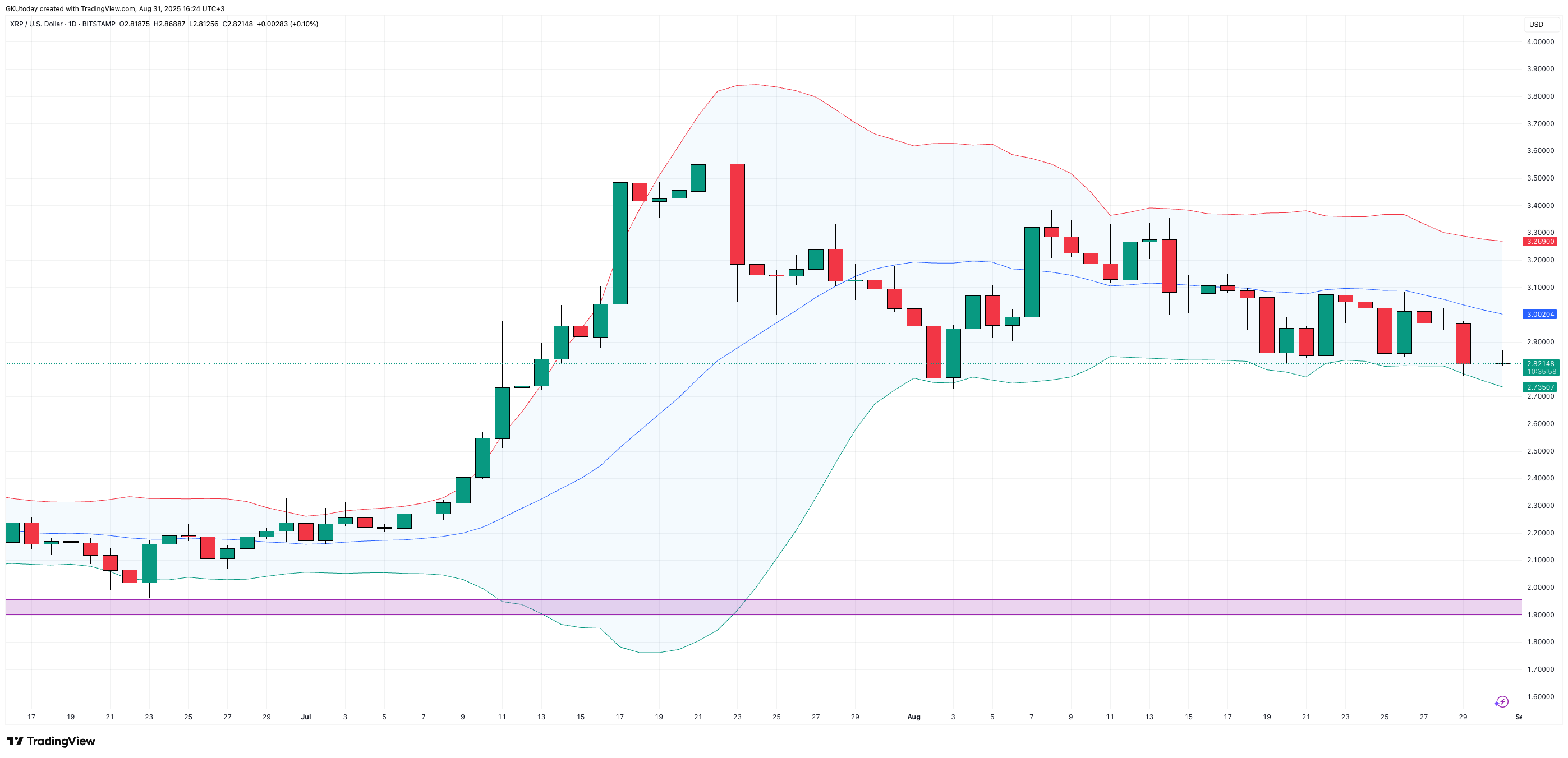

XRP is finishing August on a negative note, and the latest Bollinger Bands readings suggest the token isn't showing the kind of setup that usually happens before a rally.

On the weekly chart, the coin has slipped from early summer highs near $3.60 and is now holding just barely above $2.80. The middle band, which traders often use to figure out direction, is starting to slope downward.

That's a sign that the overall trend is losing steam.

The daily time frame backs that up. For most of August, the XRP price has been stuck below its midline, with each attempt to reach $3.10-$3.20 getting rejected. That left the price action stuck closer to the lower band, where moves tend to indicate weakness rather than strength building.

To put it simply, the range has narrowed, but not in a way that suggests new upside.

More pessimism for XRP

The 12-hour and 4-hour charts tell us the same thing. XRP has been on a bit of a slide, heading toward the $2.70 area. But as soon as it hits the midline barrier, attempts to bounce back quickly fall flat.

Even the 1-hour chart, where sudden reversals often appear, shows more of a slow grind along the lower edge than any rebound worth noting.

All these signals together suggest that the market is having a hard time attracting buyers at higher levels. If the lower band near $2.70 breaks, the next area of interest is closer to $2.40.

On the other hand, if they reclaimed the $3.00 zone, that would be a big sign of strength. For now, though, XRP's Bollinger profile is biased more toward caution than optimism, with sentiment looking more defensive as September trading begins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know