BTC Market Pulse: Week 36

Bitcoin retreated to $107K, testing the short-term holder cost basis - a key level for market sentiment. The latest Market Pulse highlights oversold spot conditions, cautious futures positioning, renewed ETF inflows, and weak on-chain activity as fragility persists.

Overview

With price contracting further away from ATH to $107k, the market is now sitting at the cost basis of short-term holders. This key level has historically acted as a battleground between buyers and sellers, making current positioning particularly critical for near-term sentiment.

In the spot market, momentum weakened further as RSI slipped into oversold territory, while trading volumes declined, reflecting waning conviction. Spot CVD showed easing sell pressure, hinting at tentative stabilization, but overall signals point to fragile demand.

The futures market revealed cautious positioning. Open interest contracted, funding payments declined, and perpetual CVD improved slightly, suggesting reduced leverage and fading bullish appetite. Traders appear less willing to extend risk, underscoring a defensive stance after recent volatility.

In the options market, participation contracted as open interest fell, while volatility spreads narrowed, pointing to complacency. However, 25-delta skew surged above historical extremes, highlighting strong demand for downside protection and reinforcing a defensive tilt among options traders.

Flows through US spot ETFs showed mixed signals. Netflows reversed into positive territory with inflows, yet trade volumes contracted and MVRV ratios declined, pointing to cautious profit- taking behavior. Institutional interest remains present but far more selective after recent price weakness.

On the on-chain demand side, active addresses and fees remain subdued, signaling weak organic activity, though transfer volumes spiked as large entities repositioned amid volatility. This divergence highlights low grassroots participation, offset by strategic moves from larger players.

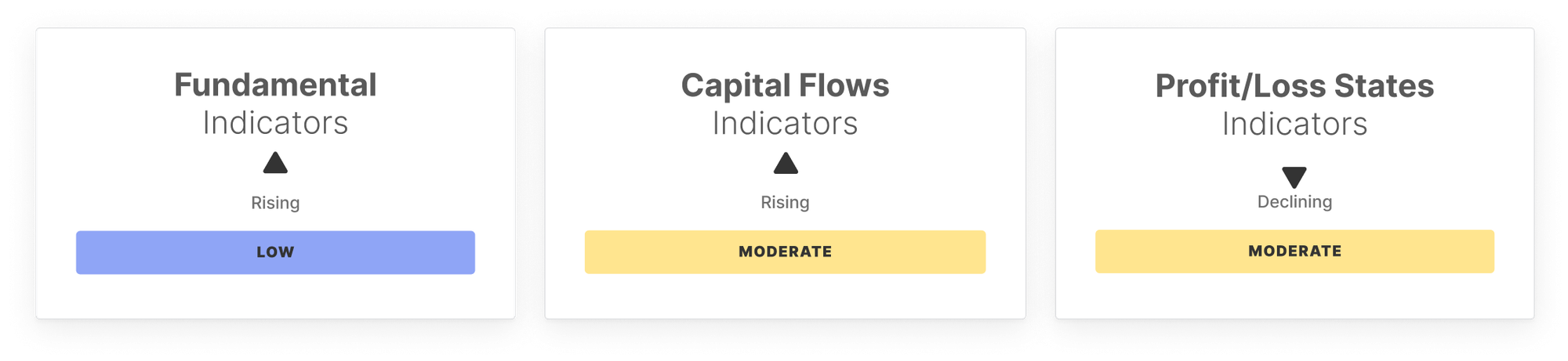

Capital flow metrics suggested cooling conviction. Realized Cap inflows slowed, Hot Capital Share pressed against its upper bound, and the STH/LTH supply ratio rose, reflecting greater speculative activity but fragile support from long-term holders.

Profit and loss states weakened notably. Percent Supply in Profit declined, NUPL moved closer to loss territory, and Realized P/L settled at equilibrium. Together, these trends confirm fading unrealized profits, fragile conviction, and cautious positioning across the investor base.

In sum, the market structure remains fragile, with bearish pressures dominating across spot, futures, and on-chain metrics. ETF inflows provided a temporary cushion, but contracting volumes and weakening profitability highlight the lack of conviction. While short-term bounce-backs are possible, sentiment overall remains defensive, with risks skewed toward further consolidation unless stronger demand re-emerges.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.