$5,940,000,000 XRP Activity Surge Shocks Market as Price Flips Direction

The crypto market saw whipsaw price action in the early Friday session, with various crypto assets seeing a surge in trading activity.

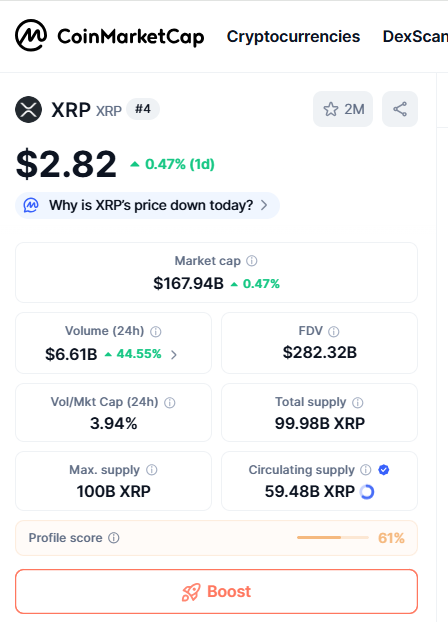

XRP likewise saw its volume rise as much as 44% to reach $6.57 billion, according to CoinMarketCap data.

The broader crypto market rose in response to a weaker jobs report released Friday, which seemed to boost the potential of a rate cut in the upcoming Fed meeting scheduled for September.

Cryptocurrencies returned to green afterward, but the rise was shortlived, followed by a drop.

At press time, XRP was down 0.85% in the last 24 hours to $2.80 after reaching an intraday high of $2.88.

XRP news

CME futures recently gave a recap of August growth, which saw a record $36 billion in OI for Crypto futures and options. XRP stole the spotlight as it reached an all-time high in open interest as institutional activity expanded beyond Bitcoin.

Ripple CEO Brad Garlinghouse took to X to highlight the recent milestone, noting XRP's impressive surge in open interest: "Per CMEGroup data, XRP Futures contracts were the fastest-ever (just over 3 months) to hit $1B in open interest."

This week, the credentials amendment was activated on the XRP Ledger mainnet. Credentials (XLS-70) are designed to be a lightweight feature additive to the DID standard and are a framework for issuing, managing and verifying user credentials directly on the XRP Ledger. This standard introduces a new "Credential" ledger object along with new transaction types for creating, accepting and deleting credentials.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jamie Dimon Expresses 'Significant Concern' About Potential Triggers for the Next Financial Crisis

Madrigal's 1.13% Price Drop Amid 108% Volume Surge Pushes It to 463rd Most Active Stock