First US Dogecoin ETF Could Launch Thursday, But Markets Are Hesitating

An ETF analyst claimed a Dogecoin ETF could launch this week, but with no SEC confirmation, markets remain cautious despite initial hype.

A leading ETF analyst claimed that a Dogecoin ETF will go live on US markets this Thursday. A meme coin ETF would open the floodgates for more altcoin approvals, as DOGE has no utility or value beyond its community.

His assessment prompted a massive rally for DOGE, but this dissipated. The SEC has gotten cold feet on several altcoin ETF approvals, and traders may be waiting for more explicit confirmation.

A Dogecoin ETF This Week?

Dogecoin has enjoyed a minor bull run this week, as increasing confidence in ETF approval is encouraging a flurry of trading activity. Eric Balchunas, a prominent ETF analyst, just claimed that the product will hit the markets in two days.

Meme coin ETF era about to kick off it looks like with $DOJE slated for a Thursday launch, albeit under the 40 Act a la $SSK. There's a big group of '33 Act-ers waiting for SEC approval still. Pretty sure this is first-ever US ETF to hold something that has no utility on purpose pic.twitter.com/BIcpu1zR4o

— Eric Balchunas (@EricBalchunas) September 9, 2025

If Dogecoin does get an ETF in the US, that would be a major milestone for crypto history. The Commission has been loath to approve any of the new wave of altcoin ETF applications, but it might greenlight a meme coin?

If this happens, it’d make meme coin history, and presumably signal a string of new SEC approvals.

DOGE was the first-ever meme coin, so it seems fitting that it’s leading the whole sector here. A Dogecoin ETF would be the first US-listed ETP of any sort where the underlying asset has zero utility whatsoever.

Sure, Balchunas noted that Rex Osprey is using a model with different approval requirements than most proposals, but it’s still an ETF.

Market Hesitancy Explained

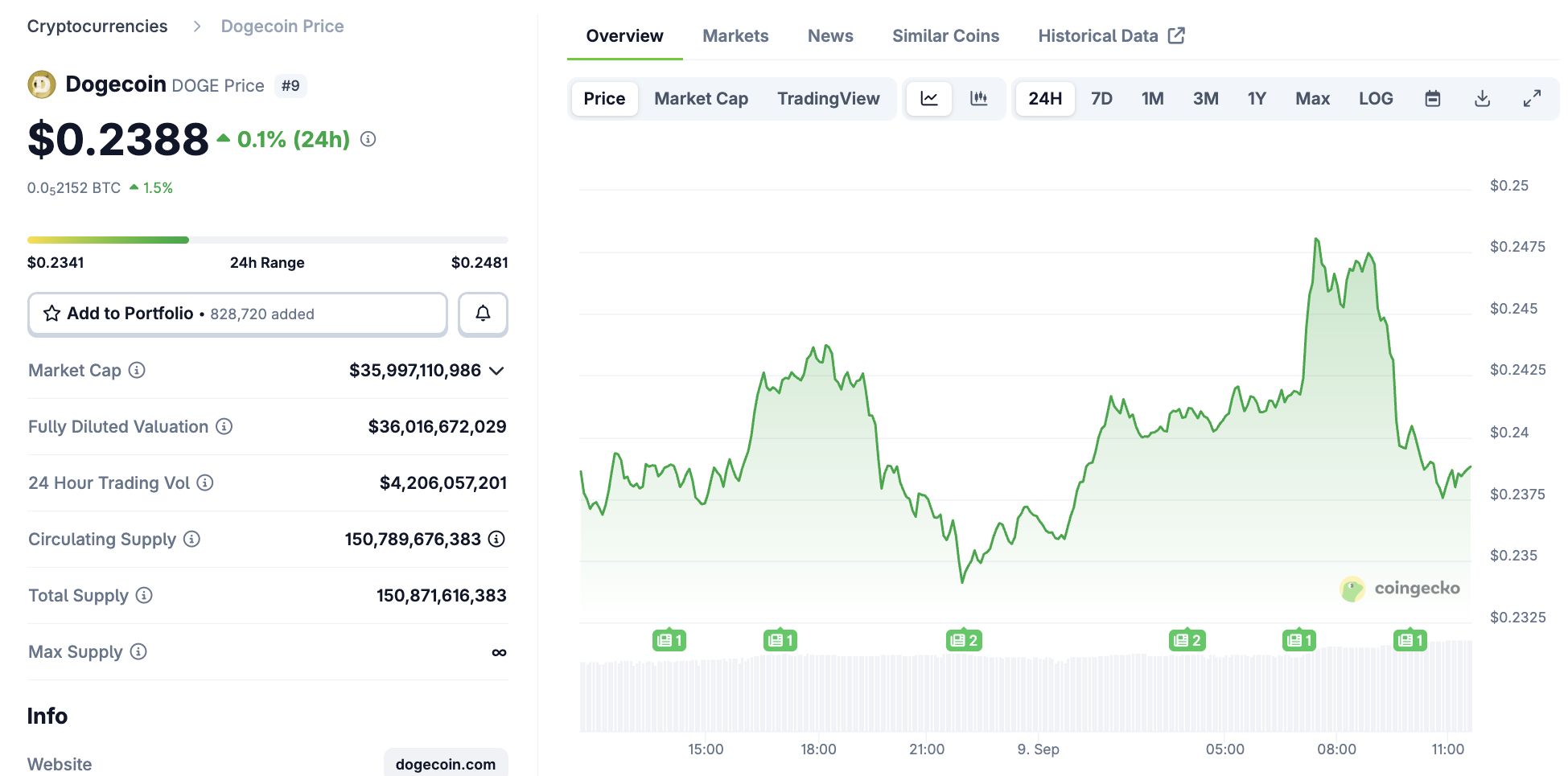

However, DOGE’s subsequent price moves seem a little confusing. Although Dogecoin spiked after the initial ETF post, those gains have completely vanished:

Dogecoin Price Performance. Source:

CoinGecko

Dogecoin Price Performance. Source:

CoinGecko

So, why is this? ETF hype has spurred Dogecoin bullishness for several days, but this major news only prompted ephemeral gains. There’s one possible explanation, and it’s quite simple: the markets need a little more proof.

Although the Commission has been trying to loosen approval requirements, no new products have actually materialized yet. In July, it explicitly approved an altcoin basket ETF, and indefinitely delayed it soon after.

Simply put, the SEC has not firmly and unequivocally stated that a Dogecoin ETF will go live in two days.

Until the product is actually available for sale, we’re in an ambiguous situation. If this approval really does go through, it would be highly likely to provide huge benefits for DOGE.

However, the SEC could get cold feet again, as it has on several recent occasions. Time will tell, but there’s a huge potential investment here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paraguay’s 30,000 Miner Strategy: Examining ANDE’s Cash Flow Dynamics

Wartime Overview: The Valuation of the Iran Crisis in Prediction Markets

Gold.com EVP Carol Meltzer sells $112k in shares