Expectations for Fed Rate Cuts Rise, Global Asset Risk Appetite Rebounds

ChainCatcher news, according to Jinse Finance, a research report from Galaxy Securities pointed out that although the US August CPI data rebounded, it was generally in line with market expectations and inflation remains within a controllable range. Meanwhile, last week’s initial jobless claims unexpectedly rose to 263,000, hitting a nearly four-year high. This combination of signals has further strengthened market expectations that the Federal Reserve will start a rate-cutting cycle within the year. It is expected that the US dollar will weaken in the future, driving capital flows to non-US markets, especially emerging markets and high-yield assets, thereby increasing global risk appetite.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Saxo Bank: This week's data may impact the repricing of US interest rates

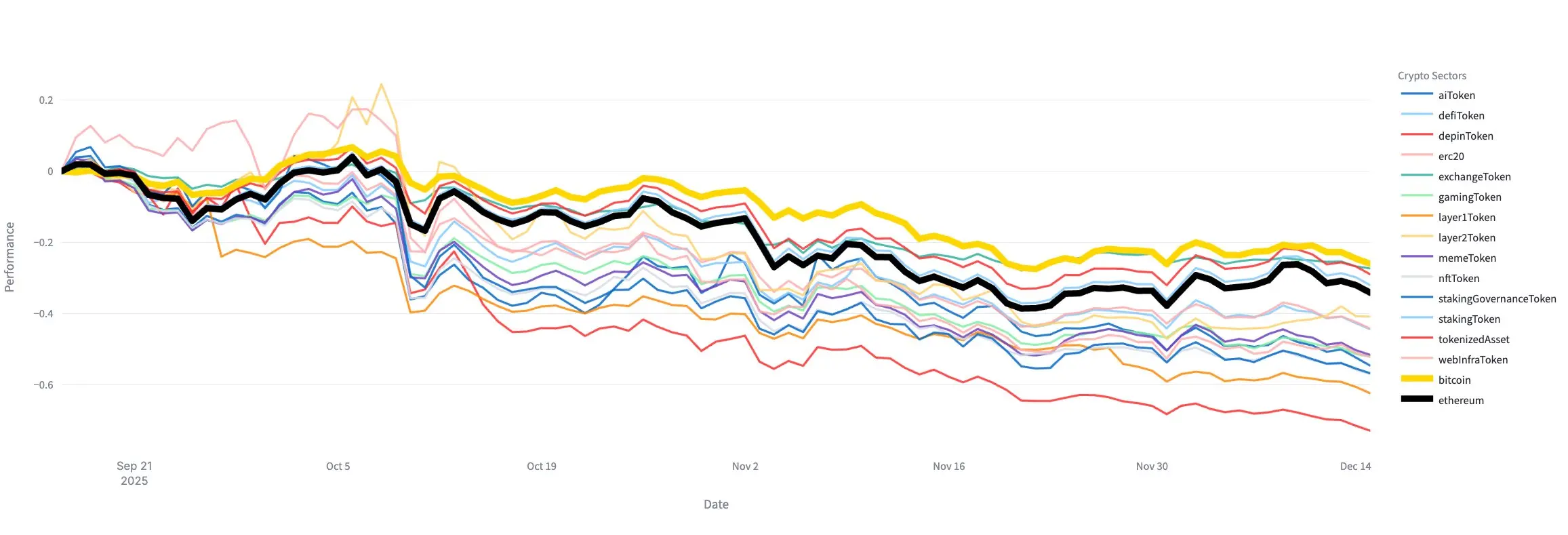

Glassnode: In the past three months, the average returns of almost all cryptocurrencies have been lower than BTC

Paradigm Head of Market Development Nick Martitsch announces resignation