Polkadot sets 2.1 billion DOT cap to reshape tokenomics, but market slides 5%

Polkadot’s DOT token slid nearly 5% in the past 24 hours, despite the network’s community approving a landmark governance proposal that reshapes its tokenomics.

On Sept. 14, the team confirmed via X that the community had passed the “Wish for Change” proposal, which sets a hard cap of 2.1 billion DOT.

The move ends Polkadot’s open-ended issuance model, which generated roughly 120 million new tokens yearly.

Currently, around 1.6 billion tokens are in circulation, meaning more than three-quarters, or 76%, of the eventual supply has already been minted.

Polkadot said it aims to stabilize its long-term economic design by introducing scarcity and winding down inflation as a funding mechanism. The change highlights a broader effort to reduce dependence on perpetual issuance and push the ecosystem toward alternative revenue streams.

DOT’s new inflation schedule

The new framework introduces a stepped-down inflation schedule beginning March 14, 2026. Under the revised model, token issuance will taper over a two-year adjustment period.

Polkadot estimates that about 1.91 billion DOT will be in circulation by 2040, which is far below the 3.4 billion projected under the old system. The final cap is expected to be reached around the year 2160.

To manage this process, the proposal outlines three schedules for reducing inflationary pressure. One option immediately cuts emissions by more than half before easing off, while another applies sharper early reductions followed by a gradual decline through the next century.

Polkadot’s ecosystem changes

The governance overhaul arrives as Polkadot works to strengthen its position against rivals like Ethereum through initiatives such as Polkadot Capital Group, which seeks to bridge traditional finance.

It also coincides with the return of co-founder Gavin Wood as CEO of Parity Technologies, the blockchain network’s development arm.

Yet these moves have failed to halt the token’s slide.

At press time, DOT trades at roughly $4.20, according to CryptoSlate data, marking a fresh 24-hour decline of nearly 5%.

The drop compounds a broader downturn, with the asset losing about 34% of its value since the start of the year.

The post Polkadot sets 2.1 billion DOT cap to reshape tokenomics, but market slides 5% appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Top 5 Analyst Questions That Stood Out During Encore Capital Group’s Q4 Earnings Call

The Zacks Analyst Blog Features Atmos Energy, Consolidated Water, and Fortis

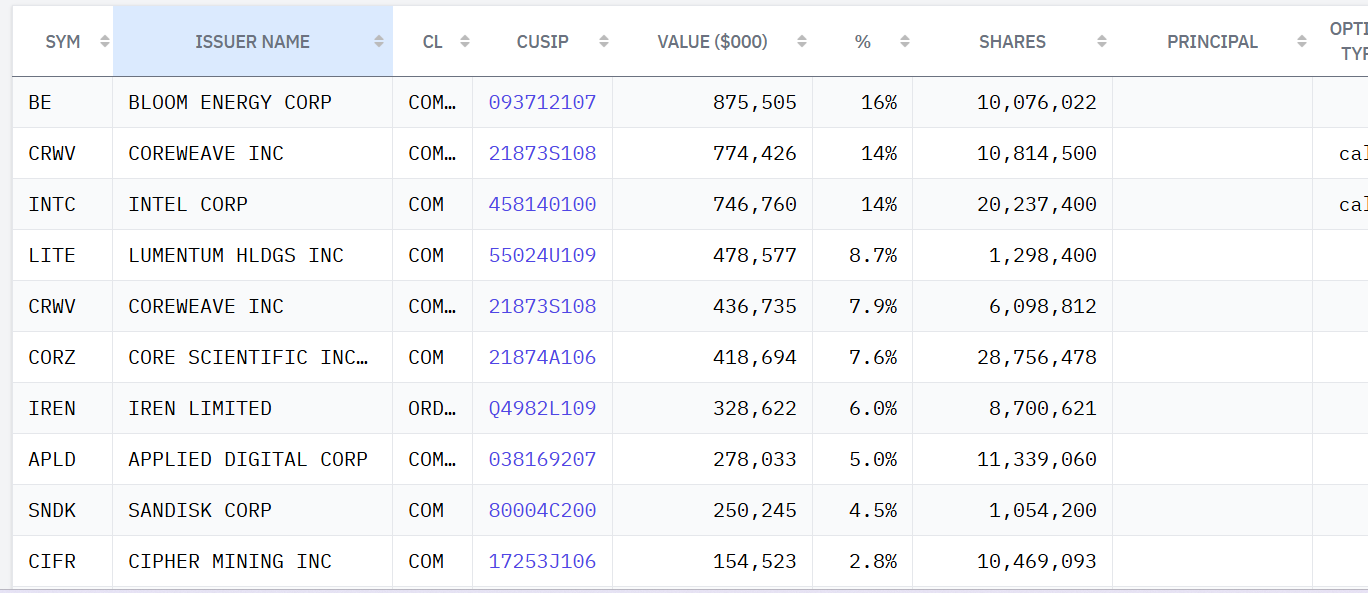

Ex-OpenAI researcher’s hedge fund reveals big Bitcoin miner bets in new SEC filing

Ethereum’s Changing Dynamics: ETF Investments and Exchange Withdrawals Point to a Potential Supply Crunch