PI Network Price Retreats: From Breakout Hopes to All-Time Low Fears

PI Network’s token faces renewed bearish pressure after losing its breakout level, with technical signals hinting at a possible return to all-time lows.

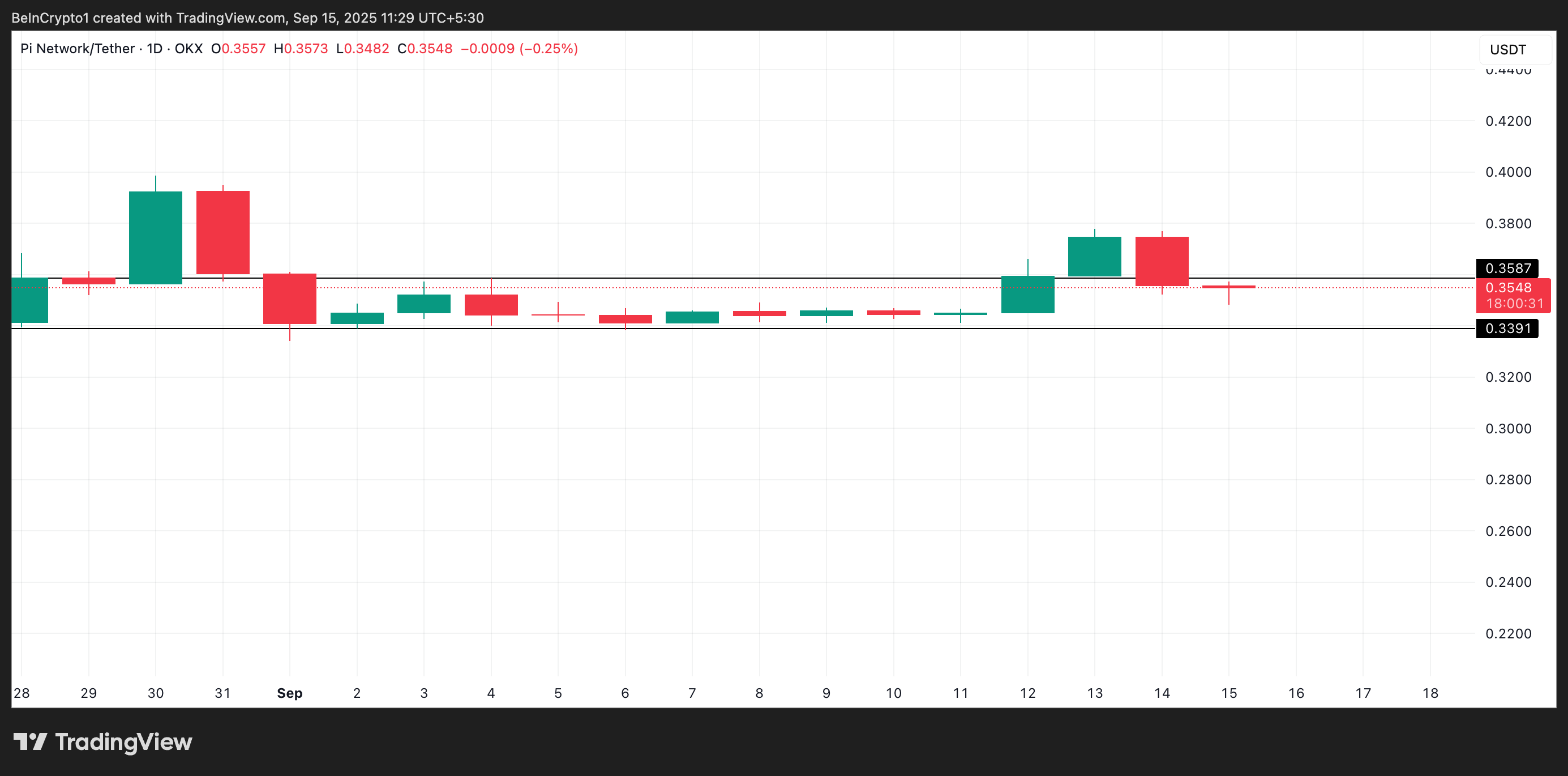

PI Network’s PI is showing signs of fading bullish momentum after briefly breaking above a key resistance level of $0.3587 two sessions ago.

The token’s subsequent fall below this breakout line has sparked concerns over renewed weakness. With bears appearing to regain strength, the token could revisit its all-time low in the near term.

Sellers Regain Control After Failed Breakout

As earlier reported by BeInCrypto, PI closed above the $0.3587 resistance on Friday, breaking out of the sideways trend that had kept its price muted since August 13.

The token maintained its position above this breakout line on Saturday, but PI closed back below the resistance as selling pressure intensified on Sunday.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PI Horizontal Channel. Source:

TradingView

PI Horizontal Channel. Source:

TradingView

Daily chart readings now point to strengthening selloffs, worsening the likelihood of a resumption of the sideways trend, or a deeper decline.

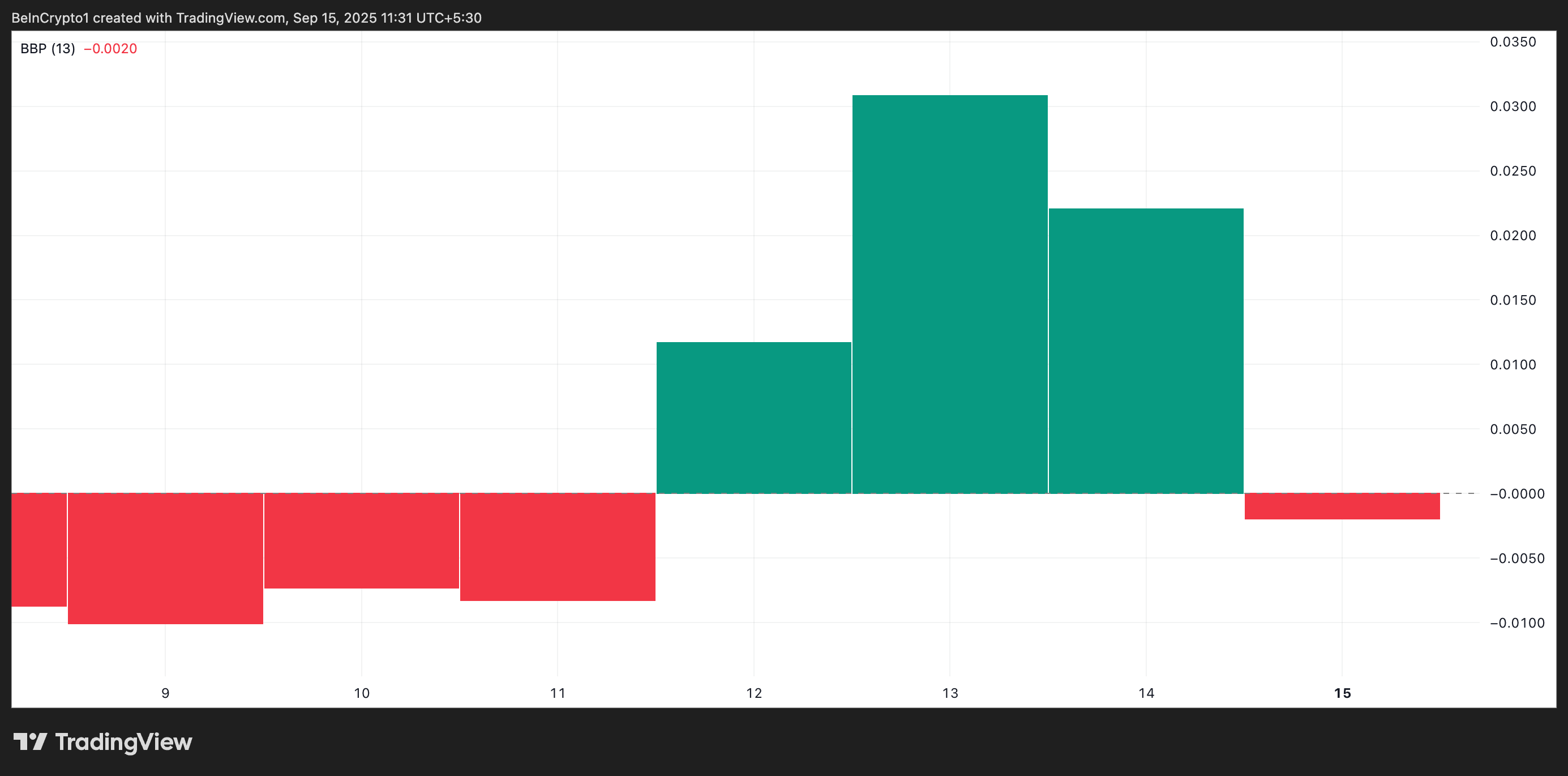

The token’s Elder-Ray Index, which measures the balance between bulls and bears, confirms the shift in control toward sellers.

After three days of posting green histogram bars reflecting bullish strength, the indicator has returned a negative value. This reversal demonstrates a growing dominance of selling pressure over buying interest.

PI Elder-Ray Index. Source:

TradingView

PI Elder-Ray Index. Source:

TradingView

This shift implies that bulls are losing their grip on PI. Unless buying momentum re-emerges, the token could struggle to reclaim its breakout levels and may face further downward pressure.

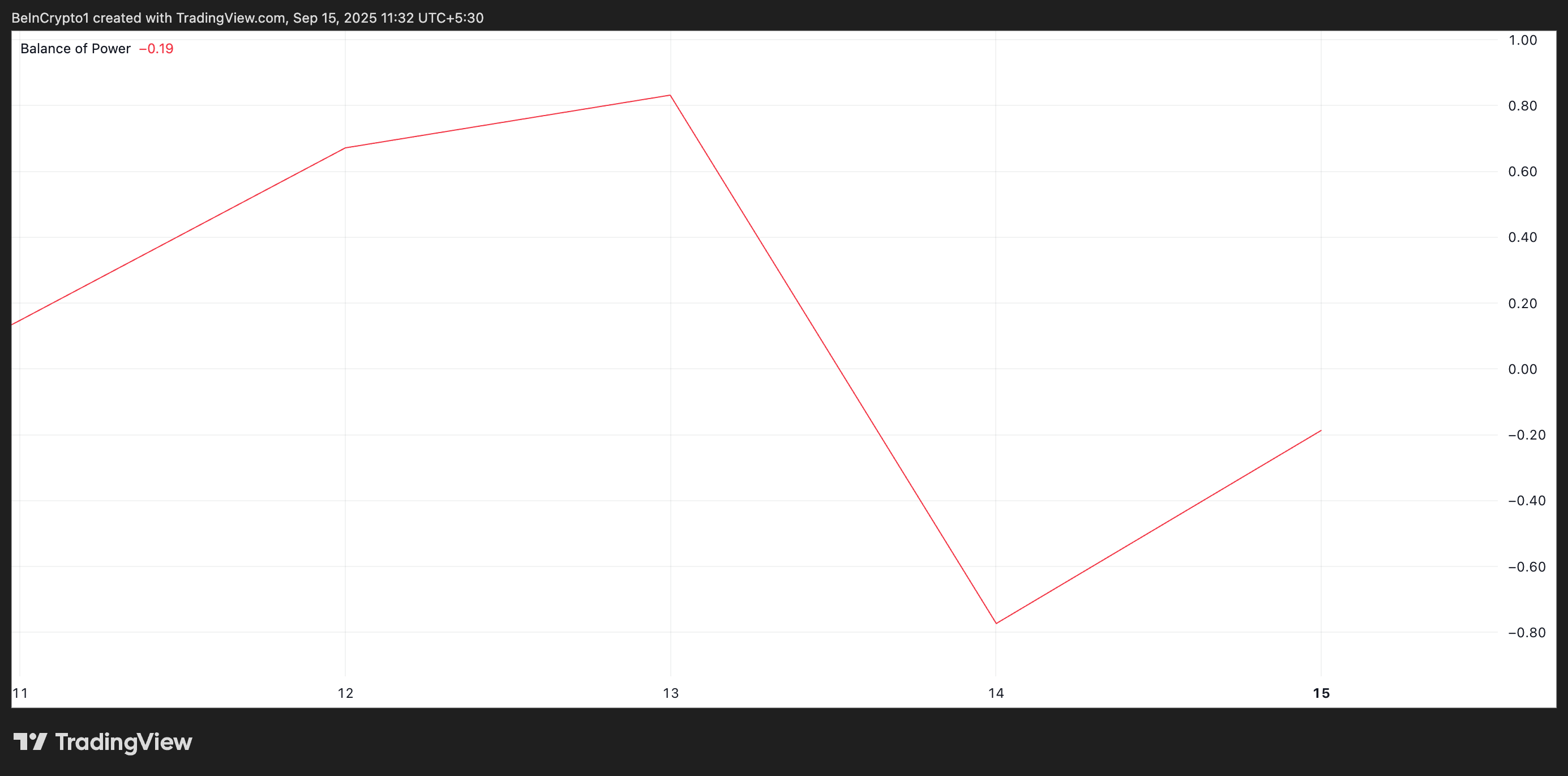

Moreover, the token’s Balance of Power (BoP) indicator is also negative at press time, pointing to weakening buying pressure. It currently stands at -0.10.

PI Balance of Power. Source:

TradingView

PI Balance of Power. Source:

TradingView

The BoP measures the strength of buying versus selling pressure in the market, helping to identify whether bulls or bears are dominating price action.

A negative reading, as seen now, indicates that sellers are exerting more influence than buyers, and buying pressure is weakening.

This increases the likelihood of a continued sideways trend or even a further decline toward lower support levels for PI.

PI Risks Revisiting Record Low Unless Demand Returns

Continued selling pressure could keep PI trapped in a consolidation range between resistance at $0.3587 and support at $0.3391. If bearish sentiment grows, the altcoin may test a break below this support level, and a successful breach could see PI revisiting its all-time low of $0.3220.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

However, if new demand enters the market, PI could climb back above $0.3587 and charge toward $0.3903.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New York's BNPL Enforcement: A 60-Day Window Driving Market Transformation

Hormuz Crisis Drives China and India to Rush for Russian Oil

IMAX CEO: AI aims to boost efficiency, not revolutionize how films are made

Bitcoin Surges to $70k: Repeating Cycle or Start of a Fresh Bull Run?