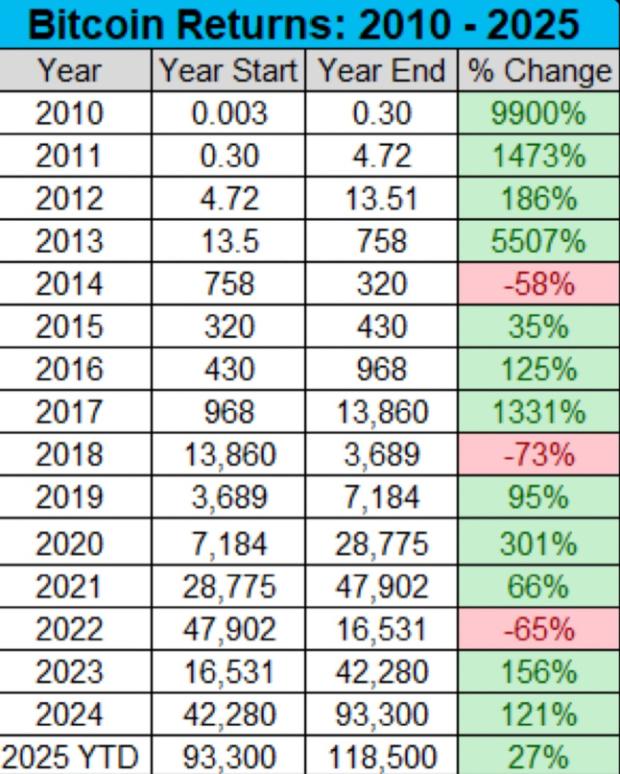

As Bitcoin Faces Downward Pressure, Meme Coins Surge Amid Dreams of 24,000% Returns

- MoonBull’s presale targets 24,000% ROI, riding meme coin resurgence driven by Pepe Unchained (PEPU) and Mog Coin (MOG) momentum. - Pepe Unchained raised $18.5M via a Layer-2 blockchain offering 116% staking yields, while Mog Coin surged 74% with $689M market cap. - Analysts highlight meme coins’ appeal amid Bitcoin volatility, though risks like 80–90% corrections and regulatory uncertainties persist. - MoonBull’s success depends on community engagement and delivering scalability promises, contrasting wit

Meanwhile, Mog Coin (MOG) has climbed 74% in the last month, now trading at $0.000001740 and boasting a market cap of $689.4 million. Technical analysis points to a potential 50% price surge as the token emerges from a falling wedge formation. Still, analysts warn that sharp corrections of 80–90% may follow rallies, offering chances for strategic accumulation. Mog’s integration with both Ethereum and Base blockchains, plus a 92% circulating supply, positions it to benefit from the ongoing meme coin trend. Recent partnerships with payment providers like MoonPay and Venmo are set to broaden its use cases beyond just speculation.

The resurgence of meme coins is also reflected in Pepe Coin (PEPE), which has jumped 21% in a week to reach $0.00000941. Increased whale activity and a 33% upside target to $0.0000162 point to continued bullish momentum. However, Pepe is facing resistance at $0.000013, and an overbought RSI of 87 suggests a possible short-term dip. Mog Coin’s 65% weekly rise and stabilization near $0.0000016 further demonstrate the sector’s strength despite wider market volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

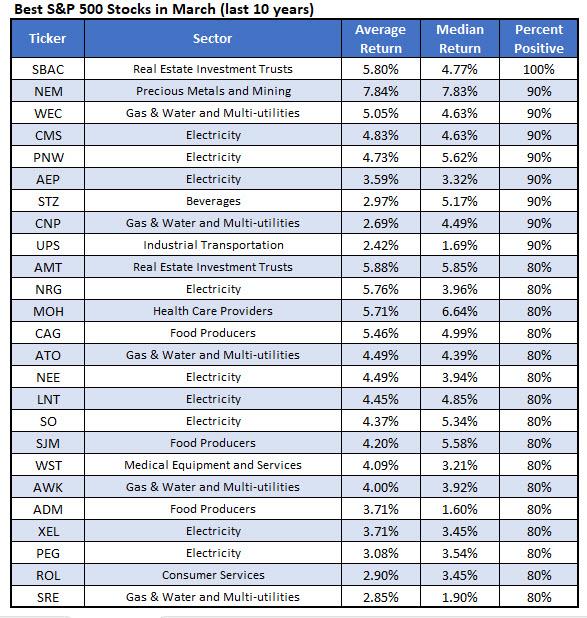

History Says Buy These 25 Stocks in March

The Contrarian Case for Strategy (MSTR)

Pi Network (PI) firms as bullish rank hits No.2 today

Will Momentum Hold as LayerZero Pressures $1.73 While Building Above Key Support?