Tether's potential $20 billion funding round could draw SoftBank, Ark as backers: Bloomberg

Quick Take SoftBank and Ark Investment are among potential investors interested in a possible funding round for stablecoin issuer Tether, according to Bloomberg. Tether is said to be in talks with investors to raise as much as $20 billion at around a $500 billion valuation.

SoftBank and Cathie Wood's Ark Investment may be interested in investing in a multibillion-dollar funding round for stablecoin issuer Tether, Bloomberg reported Friday.

"The two investors, both longstanding technology financiers, are among several high-profile names who are in early talks to provide funds to the world’s biggest stablecoin issuer in its largest search yet for external capital," the outlet said , citing anonymous sources.

Earlier this week, Bloomberg reported Tether is in talks with investors to raise as much as $20 billion at around a $500 billion valuation, which would make the crypto company one of the most valuable private companies in the world, potentially rivaling the likes of OpenAI and SpaceX.

Cantor Fitzgerald, said to be a Tether shareholder, is advising the potential deal, the report said.

Companies, investors, and advisors will often leak information about potential deals in order to signal interest or gauge market reaction.

SoftBank, Cantor Fitzgerald, and Tether are partners in the Bitcoin treasury firm Twenty One Capital. The company launched with $3.6 billion in bitcoin on its balance sheet, making it, at the time, the third-largest holder of bitcoin among publicly traded companies.

El Salvador-based Tether is the world's largest stablecoin issuer with a supply of $173 billion of USDT tokens. The company recently announced plans to launch a USD-pegged stablecoin for the U.S. market. Bo Hines, CEO of Tether's newly-created U.S. unit , said at a conference in Seoul this week that the stablecoin firm "has no plans to raise money."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.

How iRobot Strayed from Its Original Path

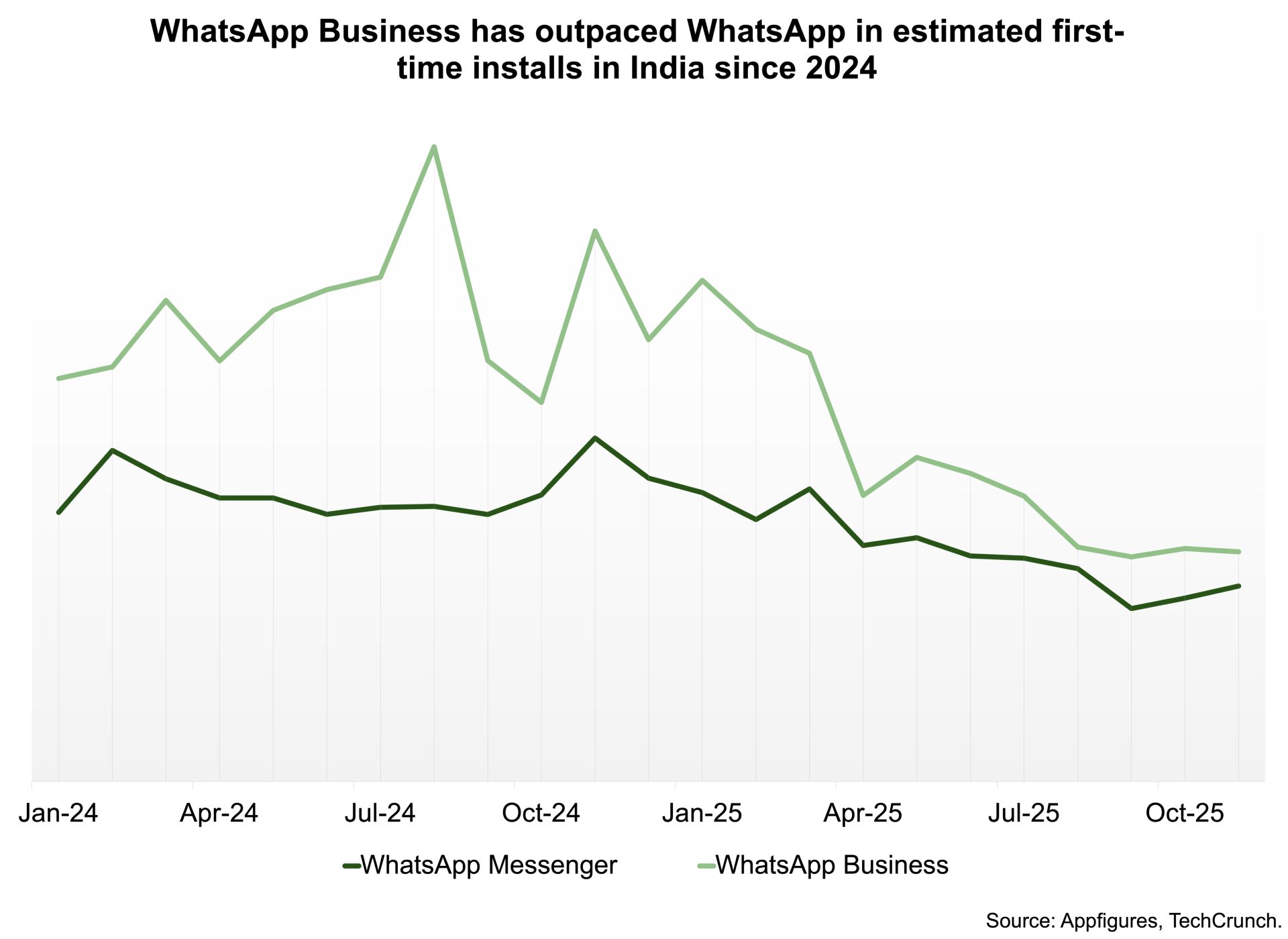

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t