Altcoins Face Challenges: Regulatory Issues and Liquidity Constraints Hamper Uptober Progress

- Altcoins struggle during Uptober despite $1.7B Bitcoin ETF inflows, as liquidity constraints and regulatory shifts dampen momentum. - Mutuum Finance (MUTM) faces liquidity bottlenecks despite $16.23M raised in its presale, with rising token prices deterring early adopters and regulatory scrutiny over its lending model. - U.S. GENIUS Act and EU MiCA framework increase compliance costs for altcoins, pushing innovation to jurisdictions like Singapore and UAE. - Delayed CLARITY Act creates legal ambiguity, d

Despite the buzz around Uptober, altcoins have remained largely stagnant as traders contend with shrinking liquidity and shifting regulatory conditions. Although

Recent regulatory shifts in the U.S. and EU have added more uncertainty for altcoins. The U.S. enacted the GENIUS Act in July 2025, introducing strict reserve rules for stablecoins and barring the Federal Reserve from launching a CBDC without Congress’s approval. Meanwhile, the EU’s Markets in Crypto-Assets (MiCA) regulation, fully in effect since late 2024, requires crypto service providers to obtain licenses, ensure transparency, and maintain capital reserves. These rules, intended to reduce systemic risks and fraud, have increased compliance burdens for smaller projects, prompting some to relocate to more accommodating regions like Singapore and the UAE.

Investors are also cautious about the CLARITY Act, which aims to define the regulatory boundaries between the SEC and CFTC but remains stalled in the Senate. The lack of progress has left legal uncertainties, discouraging institutional investment in altcoins. At the same time, the U.S. Treasury’s resistance to a retail CBDC and its advocacy for a Bitcoin strategic reserve reflect a dual approach: encouraging crypto adoption while enforcing measures to prevent excessive speculation.

Analysts believe that for altcoins to rebound, both liquidity and regulatory issues must be addressed. For projects like MUTM, success depends on proving real-world value—such as through its Layer-2 lending system and staking incentives—while adapting to stricter compliance standards. Still, the overall market remains hesitant. With

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

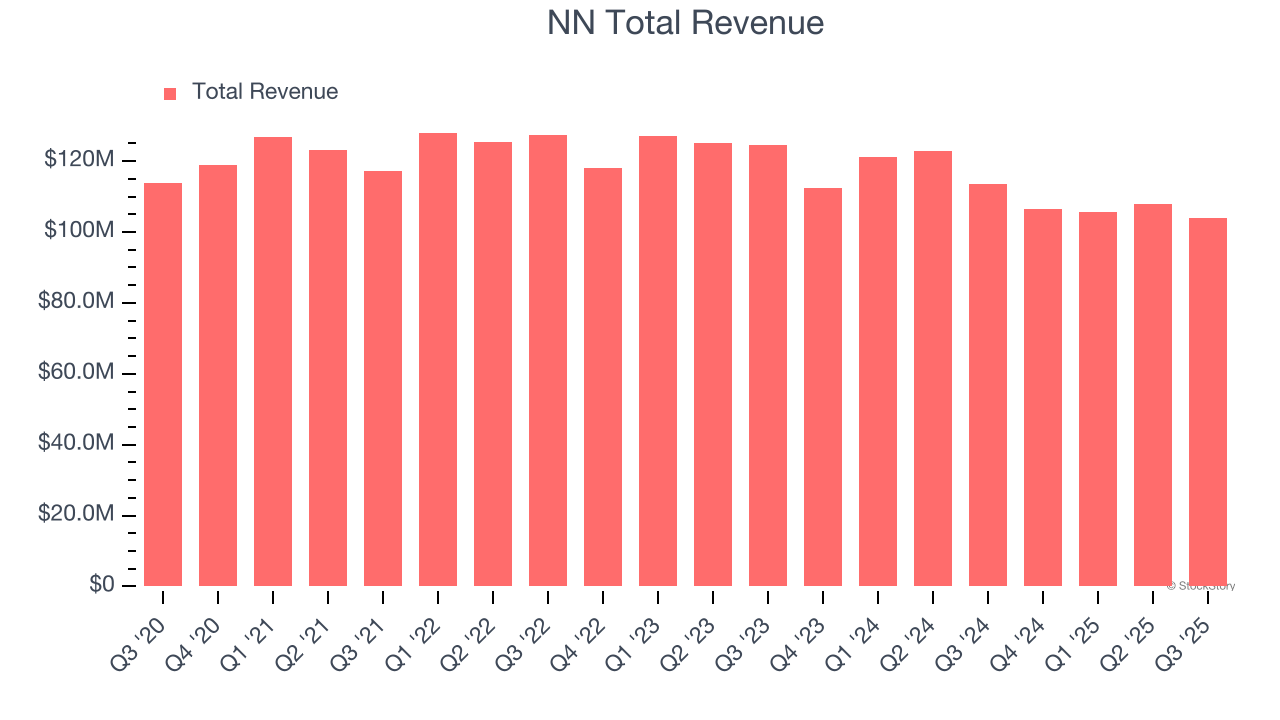

NN (NNBR) Q4 Earnings Report Preview: What To Look For

Gold price to accelerate and hit new record highs after this event – technical analyst

Magnachip Earnings: What To Look For From MX

Gold price to accelerate and hit new record highs after this event – technical analyst