DeFi Platforms Transform User Onboarding, Posing a Challenge to Bitcoin’s Retail Leadership

- DeFi platforms like Aster and Hyperliquid are challenging Bitcoin’s dominance as retail onboarding channels via high-leverage trading and self-custody features. - Aster’s $35.868B 24-hour volume and 1,001x leverage highlight its rapid adoption, surpassing Hyperliquid’s $10.094B despite competitive fee structures. - Token incentives (e.g., Aster’s 4% Genesis rewards) and community governance drive growth, blending CEX usability with DeFi transparency to attract diverse traders. - BNB Chain’s resurgence an

Retail investors now have more ways to enter the cryptocurrency market beyond Bitcoin, as decentralized finance (DeFi) platforms are quickly becoming popular alternatives for onboarding. The emergence of perpetual decentralized exchanges (perp DEXs) such as Aster and Hyperliquid has brought advanced features like high-leverage trading, yield-generating collateral, and professional-grade tools to everyday users, transforming how people access crypto. These platforms are meeting the growing demand for self-custody and sophisticated trading options. According to DeFiLlama, Aster’s 24-hour trading volume recently hit $35.868 billion—over three times Hyperliquid’s $10.094 billion Aster Volume Surges as Perp DEX Activities Hit Record Highs [ 1 ]. This development highlights a larger movement where DeFi’s rapid innovation is challenging traditional entry points, including Bitcoin’s longstanding dominance among retail participants.

Aster, a

The expansion of these platforms is also driven by token rewards and community governance. Aster’s Genesis Stage 2 rewards program allocates 4% of its 8 billion tokens to users through Rh points, with extra bonuses for team participation. This approach, along with a 5% trading fee discount for $ASTER holders, has pushed daily trading volumes to $3.13 billion, split between centralized exchanges ($1.09 billion) and DEXs ($1.84 billion) A Look at ASTER’s Dramatic Rise: Possible Reasons … [ 2 ]. Hyperliquid’s HYPE token, despite a 5.85% drop in price over 24 hours, still sees significant activity with $605.8 million in daily trades. Experts attribute this to the platforms’ ability to combine the convenience of centralized exchanges with the openness of DeFi, attracting traders who are wary of outages and regulatory risks at traditional exchanges Perp DEX Volume Hits Record $67B as BNB’s Aster Overtakes … [ 3 ].

Shifting market trends further illustrate the growing variety of entry points for new users. In September 2025, DeFiLlama reported $67.134 billion in 24-hour perp DEX volume, up from $739.599 billion over the previous month Aster Volume Surges as Perp DEX Activities Hit Record Highs [ 1 ]. Other platforms like Lighter, EdgeX, and Paradex also posted multi-billion-dollar volumes, showing a fragmented but rapidly growing sector. This surge is supported by renewed activity on BNB Chain, which surpassed

The impact on retail onboarding is significant. DeFi platforms now offer features such as hidden orders, yield-generating collateral (like asBNB and USDF), and support for multiple blockchains, appealing to everyone from beginners to institutional investors. This broadens access and reduces dependence on

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

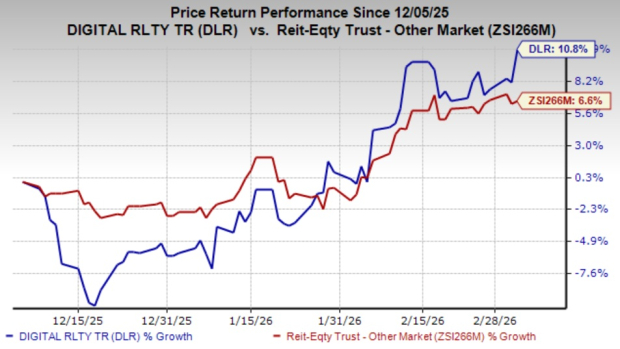

Digital Realty Enters Portugal, Boosts Southern Europe Data Hub

Cardano Founder Clashes with Ripple Over “Predatory” US Crypto Bill

Why Traders Should Pay Close Attention to This Friday’s NFP Report

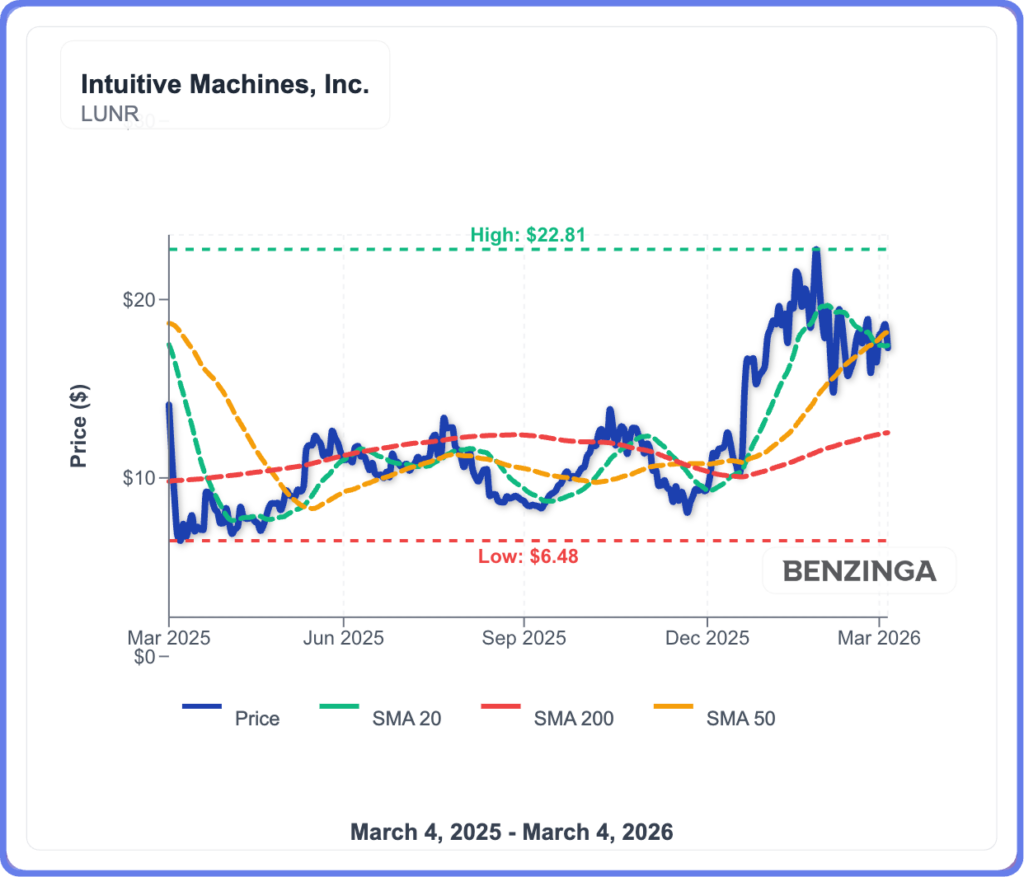

Intuitive Machines Stock Slides 8% Thursday: What's Driving The Action?