Korea’s $930B Pension Giant Urged to Invest in Bitcoin and Digital Assets

A South Korean expert suggests the National Pension Service should actively consider investing in digital assets. He recommends using Korean-style DAT firms and spot crypto ETFs as a pilot program.

A new proposal in Korea suggested that the National Pension Service(NPS), the country’s public pension fund, should actively consider investing in digital assets.

Kab Lae Kim, a senior research fellow at the Korea Capital Market Institute, made the recommendation Monday at a local conference. NPS is the world’s third-largest pension fund with over $930 billion (KRW 1,185 trillion) in assets under management.

DAT and Spot ETFs as a ‘Primer’ for Pension Funds

Kim said the NPS should actively consider digital assets and include them in its portfolio. The domestic digital asset has already discovered its industry foundation. Securities firms are moving into the space, creating significant profit potential. However, the NPS does not easily commit its capital. The asset’s reputation for high volatility could substantially obstruct investment.

Kim pointed to Digital Asset Treasury (DAT) companies and spot crypto Exchange Traded Funds (ETFs) as potential ” primers.” He believes they could lead to pension fund investment in digital assets by causing a policy shift toward a “Korean-style DAT” or a Bitcoin spot ETF in the digital asset ecosystem.

Kim added that NPS is critical in helping the country’s digital asset companies grow and compete globally, urging policy discussions.

Kim works for the Korea Capital Market Institute, a leading think tank dedicated to capital market research. KCMI conducts objective, high-quality policy research to contribute to economic growth and promote public interests.

A Growing Global Trend

Globally, pension funds and endowments are increasingly showing interest in Bitcoin investment. For example, AMP, an Australian pension fund managing about $57 billion in assets, invested $27 million in Bitcoin last December. The Michigan state pension fund invested $6.6 million in a Bitcoin ETF in the US. These investment moves will likely expand.

This past August, President Donald Trump signed an executive order to include cryptocurrencies in 401(k) retirement plans for retired US workers. Korea’s NPS has not yet made a direct investment in Bitcoin; however, in August 2024, it purchased 24,500 shares of MicroStrategy (MSTR), a stock with a high correlation to Bitcoin’s price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coeur Mining's 2.86% Surge Amid 304th-Ranked $0.41B Volume as Mixed Earnings Fail to Dampen Institutional Hype

Oneok Stock Slides 1.49 as 0.40 Billion Volume Ranks 306th Following Disappointing Earnings

Avino Silver (ASM) Surpasses Q4 Earnings and Revenue Estimates

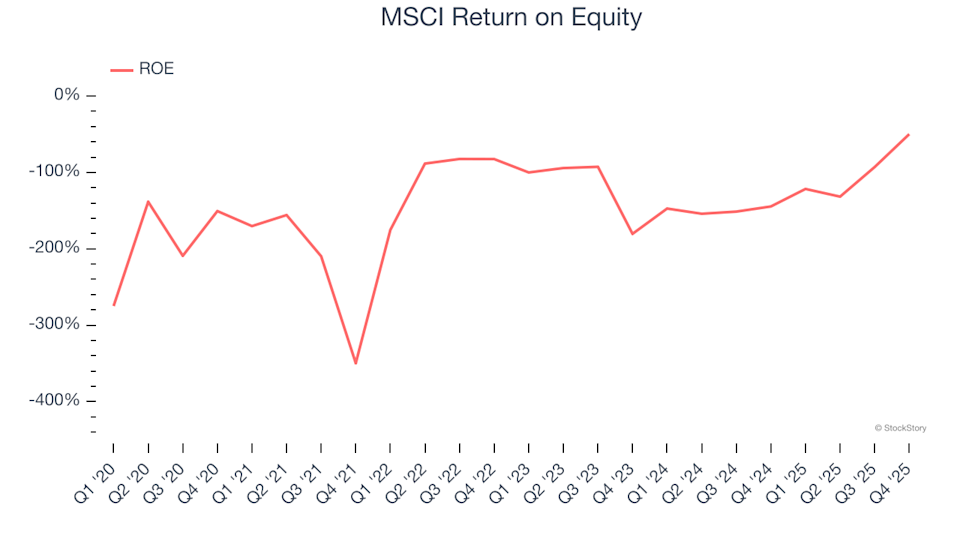

MSCI (MSCI): Should You Buy, Sell, or Hold After Q4 Results?