'The turf war is over': CFTC Acting Chair Caroline Pham says as agencies look to work together on crypto

Quick Take “It’s a new day and the turf war is over,” said Commodity Futures Trading Commission Acting Chair Caroline Pham during a joint roundtable on Monday hosted by the CFTC and Securities and Exchange Commission. The CFTC and the SEC have arguably been engaged in a turf war over crypto market regulation for years.

The "turf war is over" between the Commodity Futures Trading Commission and the Securities and Exchange Commission, said CFTC Acting Chair Caroline Pham.

"It's a new day and the turf war is over," Pham said during a joint roundtable on Monday hosted by the CFTC and SEC.

The CFTC and the SEC have arguably engaged in a turf war over crypto market regulation for years. For digital assets, former CFTC Chair Rostin Behnam has said the majority of the market meets the definition of commodities under his agency's supervision, while former SEC Chair Gary Gensler said that most cryptocurrencies were actually securities.

In Washington, D.C., lawmakers are working on a bill to regulate the crypto industry at large — called the Clarity Act, outlining market structure legislation — that could give the CFTC broader authority over digital assets. So, how the CFTC and its sister agency, the SEC, move forward could be significant.

"There's no question that because we both oversee related parts of the financial markets, the regulatory lanes for our two agencies aren't always clear or intuitive," Pham said. "At times, this has led to unnecessary friction between the two agencies and avoidable headaches for the market participants who depend on us."

Although there has been talk that the SEC and CFTC could be merged, SEC Chair Paul Atkins once again refuted it.

"Let me be clear: our focus is on harmonization, not on a merger of the SEC and CFTC, which would be up to Congress and the President," Atkins said on Monday at the roundtable. "Fanciful talk of reorganizing the government risks distracting us from the monumental opportunity we have in front of us."

The roundtable is continuing into Monday with panels including executives from Kalshi, Kraken, Polymarket, Robinhood Markets, Bank of America, and J.P. Morgan.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nexstar's Morgan Stanley TMT Conference: A Tactical Reaffirmation or a Missed Catalyst?

XRP Is Pushing Above 200 EMA, Can The Bulls Make It?

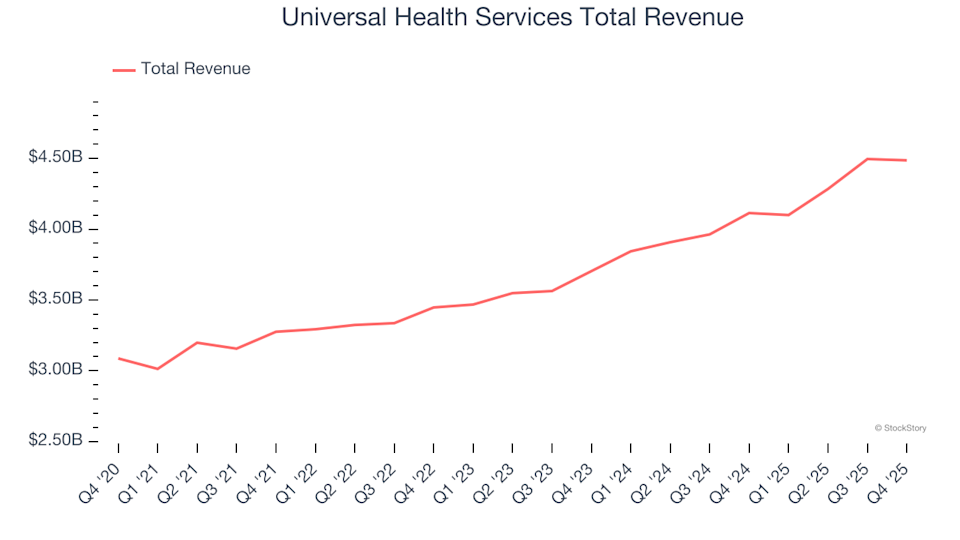

Hospital Chains Stocks Q4 Summary: Universal Health Services (NYSE:UHS)