Quant Analyst PlanB Says Bitcoin Now at Point of ‘No Return,’ Similar to 2020, 2017 and 2013 Bull Markets

A popular crypto analyst thinks the Bitcoin ( BTC ) bull market isn’t over yet.

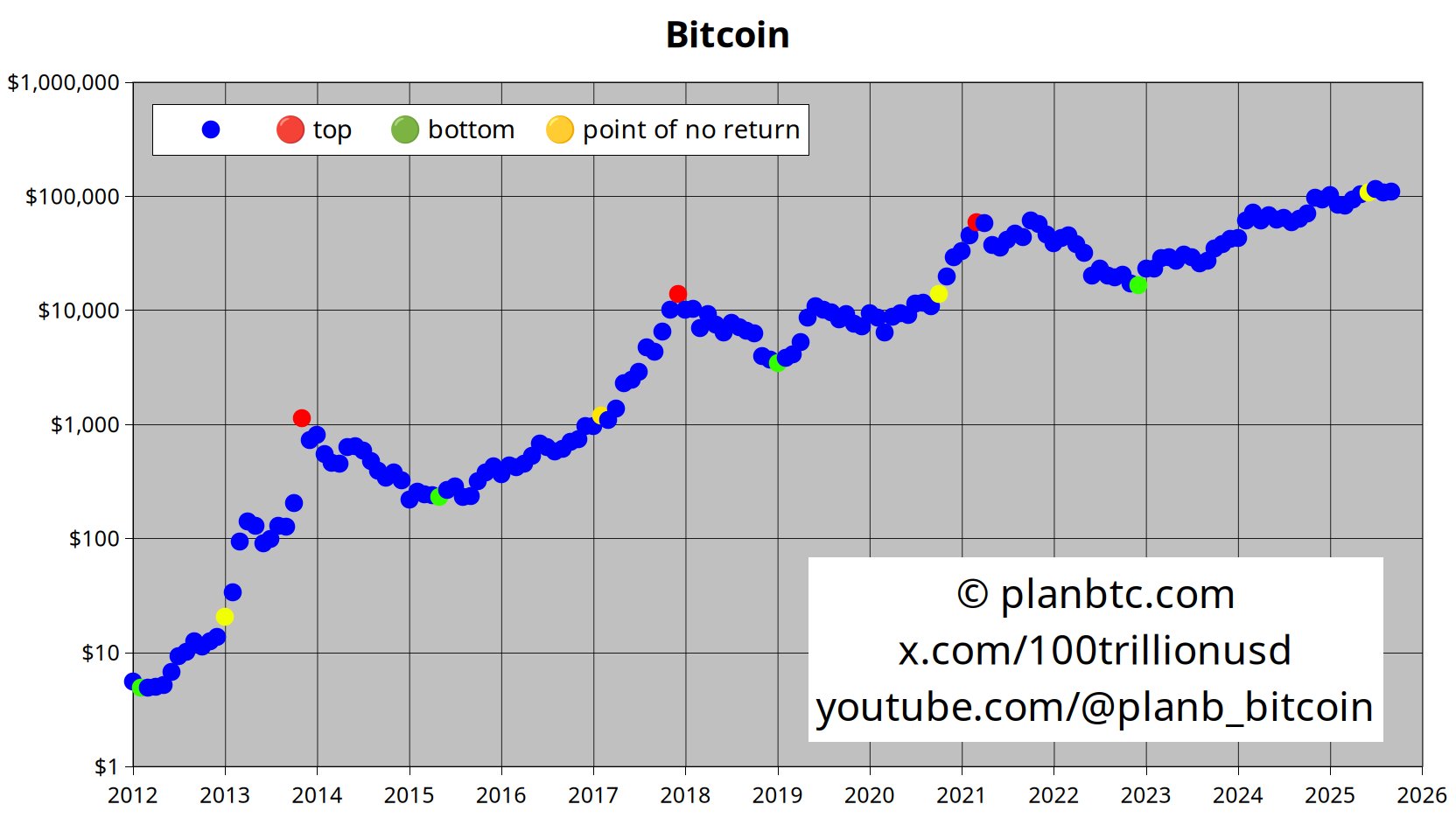

The pseudonymous trader PlanB tells his 2.1 million X followers that BTC has passed the “point of no return.”

“I think [the] Bitcoin bull market has not ended and will continue. I don’t know until when, or how high. It could also be a long, steady uptrend, without FOMO+crash. IMO, we passed the point of no return (yellow dots) in June 2025, similar to October 2020, February 2017 and January 2013.”

Source: PlanB/X

Source: PlanB/X

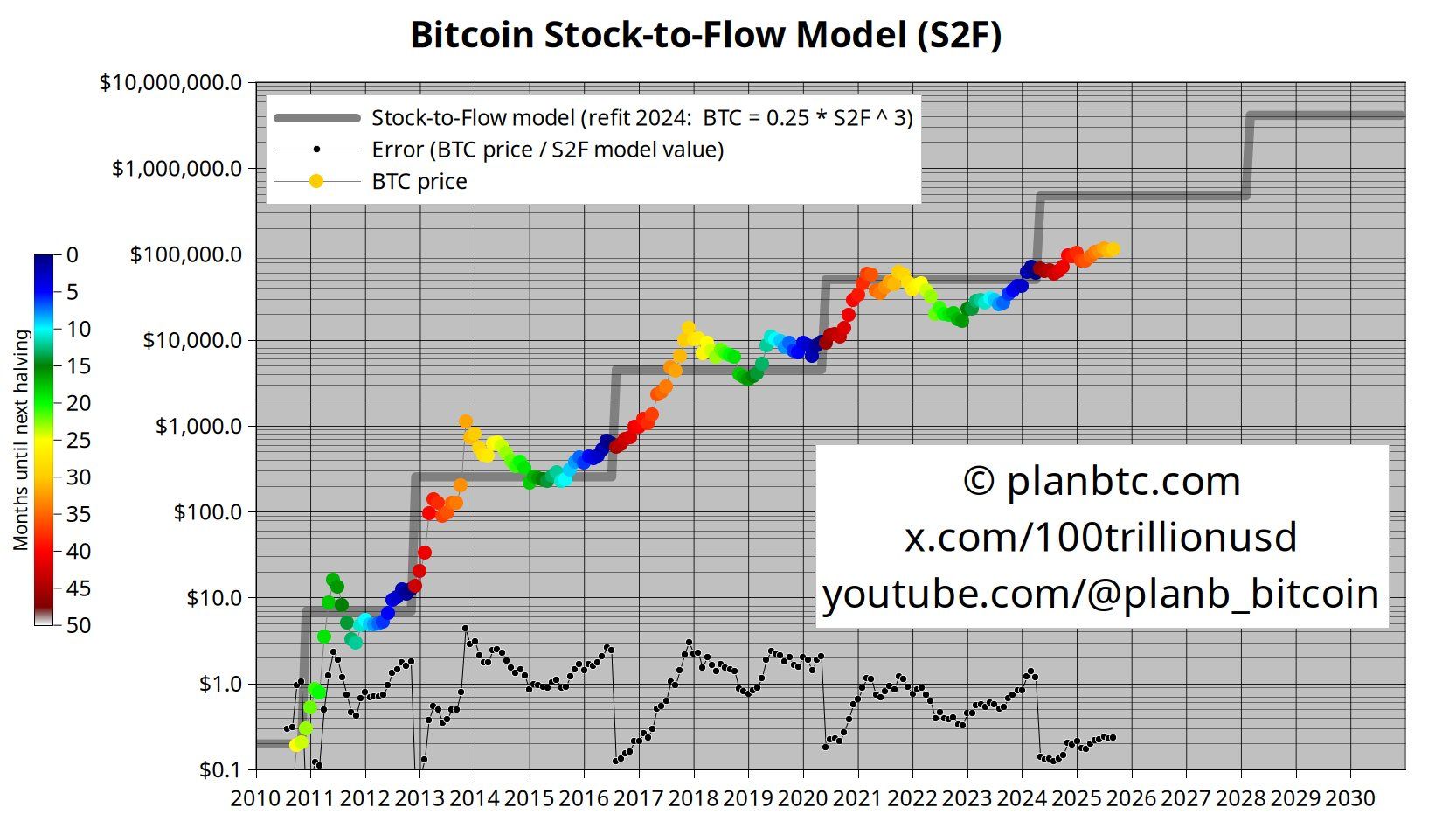

PlanB also shares a graph of the stock-to-flow model, a predictive tool that assumes the scarcity of a commodity drives its price.

“Whether you like it or not, Bitcoin’s value is very much linked to its scarcity. Fiat will be printed, Bitcoin will rise.”

Source: PlanB/X

Source: PlanB/X

While the stock-to-flow model was originally created to track traditional commodities, PlanB was one of the first analysts to apply it to Bitcoin.

Earlier this month, the crypto analyst argued that all asset prices – including gold, BTC, and the S&P 500 – have been rising during the last decade due to the Fed printing money.

“How will there be diminishing returns when debasement is exponential? All asset prices increased exponentially last 10 years (driven by money printing): -Gold 3x (~$1,000 to ~$3,000) -S&P 3x (~$2,000 to ~$6,000) -Bitcoin 250x (~$400 to ~$100,000). In my opinion, it is a unit of account phenomenon.”

BTC is trading at $114,471 at time of writing. The top-ranked crypto asset by market cap is up nearly 2% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India Gold price today: Gold increases, as per FXStreet data

Japan’s Akazawa says to Discuss allocation, timing of IEA oil reserve release

Netflix - Heading for new all time highs!

What Is Ethereum Really For? Vitalik Buterin Finally Has a Clear Answer