Court Case Reveals Lack of Evidence

Bill Morgan, a lawyer who closely followed the SEC v. Ripple case, has dismissed claims that Ripple organized influencers to promote XRP. He argued that if the SEC had evidence of such activities, it would have been central to the legal proceedings.

“The SEC had nothing to show the court about hype or promotional activities directed to programmatic and secondary market buyers,” Morgan stated, referencing court documents. The judgment confirmed that Ripple’s promotional materials, including the “Ripple Primer” and “Gateways” brochure, were primarily shared with institutional buyers rather than retail traders on exchanges.

Market Comparisons Spark Debate

The discussion resurfaced following Chainlink’s announcement about SWIFT’s blockchain initiative. At Sibos 2025, SWIFT revealed plans to launch a blockchain-based ledger to extend its global financial messaging network. Chainlink highlighted this as validation of its role in helping banks connect to blockchain networks through oracles while using existing infrastructure.

This partnership builds on more than seven years of collaboration between Chainlink and SWIFT, including digital asset trials and cross-border transaction pilots. After the SWIFT news, market analyst Dave Weisberger questioned why XRP’s market capitalization exceeds Chainlink’s by more than ten times, despite Chainlink’s institutional partnerships.

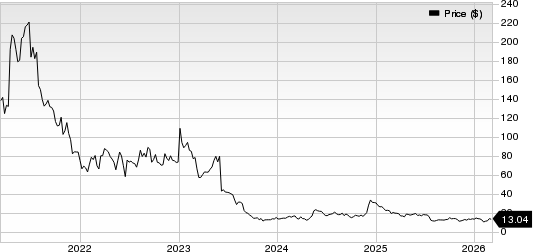

For context, XRP currently holds a market cap of $170.9 billion compared with LINK’s $14 billion. Over the past 24 hours, XRP saw $4.9 billion in trade volume, significantly higher than Chainlink’s $641 million.

Influencer Marketing Claims Examined

Some critics argued that XRP’s popularity stems from organized promotion rather than institutional adoption. One user pointed to Ripple documents that referenced building and activating a network of influencers as part of its marketing strategy.

However, Morgan emphasized that none of this was proven in court, and programmatic buyers were not shown to have been targeted by Ripple’s campaigns. He believes Ripple might have lost the case if the SEC could establish that the company paid influencers to promote XRP.

XRP supporters countered that the token’s value reflects real-world adoption, with higher trading volumes and usage on the XRP Ledger compared to Chainlink. The debate continues as both projects pursue different approaches to blockchain integration and market development.