Pendle downplays major break after seemingly lone actor began minting PT and YT token swaps

Quick Take Decentralized yield protocol Pendle disclosed that an onchain wallet has been drained, and an exploiter is minting principal/yield tokens “to dumping.”

Decentralized yield tokenization and trading protocol Pendle disclosed that an onchain wallet has been drained, and an exploiter is minting principal token (PT) / yield tokens (YT) "and dumping them."

However, the protocol "has not been hacked and all funds remain safe," they said in a message on X Monday. It appears some amount of PT and YT tokens are being swapped for ETH , though it may have stemmed from a false flag operation involving a potent Pendle hack.

The situation is developing and will be updated as we learn more. It is not yet clear how the attacker is minting free PT and FY tokens.

Significantly, the move comes shortly ahead of Pendle introducing the native stablecoin Plasma chain to its platform, which is expected to bring back notable total-value locked.

Launched in June 2021 on Ethereum, Pendle allows users to tokenize, trade, and manage future yields from yield-bearing assets, like staked tokens or lending positions, in a permissionless manner. It has about $6.5 billion locked, according to DeFi Llama.

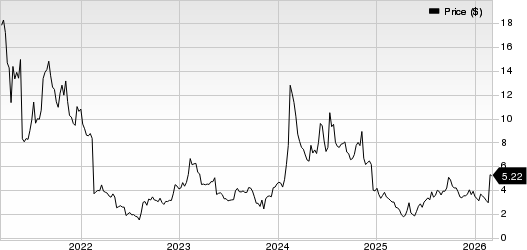

According to Certik, PENDLE experienced a sharp decline to $4.137 before recovering following an official statement that no security breach occurred. PENDLE is down about 5.4% to $4.41 on the day, according to The Block's price data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LRMR Stock on the Move: What Sparked the 55% Jump in the Past Month?

Do Options Traders Know Something About TPG Mortgage Investment Trust Stock We Don't?

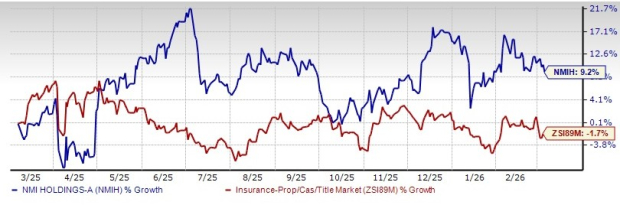

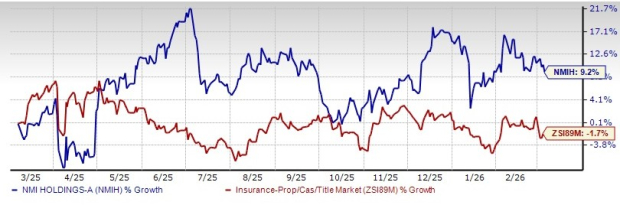

NMIH Stock Trading at a Discount to Industry at 1.15X: Time to Buy?

NMIH Stock Trading at a Discount to Industry at 1.15X: Time to Buy?