Institutions Anticipating Potential XRP and Solana ETFs Amid Strong Product Inflows: CoinShares

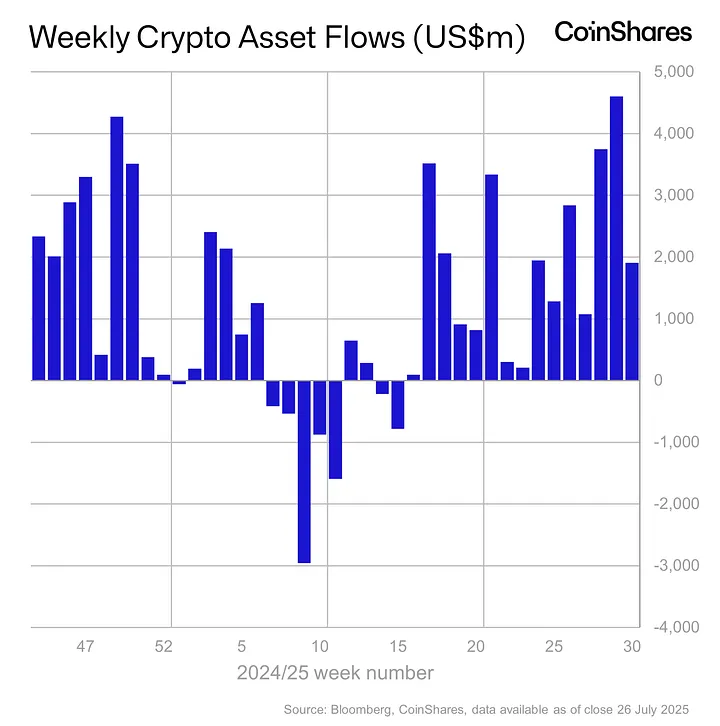

Leading digital asset research manager CoinShares says institutional investors are pouring money into altcoin exchange-traded products (ETPs) in anticipation of XRP and Solana ( SOL ) exchange-traded funds (ETFs).

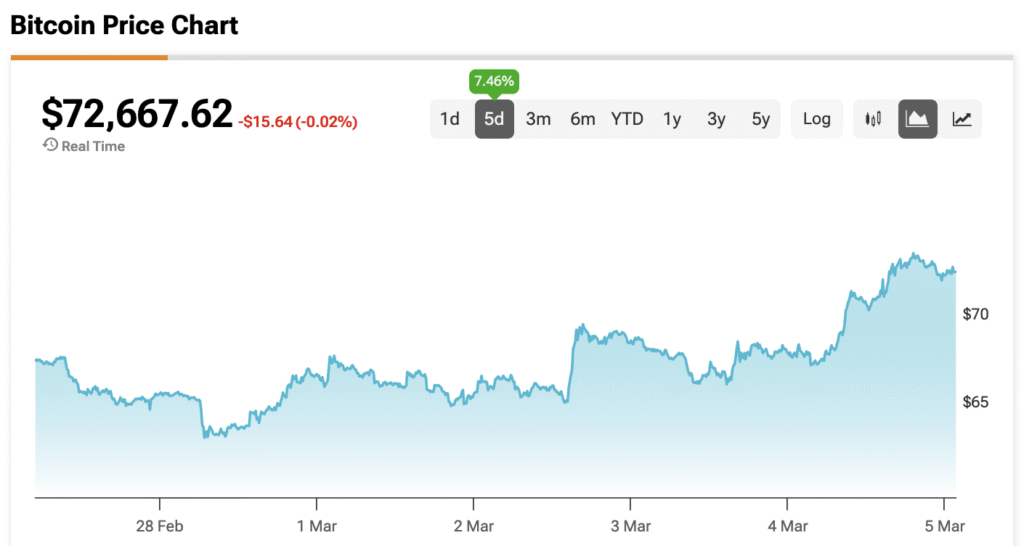

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that Bitcoin ( BTC ), which usually leads the pack in inflows, suffered outflows last week while certain altcoins enjoyed inflows.

“This has raised the question of whether we are entering an ‘altcoin season.’ While inconclusive, there are some signs: Solana and XRP attracted substantial inflows of US$311m and US$189m respectively, with SUI also seeing US$8m.

However, beyond these names, inflows tapered off quickly. Several altcoins saw outflows, including Litecoin (US$1.2m) and Bitcoin Cash (US$0.66m).”

Source: CoinShares

Source: CoinShares

Overall, the digital assets investment products market saw $1.9 billion in inflows last week, the fifteenth week in a row of positive flows.

“This pushed month-to-date inflows to a record US$11.2bn, significantly surpassing the US$7.6bn seen in December 2024 following the US election.”

Regionally, the US led with $2 billion in inflows, followed by Germany at $70 million. These inflows were offset by outflows from Hong Kong, Canada and Brazil to the tune of $160 million, $84 million and $23 million, respectively.

Unusually, leading smart contract platform Ethereum ( ETH ) led all inflows last week with $1.59 billion.

“Year-to-date inflows into Ethereum have now reached US$7.79bn, surpassing the total for all of last year.”

Generated Image: Midjourney

Featured Image: Shutterstock/monkographic

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Loar's M&A Surge: Is the Deal Story Already Priced In?

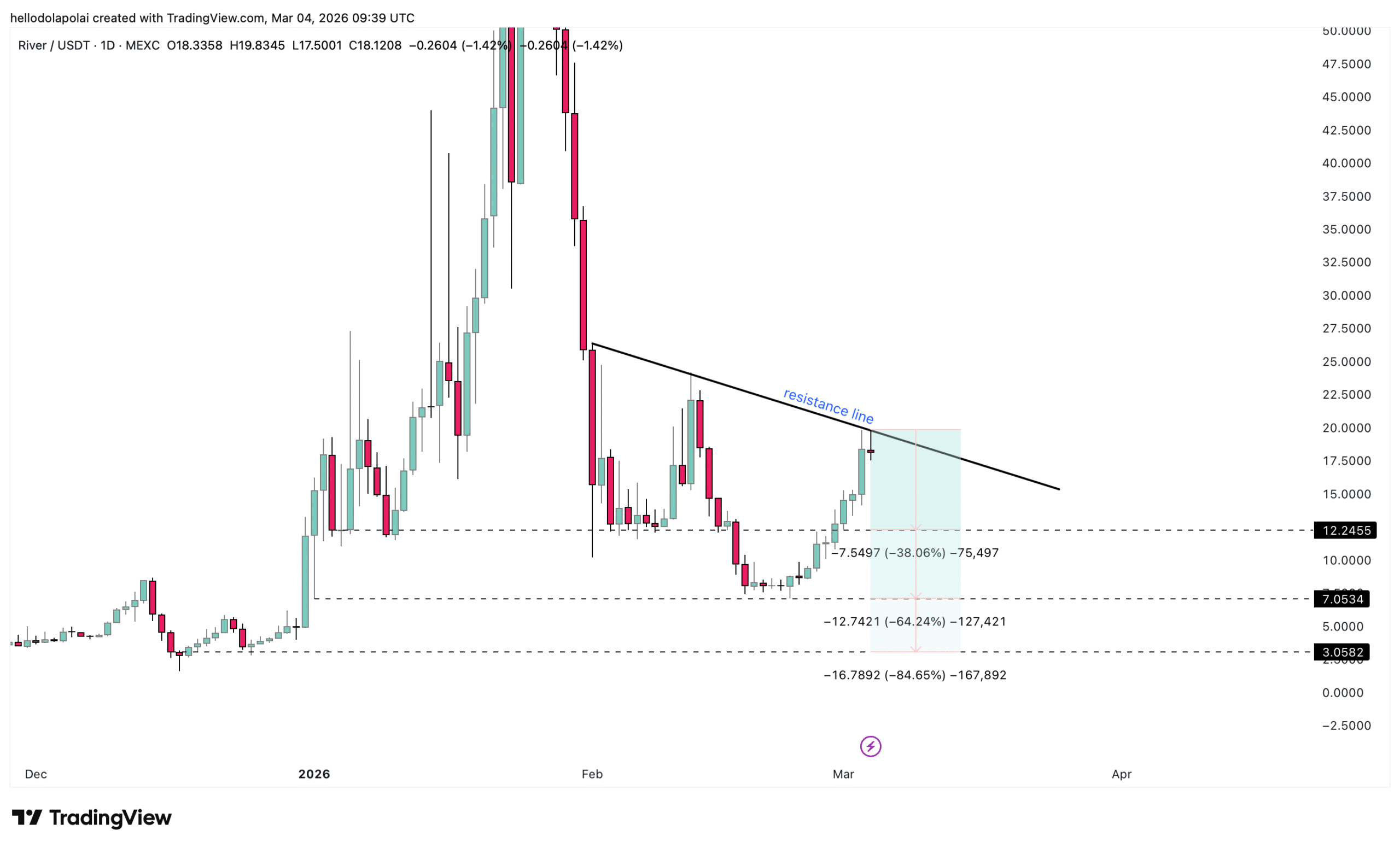

RIVER tops crypto gains with 34% surge – But ONE zone could end it fast