AlphaTON Capital to acquire 51% stake in Animoca’s gaming arm GAMEEAlphaTON’s TON strategy

AlphaTON Capital, a TON treasury company, has signed a non-binding letter of intent to acquire a controlling interest in mobile gaming firm GAMEE, a wholly owned subsidiary of Animoca Brands.

- AlphaTON Capital has signed a non-binding letter of intent to acquire a 51% stake in Animoca Brands’ gaming subsidiary GAMEE.

- The deal includes plans to acquire $4 million worth of GMEE and WAT tokens from the open market.

- AlphaTON shares initially slipped, but rebounded in after-hours trading following the announcement.

According to a Sep. 30 announcement , the letter of intent includes equity and token investments in GAMEE, which is a high-engagement mobile gaming platform and web3 ad network built on the TON blockchain with over 119 million registered users and a strong foothold within the Telegram ecosystem.

For AlphaTON, the acquisition is touted as part of the company’s broader strategy to accelerate Web3 adoption across Telegram’s billion-user network by backing high-traction platforms that can drive engagement, token utility, and ecosystem growth within the TON blockchain.

As part of the LOI, AlphaTON would acquire a 51% equity stake in GAMEE along with 51% of the GMEE and WAT tokens held in the company’s treasury. The company will also purchase another $3 million worth of GMEE and $1 million worth of WAT on the open market.

GMEE is the native token for GAMEE’s gaming ecosystem and supports rewards and governance on the platform. Meanwhile, WAT is a community-first token for WatBird, a gaming project incubated within the GAMEE ecosystem.

If the transaction, which is pending customary closing conditions and final definitive agreements, is completed, it would make GAMEE “the first Nasdaq-listed Web3 gaming company with gaming assets listed on a major exchange,” according to Animoca Brands executive chairman Yat Siu.

“We believe GAMEE can facilitate the mass adoption of open-source and decentralized technologies such as TON,” AlphaTON CEO Brittany Kaiser added.

AlphaTON shares slipped nearly 3% on Oct. 1 to close at $5.36, but climbed back in after-hours trading more than 7% to $5.77 as investors reacted to news of the potential GAMEE acquisition.

AlphaTON’s TON strategy

AlphaTON, formerly Portage Biotech Inc., pivoted from its biotechnology business earlier this month to become a treasury company focused on building a Toncoin treasury. The latest development follows a $71 million capital raise through a private placement and a loan facility with BitGo Prime, which AlphaTON is using to build a $100 million Toncoin treasury and support strategic investments in the TON ecosystem.

On Sep. 25, the company disclosed that it had already deployed $30 million into Toncoin, marking its entry as a top holder in the network.

Over the long run, AlphaTON plans to support TON-based apps in Telegram’s mini-app ecosystem and intends to incubate and develop leading applications, including TON-based DeFi protocols and gaming platforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

72 Hours of Life and Death! Decisive Factors That Will Determine the Market's Next Move

AUD/JPY trades above 111.00 after paring recent losses

NZD/USD recovers early lost ground; climbs back closer to 0.6000 amid modest USD pullback

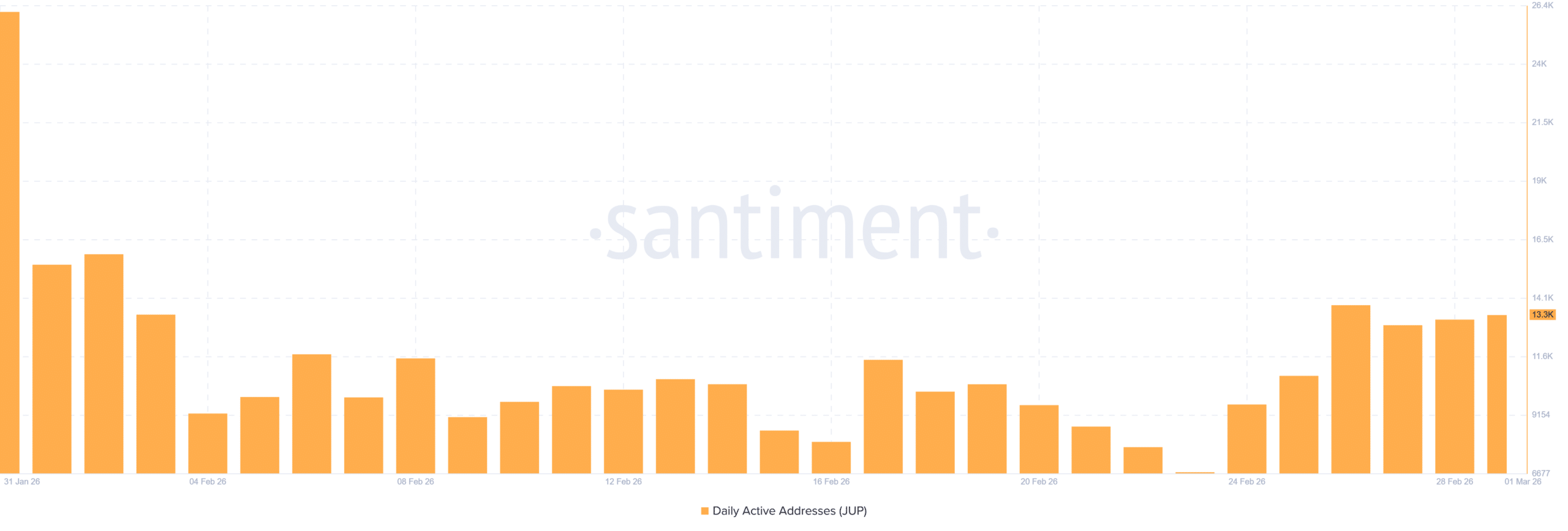

Jupiter surges 17% after rebound – Traders still bet on JUP’s dip