Ethereum’s October Record Says $4,500 Is in Sight—Will History Repeat?

Ethereum could test $4,500 in October as historical gains, shrinking exchange reserves, and surging on-chain activity fuel bullish momentum.

Ethereum could be poised for another strong October if history repeats itself. On average, ETH has gained 4.77% during the month, which would place the coin above $4,500 by the end of October.

With on-chain data showing fewer selloffs and increased network activity, the coin could record gains over the next few weeks.

Ethereum Investors Move Coins Off Exchanges, Confidence on the Rise

According to CryptoQuant, ETH’s exchange reserve has declined consistently over the past few months. It sits at a nine-year low of 16.38 million ETH at press time, signaling that fewer coins are being held on centralized platforms for potential selling.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Exchange Reserve. Source:

CryptoQuant

Ethereum Exchange Reserve. Source:

CryptoQuant

ETH’s exchange reserve tracks the total amount of the coin held in wallets associated with centralized exchanges. When the figure rises, it usually indicates that holders are moving their assets to exchanges, potentially preparing to sell or trade them.

Conversely, a declining reserve suggests that investors are transferring their coins into cold storage or long-term custody, reflecting a lower intention to sell.

In ETH’s case, the steady fall in exchange reserves indicates growing investor confidence and long-term holding behavior.

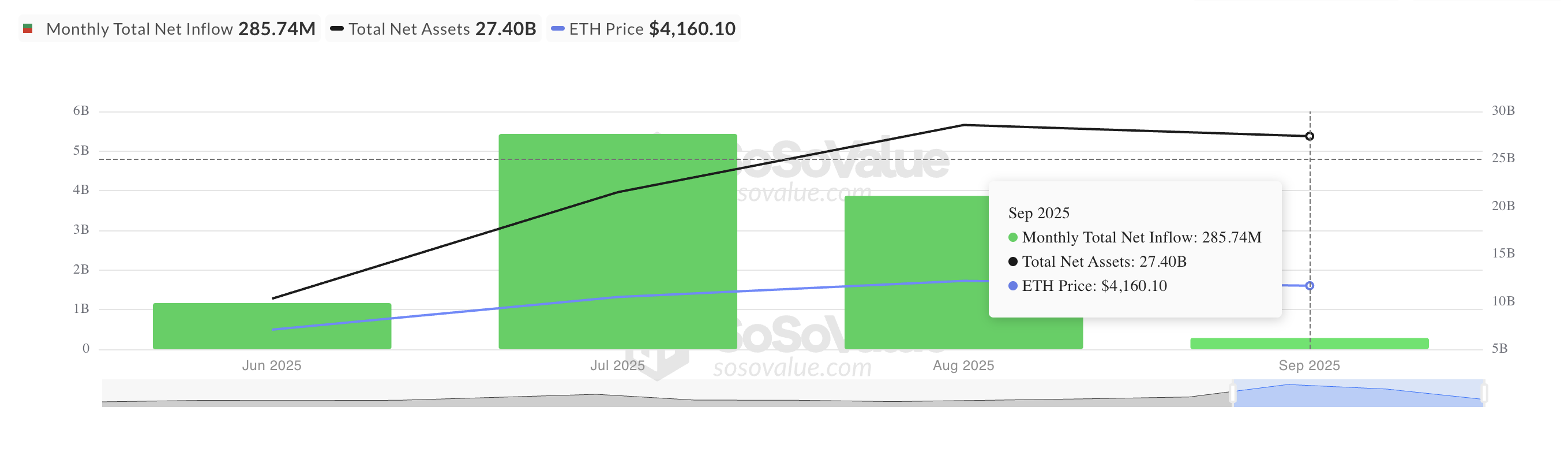

A large part of this trend has been attributed to swelling institutional accumulation. According to SosoValue data, monthly net inflows into spot ETH exchange-traded funds (ETFs) totaled $286 million in September.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

If this continues, it could tighten ETH’s supply and reduce immediate sell pressure.

Ethereum Daily Transactions Soar—What It Means for Price

Ethereum has also begun to see a rise in network activity, which could aid ETH’s rally over the next few weeks.

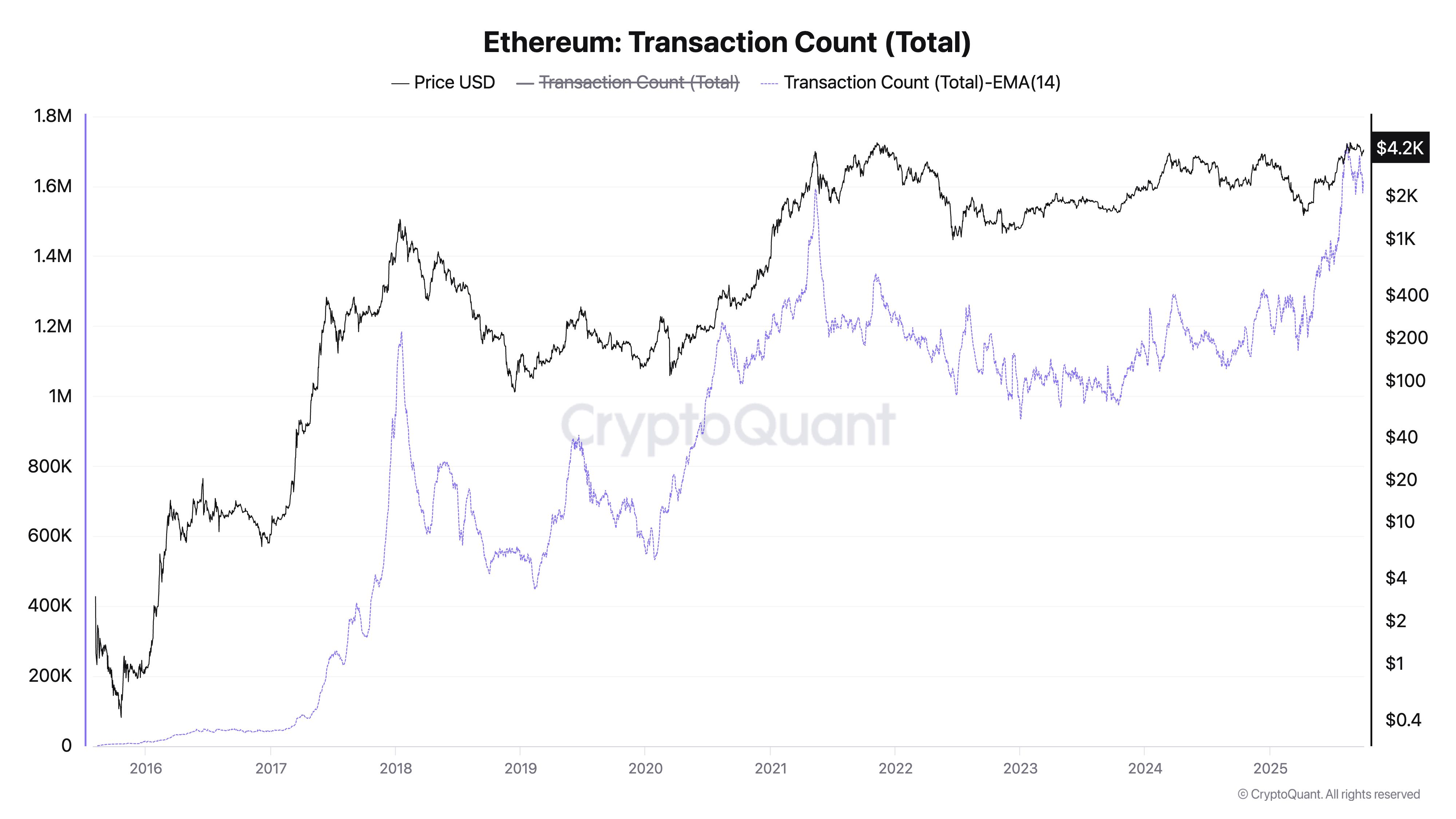

In a new report, pseudonymous CryptoQuant analyst Darkfost argued the current expansion in the decentralized finance (DeFI) activity is driving an increase in Ethereum’s on-chain activity.

According to the report, daily transactions on the Layer-1 (L1) network have broken out of a four-year range, reaching an unprecedented 1.6–1.7 million. This marks the “highest levels ever recorded on Ethereum,” Darkfost added.

Ethereum Transaction Count. Source:

CryptoQuant

Ethereum Transaction Count. Source:

CryptoQuant

Higher transaction volumes on Ethereum like this often result in greater demand for its native coin, ETH, which is used to settle transactions on the L-1. If this growth continues, the demand for ETH rises, which can also push up its price.

Ethereum Eyes $4,500 in October, But Risks Loom at $3,875

At press time, ETH trades at $4,308. If the historical trend holds—sustained by the current bullish momentum—and the coin records its average 4.77% gain, it could close October around $4,500.

While this remains below its all-time high of $4,957, it would still mark welcome growth given the lackluster momentum across the broader market.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if bullish trends reverse and selloffs strengthen, ETH’s price could slip toward $4,211 and potentially extend losses to $3,875.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

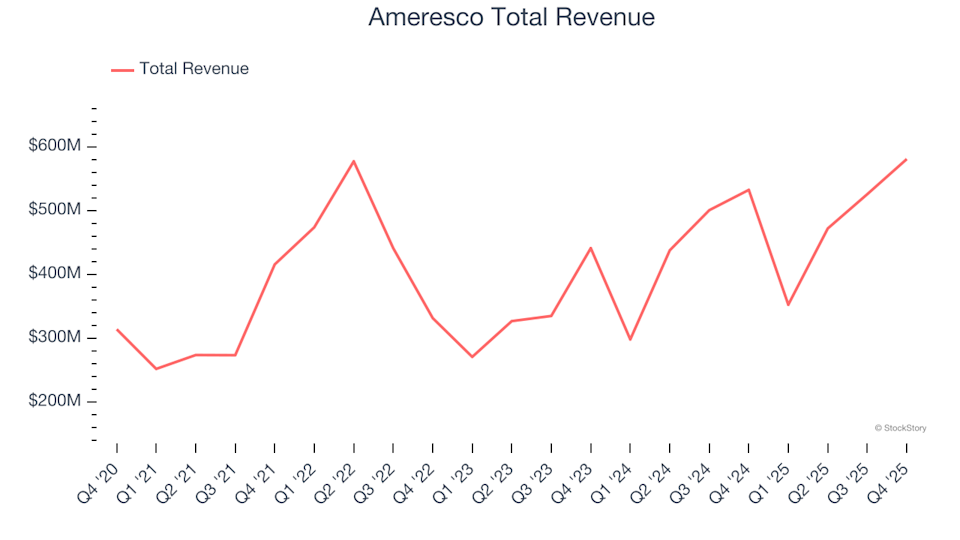

Unveiling Q4 Results: How Ameresco (NYSE:AMRC) Compares With Other Construction and Engineering Companies

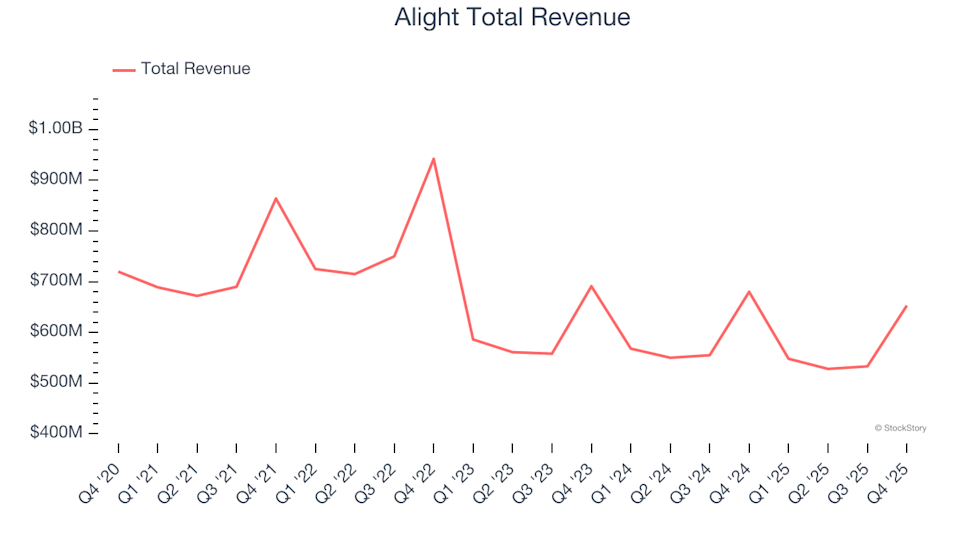

Professional Staffing & HR Solutions Q4 Performance: Comparing Alight (NYSE:ALIT)

CLARITY Act Deadlock: The $500 Billion Deposit Exodus That Worries Banks

China’s yuan drops to lowest level in a month versus strengthening US dollar amid rising Iran tensions