US Government shutdown freezes SEC reviews, altcoin ETF floodgates remain shut

The US government shutdown delayed the approval of exchange-traded fund (ETF) filings by the Securities and Exchange Commission (SEC), which puts the “altcoin ETF floodgates” on hold.

Under its “Operations Plan Under a Lapse in Appropriations & Government Shutdown”, the SEC says it “will not review and approve… new financial products,” will not “accelerate the effectiveness of registration statements,” and will not “provide non-emergency support to registrants.”

In practice, this freezes the more than 100 crypto-related filings until funding is restored, including the S-1 effectiveness work that issuers need to complete to launch spot products.

As Nate Geraci, President of NovaDius Wealth, posted on Oct. 1:

“Looks like a prolonged government shutdown would definitely impact the launch of new spot crypto ETFs… ETF Cryptober might be on hold for a bit.”

Issuers had primed October as the month when altcoin ETFs would finally clear the runway, but then the government shut down.

Approval batch delayed

The timing stings because the policy plumbing had just been simplified. The SEC adopted a generic listing standard for crypto exchange-traded products on Sept. 17, eliminating the need for token-specific 19b-4 filings.

The new pathway streamlines what had been an asset-by-asset review. Reports surfaced that the SEC requested issuers to withdraw previous altcoin ETF filings so that they could be approved through the standard process.

Bloomberg ETF analyst Eric Balchunas said that the reported move increased the odds of altcoin ETF approval to 100%. Additionally, issuers reportedly expressed “high conviction” that Solana spot ETF approvals could happen between Oct. 6 and 10.

That calendar is now threatened. The SEC’s plan is explicit about what stops during a lapse: no reviews, no accelerations, and no new product approvals. Even with listing standards in place and prospectuses updated, launches require staff action that the agency won’t take during a shutdown.

Nevertheless, none of this reverses the policy trajectory. The generic-standards framework still lowers friction once doors reopen, and the Solana cohort remains first in line.

For now, the altcoin ETF floodgates stay shut. When appropriations return, the backlog becomes a sequencing problem rather than a policy one.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

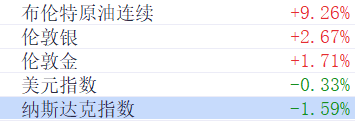

Analysis of the Reasons Behind Yesterday's Surge in Crude Oil Prices

Grocery Outlet plans to shut down numerous locations following rapid overexpansion

HELOC and home equity loan interest rates on Saturday, March 7, 2026: Responding to a Federal Reserve rate hold