Donald Trump Jr. and Zach Witkoff Announce That USD1 Stablecoin Is Coming to Aptos (APT) Chain

World Liberty Financial’s ( WLFI ) stablecoin, USD1, is integrating with the layer-1 chain Aptos ( APT ).

The decentralized finance (DeFi) project’s co-founders, Donald Trump Jr. and Zach Witkoff, announced the integration, which begins on October 6th.

USD1, which aims to maintain a 1:1 peg with the US dollar, is already available on Ethereum ( ETH ), Solana ( SOL ), TRON ( TRX ), the BNB Smart Chain ( BNB ) and the real-world asset (RWA)-focused chain Plume ( PLUME ).

World Liberty’s native token, WLFI, launched public trading at the beginning of September.

A corporate entity linked to President Donald Trump and his family has slashed its equity stake in World Liberty over the course of the year.

The Trump-affiliated company DT Marks DEFI LLC previously owned a 60% stake in the DeFi project.

Fine print on the platform’s website now indicates DT Marks owns approximately 38% of the equity interests in WLF Holdco LLC, which holds the only membership interest in World Liberty Financial.

World Liberty notes that WLF Holdco holds all the rights to net protocol revenues from the DeFi platform, except for net proceeds from the sale of WLFI tokens. The platform also says neither Trump nor any of his family members “is an officer, director or employee of, WLF Holdco LLC or World Liberty Financial.”

However, the DeFi project’s website notes that DT Marks DEFI LLC and “certain family members of Donald J. Trump” hold 22.5 billion WLFI tokens.

WLFI is trading at $0.204 at time of writing.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.

How iRobot Strayed from Its Original Path

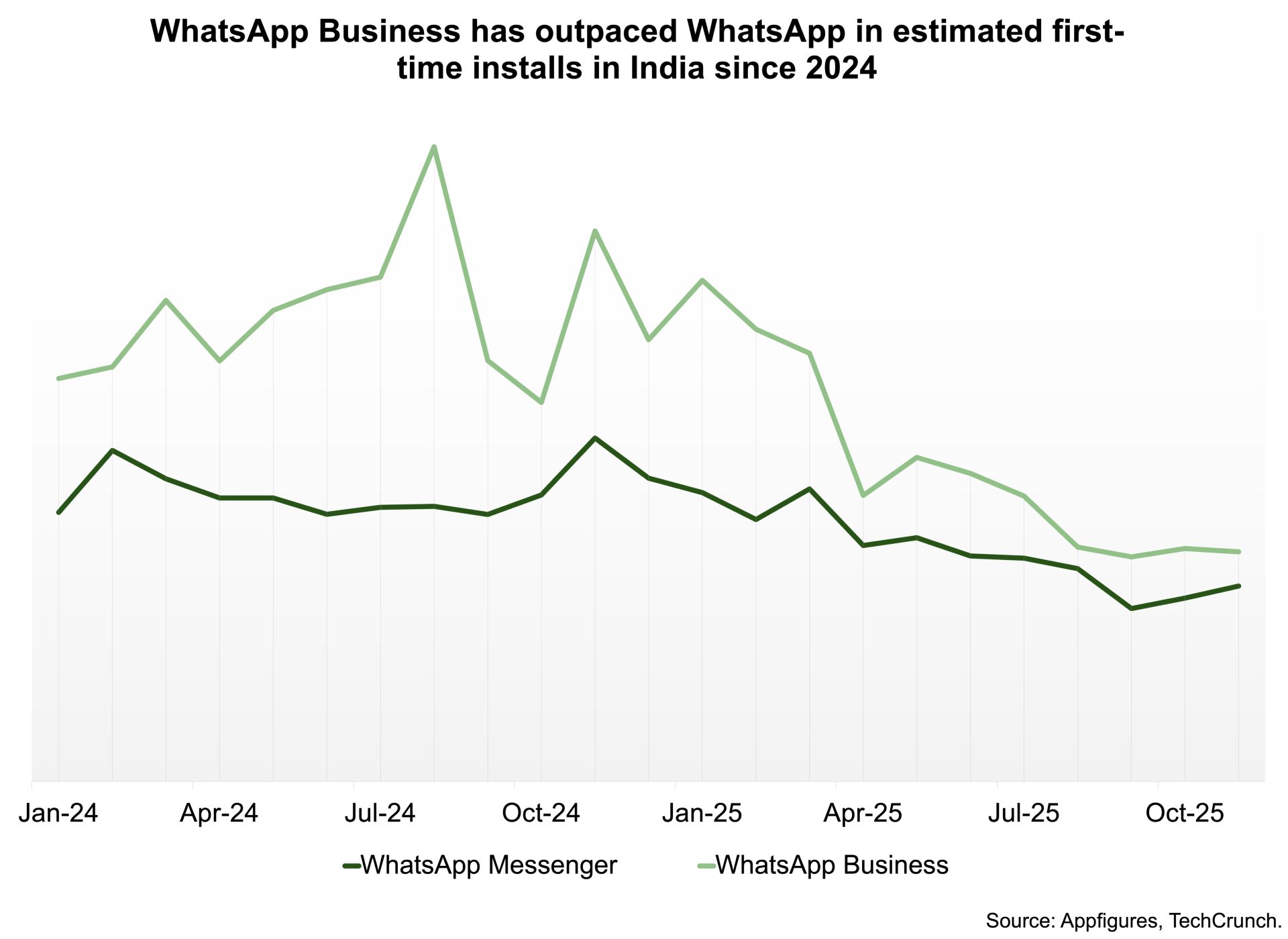

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t