Bitcoin UTXO Dips to 17-Month Lows, Indicates Re-Accumulation among HODLers

Bitcoin ($BTC) is making waves in the market with significant price progress amid a notable decrease in UTXO. Hence, Bitcoin’s Unspent Transaction Output (UTXO) count has dropped to the 17-month low spot of 166.6M, highlighting re-accumulation among the $BTC HODLers. As per the data from the popular crypto analyst going by, CryptoOnchain, this notable development comes parallel to the massive price surge of Bitcoin ($BTC). Keeping this in view, the growing whale accumulation and the price spike indicate the wider bullish outlook.

🚨 Bitcoin UTXO count drops to 166.6M – lowest since April 2024

— CryptoOnchain (@CryptoOnchain) October 4, 2025

While UTXOs fell 11%, BTC surged from 99K → $122K 📈

Signs point to:

• Whale accumulation 🐋

• HODLers holding strong 💎

• Market in re-accumulation phase

Despite ATH prices, nobody’s selling. Bullish?#Bitcoin… pic.twitter.com/D05MhUo0w2

Bitcoin UTXO Count Drops to 17-Month Bottom, with Whales Entering Re-Accumulation

With a drop to 166.6M, the Bitcoin UTXO count stands at its 17-month low point, signifying a rise in the re-accumulation of $BTC among whales. This figure reportedly underscores an 11% dip since April 2024. In addition to this, the respective development also highlights the shifting market behavior at large. At the same time, the price trajectory of the flagship crypto asset is also considerably optimistic with continuous upswings.

Based on the market data, the minimized UTXO count of Bitcoin points toward the decrease in on-chain activity irrespective of rising valuation. Hence, the top crypto asset is going through a broad-scale accumulation among the big holders. Therefore, by holding instead of selling their $BTC coins, the holders present notable consolidation while the price has jumped above the $122K mark.

Particularly, Bitcoin ($BTC) is now hovering around $122,422.31, indicating a 2.1% price spike over 24 hours. Similarly, the market capitalization of the leading cryptocurrency stands at $2.44T, denoting a 2.11% rise. Additionally, with a 25.28% increase, Bitcoin’s 24-hour volume has climbed to the $83.24B mark. Simultaneously, the drop in UTXO count supports the idea that Bitcoin market is now entering another re-accumulation phase rather than a distribution period.

UTXO Plunge and Price Rally Indicate Bullish Outlook for Bitcoin’s Potential Leg Up

According to CryptoOnchain, the bullish price growth and parallel UTXO dip to 166.6M hint at the start of an exclusive $BTC re-accumulation wave. In this respect, the investor sentiment is surging to a great extent. Ultimately, the consolidation, rather than panic selling, triggers speculation of Bitcoin’s movement toward another potential leg up in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

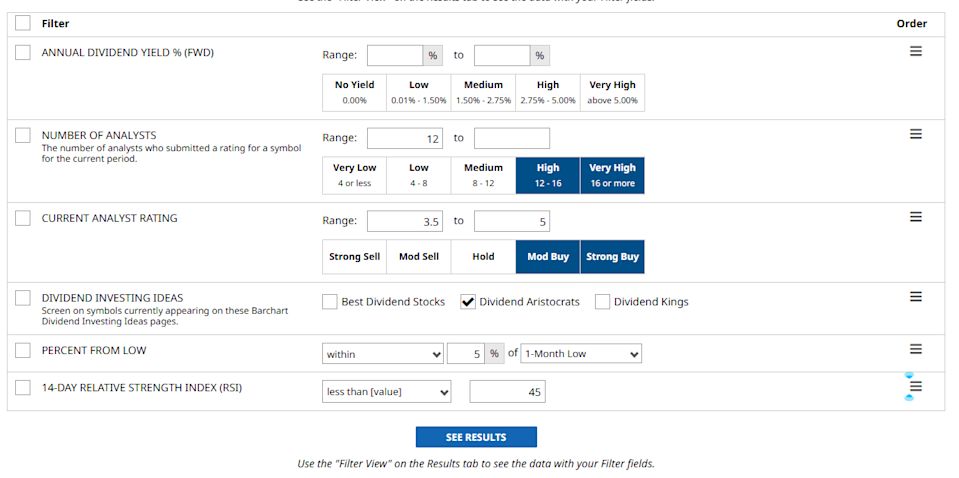

These three Dividend Aristocrats appear poised for a comeback in 2026. Is now the right time to invest in them?

MoonPay Taps Dreamcash for Fast and Seamless Fiat On-Ramps Trading

Top 3 Altcoins With 300% Growth Potential

Bitcoin's bull catalyst could be AI stocks becoming 'silly big': Lyn Alden