- Bitcoin hits an all-time high weekly candle close.

- Strong buying momentum seen across the market.

- Investors eye new highs as bullish trend strengthens.

Bitcoin has just printed its highest weekly candle close in history, marking a major milestone for the world’s largest cryptocurrency. This key technical event indicates strong bullish momentum and shows that investor confidence remains high despite market volatility.

A weekly candle close refers to the price level at which Bitcoin finishes trading for the week. When it ends higher than any previous week in history, it signals that buying pressure is outweighing selling, and the market is leaning towards a continued uptrend.

This historic close suggests that Bitcoin is not only holding its recent gains but building on them, potentially setting the stage for another breakout.

What Does This Mean for the Market?

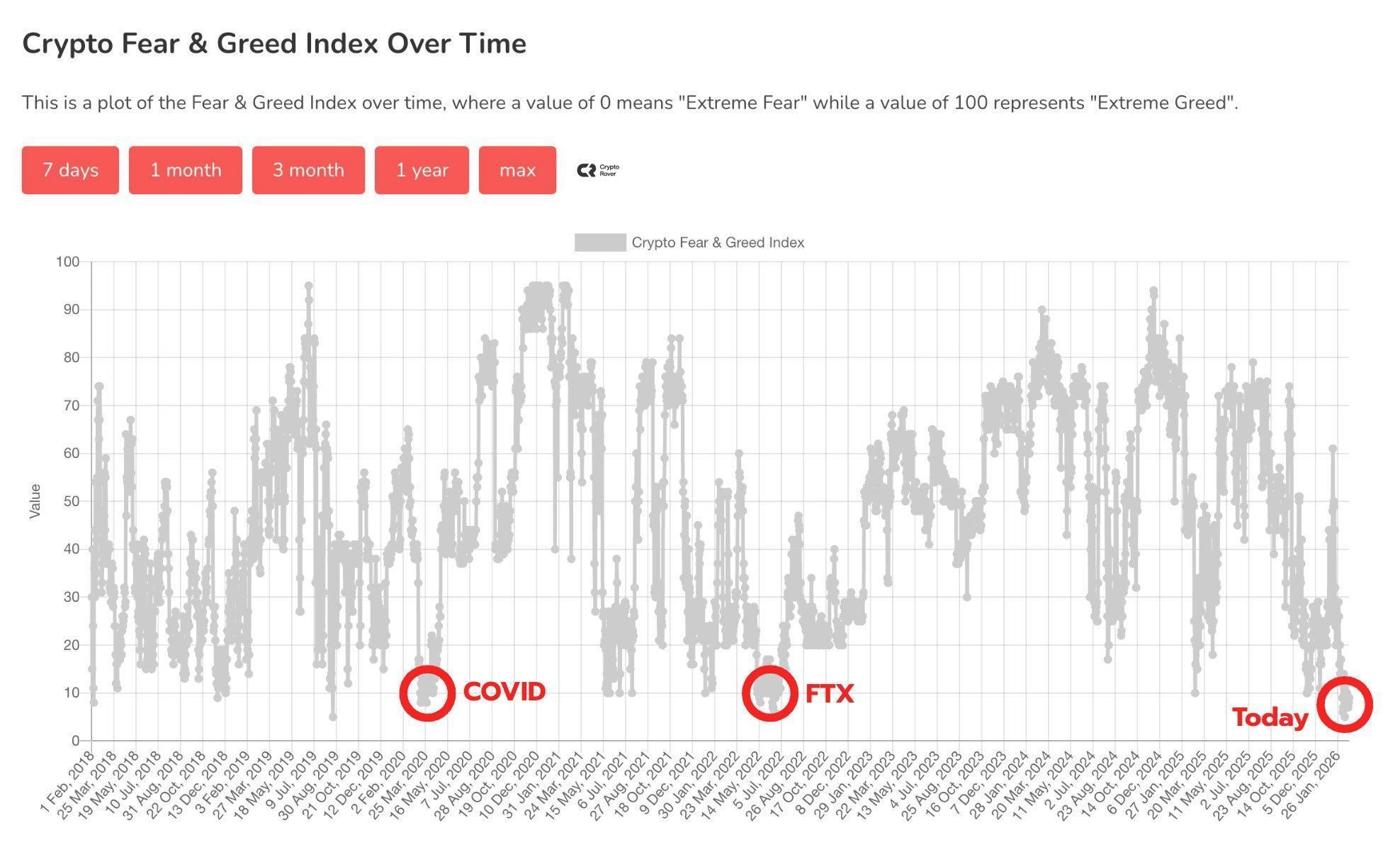

Reaching a new all-time weekly close could trigger a new wave of FOMO (fear of missing out) from retail and institutional investors alike. Historically, such price action has often preceded parabolic runs, as confidence grows and market sentiment shifts further into bullish territory.

Bitcoin’s resilience at this level indicates a strong support base. With institutional interest still on the rise and macroeconomic conditions favoring digital assets, this weekly close may be the spark that lights the next rally.

Traders will now be watching closely for the next daily and monthly closes to confirm whether Bitcoin can sustain this bullish momentum. Technical analysts are eyeing key resistance zones, but if this upward trend continues, new all-time highs could be on the horizon.

Eyes Set on New Highs

The crypto community has erupted with excitement, and social media is buzzing with calls for a potential breakout. If Bitcoin holds above this weekly close level, the market may see rapid acceleration toward uncharted territory.

With strong fundamentals, increasing adoption, and growing institutional support, Bitcoin appears ready for its next major move.