US-Listed Company Announces Unexpected Altcoin Investment! Here Are the Details

Silo Pharma, a company specializing in biopharmaceutical and cryptocurrency treasury management, announced the acquisition of ResearchCoin (RSC) as part of its digital asset strategy.

According to its official statement, the company aims to capture long-term value from multiple blockchain opportunities with this move.

ResearchCoin (RSC) stands out as the native token of ResearchHub, the decentralized scientific research platform founded by Coinbase CEO Brian Armstrong in 2019.

The platform aims to reshape scientific collaboration with blockchain technology. Silo Pharma CEO Eric Weisblum said, “With our investment in RSC, we are joining the growing decentralized science (DeSci) movement while also providing diversification and potential value growth for our shareholders.”

“The ResearchCoin investment demonstrates our commitment to modernizing scientific collaboration and supporting blockchain-driven innovation at the core of biomedical discovery.” Following the development, the RSC price rose by around 4% in the last 24 hours. The token has a market capitalization of $60 million and is listed on Coinbase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BMY Shares Dip 0.05% on Mixed Signals $1.1B Volume 117th NYSE Rank Highlight Dividend-Earnings Divide

Great Elm Capital: A High-Quality Choice Amid Challenges in the BDC Industry

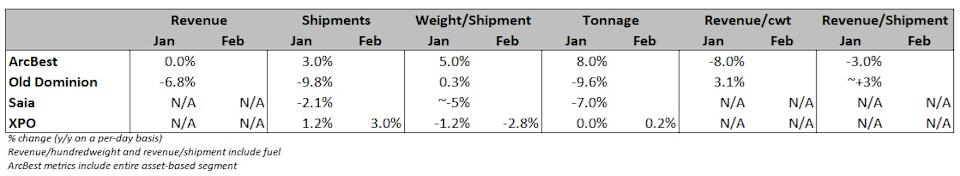

XPO’s freight volume sees growth in February