Pi Coin Price Needs to Reclaim $0.27 For Recovery — But the Math Isn’t Adding Up

Pi Coin’s price action remains puzzling. After months of losses, retail buyers are stepping in, but institutional money is slowing down. Unless both align, Pi’s rebound above $0.272 might not last.

Pi Coin’s price action has been an enigma. Year-on-year, it’s down nearly 70%. Over the past month, it has slipped 22.8%, and it’s just 3.7% away from its all-time low. Even in the past seven days, the Pi Coin price is still down 1.2%.

However, today’s 1.7% uptick offers a flicker of green. The problem is, every time Pi Coin moves up, it fails to hold those gains — producing short-lived surges instead of sustained recoveries. A similar short recovery might be forming again, but this time, diverging money flows show that the real tug-of-war lies between retail and institutional players.

Retail Buys the Dips, Big Money Steps Back

On-chain indicators tell a split story between small and large holders.

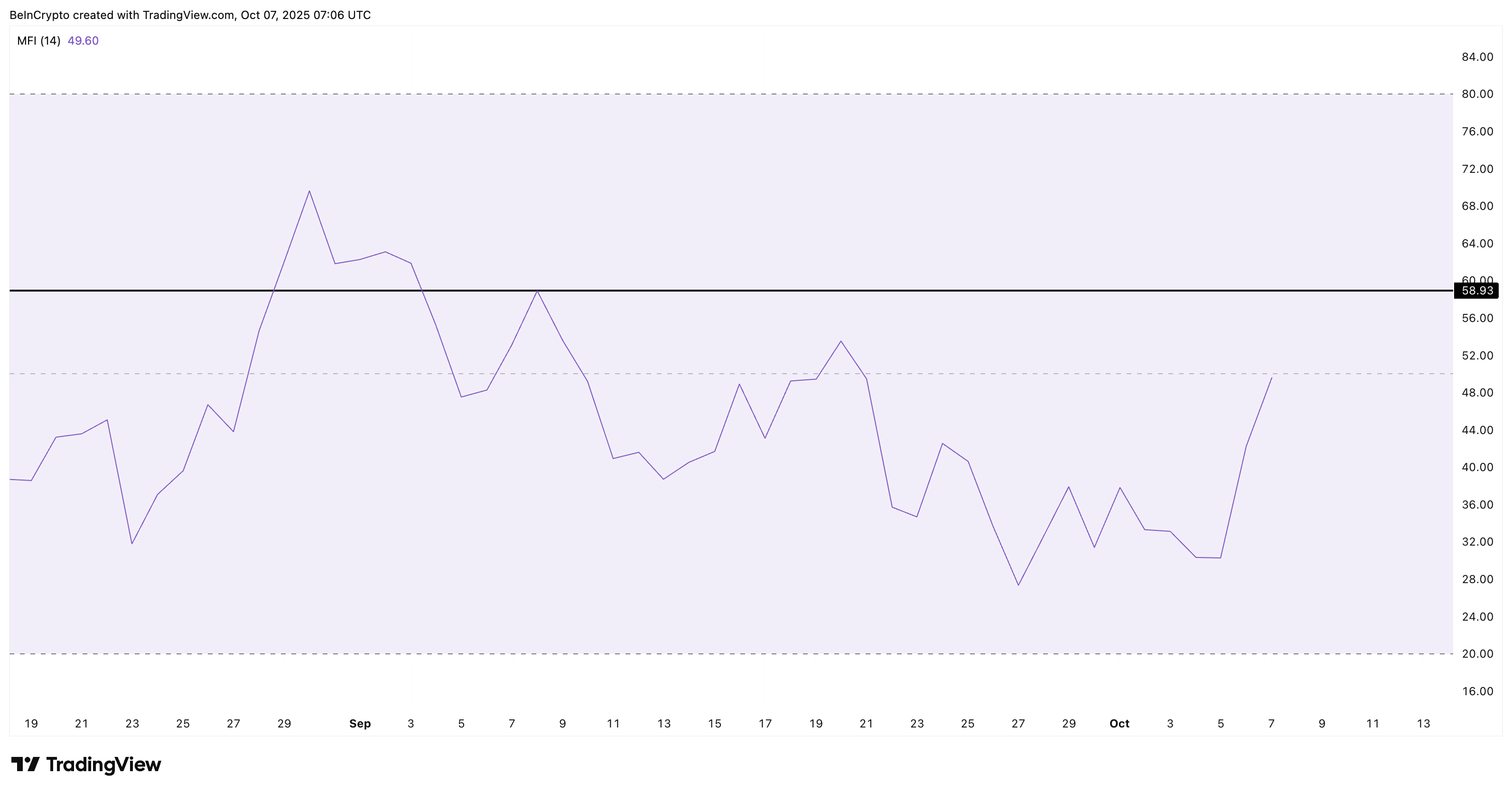

The Money Flow Index (MFI), which measures buying and selling pressure by combining both price and volume data, is rising. This means retail traders are buying dips and showing interest even as the Pi Coin price stays near historic lows.

Pi Coin Sees Retail Dip-Buying Action:

TradingView

Pi Coin Sees Retail Dip-Buying Action:

TradingView

For retail strength to build further, the MFI needs to move above 59, one of the earlier local highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

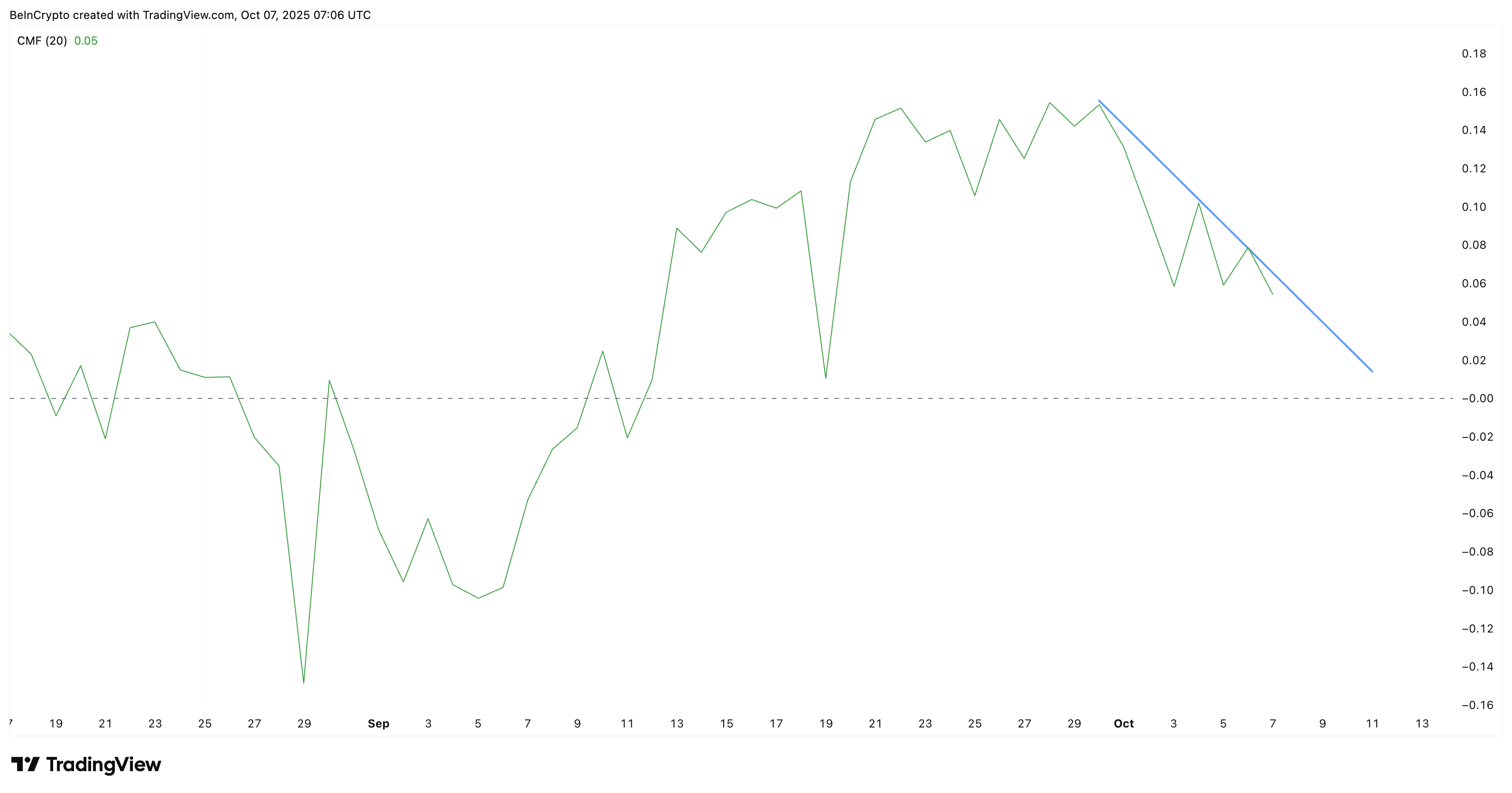

In contrast, the Chaikin Money Flow (CMF) — a tool that tracks how much capital is entering or leaving an asset based on where prices close within their daily range — is trending downward. It’s still above zero, so big money hasn’t left completely, but it’s making lower highs, a sign that institutional inflows are cooling off.

Pi Coin Seeks Weak Big Money Flows:

TradingView

Pi Coin Seeks Weak Big Money Flows:

TradingView

This divergence is key: retail investors are showing optimism, but institutions are cautious. When MFI and CMF move in opposite directions, it often signals that a rally attempt could lack the strong backing needed to last. In other words, Pi’s math doesn’t add up yet — the energy is there, but the capital isn’t.

Short-Term Pi Coin Price Chart Shows a Flicker of Strength

To track Pi Coin’s short-term behavior, the 4-hour chart offers a clearer picture of immediate momentum. Unlike daily charts that highlight broader moves, the 4-hour setup shows how traders are reacting in real time.

Here, Pi is trading within an ascending triangle (led by the ascending trendline acting as support), a pattern that generally signals accumulation before a breakout. The Bull-Bear Power (BBP) indicator — which measures whether buyers or sellers dominate — has flipped from red to green since October 2, confirming that short-term momentum is leaning bullish.

Pi Coin Price Analysis:

TradingView

Pi Coin Price Analysis:

TradingView

The key levels to watch are clear: $0.272 is the immediate resistance zone. A 4-hour candle close above $0.272-$0.278 could confirm renewed strength and potentially lift Pi toward $0.291.

However, a drop below $0.258 would break the short-term structure and send the PI price back into bearish territory.

For now, Pi Coin’s chart looks cautiously optimistic — but only if both sides of the market, retail and institutional, decide to add their weight to the same side of the equation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amer Sports Climbs to 206th in Trading Volume Following a 367% Jump as Shares Drop 2.56% in Unexplained Sell-Off