BSC DEX volume surges to $6.05b amidst meme coin boom

BSC DEX trading volume reaches its highest peak since June 2025, surging to $6.05 billion on Oct. 8. The rise comes just as meme coin traders dominate BNB Chain.

- Daily DEX trading volume on Binance Smart Chain surged to $6.05 billion on Oct. 8, with most of it coming from PancakeSwap’s $4.28 billion contribution.

- Meme coin season on BNB Chain has brought major gains, with 70% of traders profiting and total on-chain profits reaching $401 million.

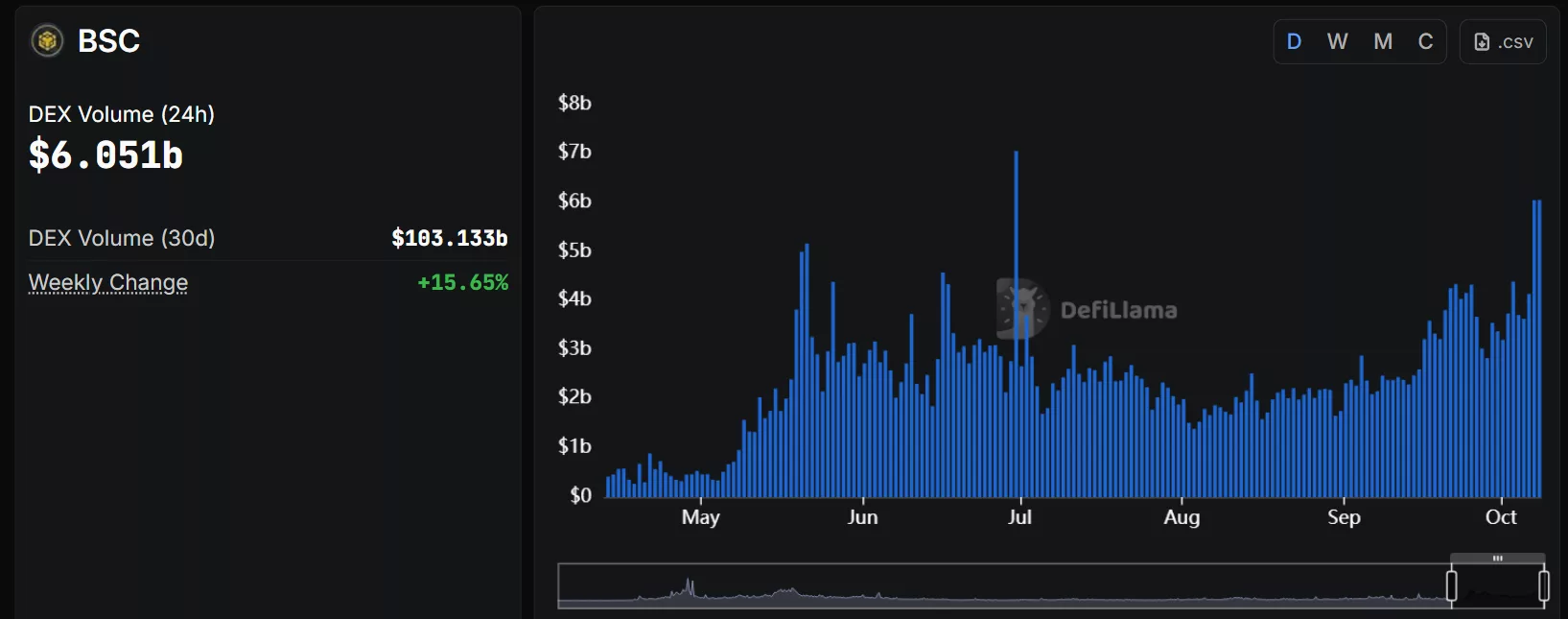

According to data from DeFi Llama, on Oct. 8 the daily DEX trading volume for Binance Smart Chain or BSC has risen to $6.05 billion, the highest its been since June 2025. At the moment, the number is still about $1 billion below its highest peak for DEX trading on the BNB Chain which stood at $7.05 billion on June 30, 2025.

In the past month, the DEX trading volume on Binance ( BNB ) Smart Chain has amounted to $103.13 billion with a weekly increase of 15.65%. The majority of DEX trading volume on BNB Chain comes from the BNB meme coin launchpad PancakeSwap ( CAKE ), which accounts for $4.28 billion of the daily DEX trading volume.

BSC DEX trading volume has reached its highest level since June 2025 | Source: DeFi Llama

BSC DEX trading volume has reached its highest level since June 2025 | Source: DeFi Llama

In the past month, PancakeSwap has contributed about $78 billion of the total $103.13 billion volume of on-chain DEX trading. Coming in at second place is Uniswap ( UNI ) with $1.30 billion in daily DEX trading volume. Meanwhile, the third largest contributor of DEX trading volume is none other than another meme coin launchpad on BNB Chain, Four.meme.

As of Oct. 8, Four.meme has generated about $139.15 million in daily trading volume on-chain. Meanwhile, its 30-day DEX trading volume hinges just below $1 billion, with $815 million in total.

BSC traders reap 70% profits from meme coin season

Meme coin season has officially begun on the BNB Chain, with former Binance CEO Changpeng Zhao announcing it through his X account. The founder seemed surprised at the turn of events, considering just a few months ago meme coins were mostly backed by Solana ( SOL ) and launched through platforms like Pump.fun.

However most recently, more traders have been gravitating towards BSC to launch and trade their meme coins backed by BNB.

According to on-chain data from BubbleMaps, more than 100,000 on-chain traders have bought new meme coins on BNB Chain. The data shows that about 70% of BNB meme coin traders have gained profit.

One trader made more than $10 million in profit from trading BNB meme coins, meanwhile 44 wallets gained $1 million worth of profit. In addition, around 900 traders made $100,000 by trading BNB meme coins.

However, the majority of traders made only about $1,000 in profit, a relatively small number compared to the total profit made on-chain which amounted to $401 million.

As for losses, two traders lost more than $1 million from trading BNB meme coins. Despite this, only about 4,418 traders experienced losses of about $1,000 by trading meme coins on BSC. This means that the winners still outweigh the losers throughout this meme coin season so far.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Oil prices may surpass $90 following Iran's attacks, but are expected to decline subsequently

XRP Risks Losing 50% vs Bitcoin After Unfortunate February Closing

Polymarket Breaks $478 Million Record as Kalshi Khamenei Market Sparks Backlash

+600 Billion Shiba Inu (SHIB) Exchange Injection Spotted Amid Price's Critical Turnaround