Hedera (HBAR) Turns to Whales to Save Price From a 10% Dip

Hedera’s (HBAR) price is struggling to stay above support as selling pressure builds. While whales are adding to their holdings, smart money isn’t showing the same confidence, leaving the token exposed to a possible 10% drop if $0.21 breaks.

Hedera (HBAR) hasn’t managed to register decent October (‘Uptober’) gains like some other major altcoins, including ETH and BNB. The token is down nearly 6% over the past 24 hours, showing growing weakness on shorter timeframes. Even with a 1.4% gain in the past seven days, the overall HBAR price trend still doesn’t lean completely bullish.

Despite that, large holders continue to add to their stacks — even as the broader market sentiment stays cautious.

Whales Accumulate as Smart Money Steps Back

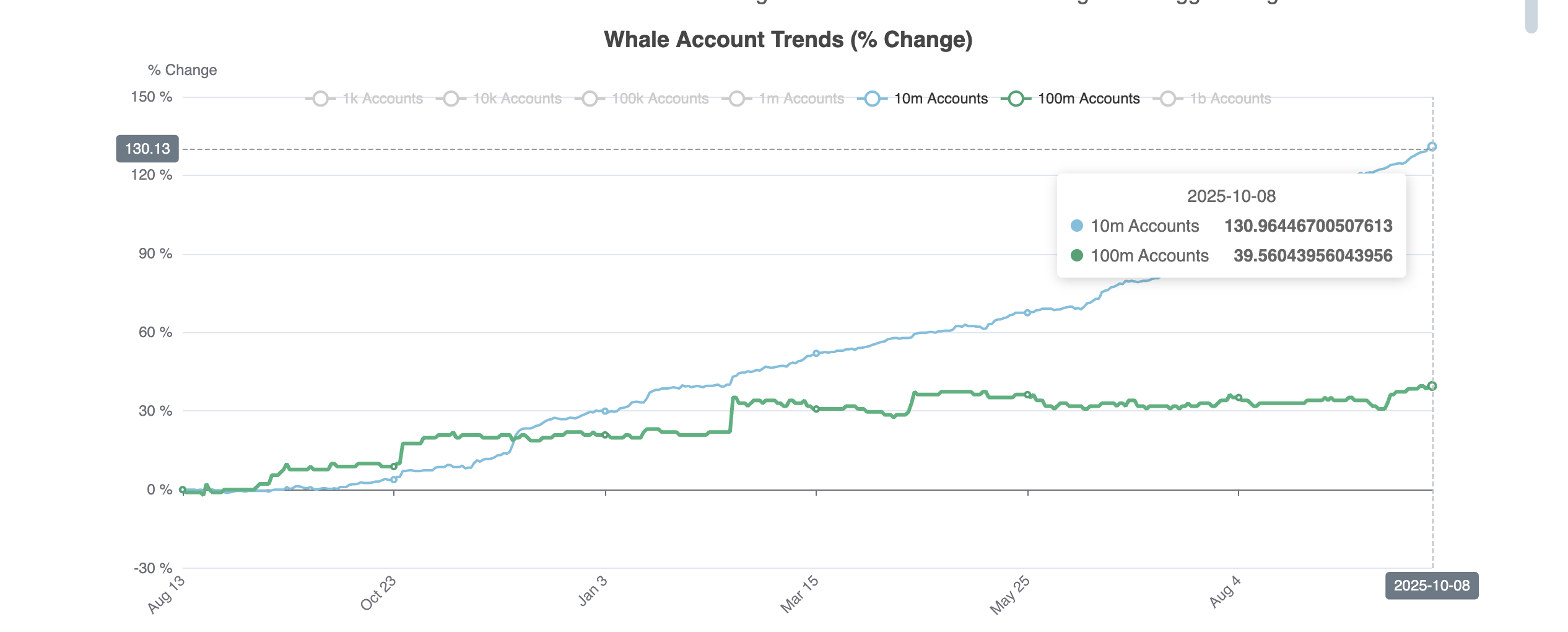

On-chain data shows a clear divide between long-term whale accumulation and short-term trader caution.

Addresses holding more than 10 million HBAR have increased from 129.18 to 130.96, while wallets with over 100 million HBAR grew from 38.46 to 39.56 since October 6.

That’s roughly 127.8 million HBAR — at minimum — added by whales, worth around $26.8 million at the current HBAR price.

HBAR Whales Saving The Price From Crashing:

HBAR Whales Saving The Price From Crashing:

This quiet buying from whales often signals accumulation during uncertainty, helping prevent steeper selloffs. But the optimism stops there.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

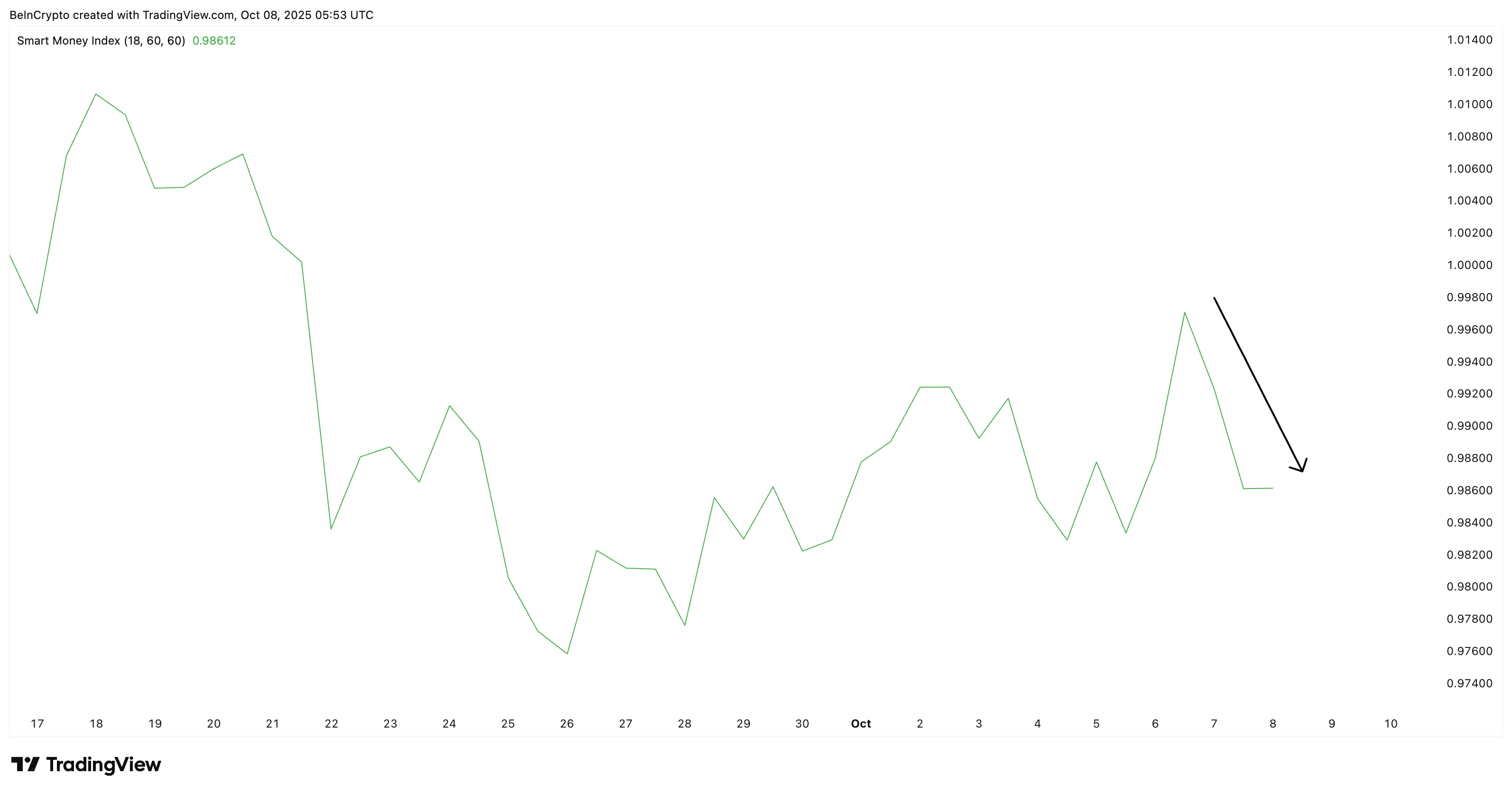

The Smart Money Index (SMI) — which tracks activity from historically successful traders — has flattened after dropping from its October 6 local peak. This means high-confidence investors are no longer positioning for a quick HBAR price rebound.

HBAR Doesn’t Excite Smart Money:

HBAR Doesn’t Excite Smart Money:

Such divergence between whale accumulation and smart money retreating usually suggests a period of sideways or downward movement.

In simple terms, whales might be buying dips for the long term, but the absence of aggressive smart money signals that near-term price recovery looks unlikely.

HBAR Price Chart Shows Rising Wedge Risk

On the 12-hour chart, HBAR trades inside a rising wedge pattern, typically considered bearish. Prices are testing the lower trendline near $0.21, a key support zone that has held multiple times since late September.

If $0.21 breaks, the next downside targets lie at $0.20 and $0.19, marking a potential 10% dip from current levels. The zone around $0.20 could offer temporary support, but $0.19 remains the critical level to watch.

HBAR Price Analysis:

HBAR Price Analysis:

Adding to this, the Bull-Bear Power (BBP) indicator — which compares buyer and seller strength — has turned red again. A correction followed the last red shift on Sept 4 before bulls managed a short-lived recovery.

For now, the bears remain in control. A daily or 12-hour candle close above $0.23 would invalidate this bearish structure and hint at renewed strength.

Until that happens, HBAR’s best hope for avoiding a deeper correction lies with continued whale accumulation — and a change in sentiment from smart money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Bancorp's 82% Trading Volume Spike Fails to Offset 0.79% Drop Ranks 218th in Market Activity

Stryker Falls 2.98%, Ranking 198th in Trading Volume as Tariff Concerns Meet Earnings Hopes

Okta's Stock Surges 11.03% on Earnings Beat, Ranks 207th in U.S. Trading Volume

IonQ's Stock Plummets 2.99 as $1.8 Billion Acquisition Drives Rank 196 Trading Volume Amid Financial Risks