Imagine You Had XRP Buy Orders in at $1.30 and Bought 10M XRP on a “Sure Thing”

XRP market commentators are highlighting a silver lining for investors in the wake of the overnight shock that rattled the entire crypto market.

While XRP suffered a violent flash crash, those who were properly positioned for the event are already reaping massive rewards from the outcome.

For context, XRP’s price plunged from $2.83 to $1.25 within hours before swiftly rebounding to $2.45. The move represented a 56% drop followed by a 100% recovery, one of the most volatile 24-hour periods in recent memory.

“Only Insiders Knew”

The sudden collapse has sparked debate within the XRP community about what truly caused the crash and who may have profited from it.

Vincent Van Code, a software engineer and prominent member of the XRP community, described the market chaos as something only “insiders who shorted” could have anticipated.

He dismissed claims from analysts who said they had “predicted” the crash, calling them lucky at best. “Saying it will crash week in and week out doesn’t make you a TA genius,” he said. “It’s just playing the odds.”

Van Code pointed to the lack of regulatory oversight in the crypto market, contrasting it with traditional stock trading, where such rapid collapses would likely trigger circuit breakers and formal investigations.

Trump’s Tariff Shock Triggers Market Meltdown

On Friday evening, President Donald Trump announced plans to impose a 100% tariff on Chinese imports starting November 1. This comes on top of the existing 30% tariffs, marking a new escalation after months of relative trade calm.

Markets reacted sharply: the Dow dropped 878 points (1.9%), the S&P 500 fell 2.7%, and the Nasdaq tumbled 3.5%.

A previous spike to 145% tariffs had briefly choked U.S.-China trade, before both nations agreed in May to roll back the rates.

Imagine You Bought 10M XRP at $1.30

As global markets reeled, some opportunistic buyers who had placed deep limit orders may have massively benefited from the flash crash.

When XRP briefly traded under $1.30, buying 10 million XRP would have cost less than $13 million. With the current price at $2.40, that same position is now worth $24.5 million. This has netted a gain of nearly 100% in less than a day, even as the market is still reeling from the crash.

Analyst Van Code highlighted this in his commentary, stating: “Imagine you had buy orders in at $1.30 and bought 10 million XRP, on a ‘sure thing.’”

He noted that XRP has already gained more than $1 since dipping below $1.30. Accordingly, traders who took advantage of the dip are now in an extremely favorable position.

Interestingly, should XRP break back into the $3 range in the coming days, those who scooped the dip could be up nearly 150%—all on a mere recovery.

Essentially, Vincent Van Code’s statement implies that sometimes the market doesn’t reward skill. Sometimes, it’s just about being in the right place at the right time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

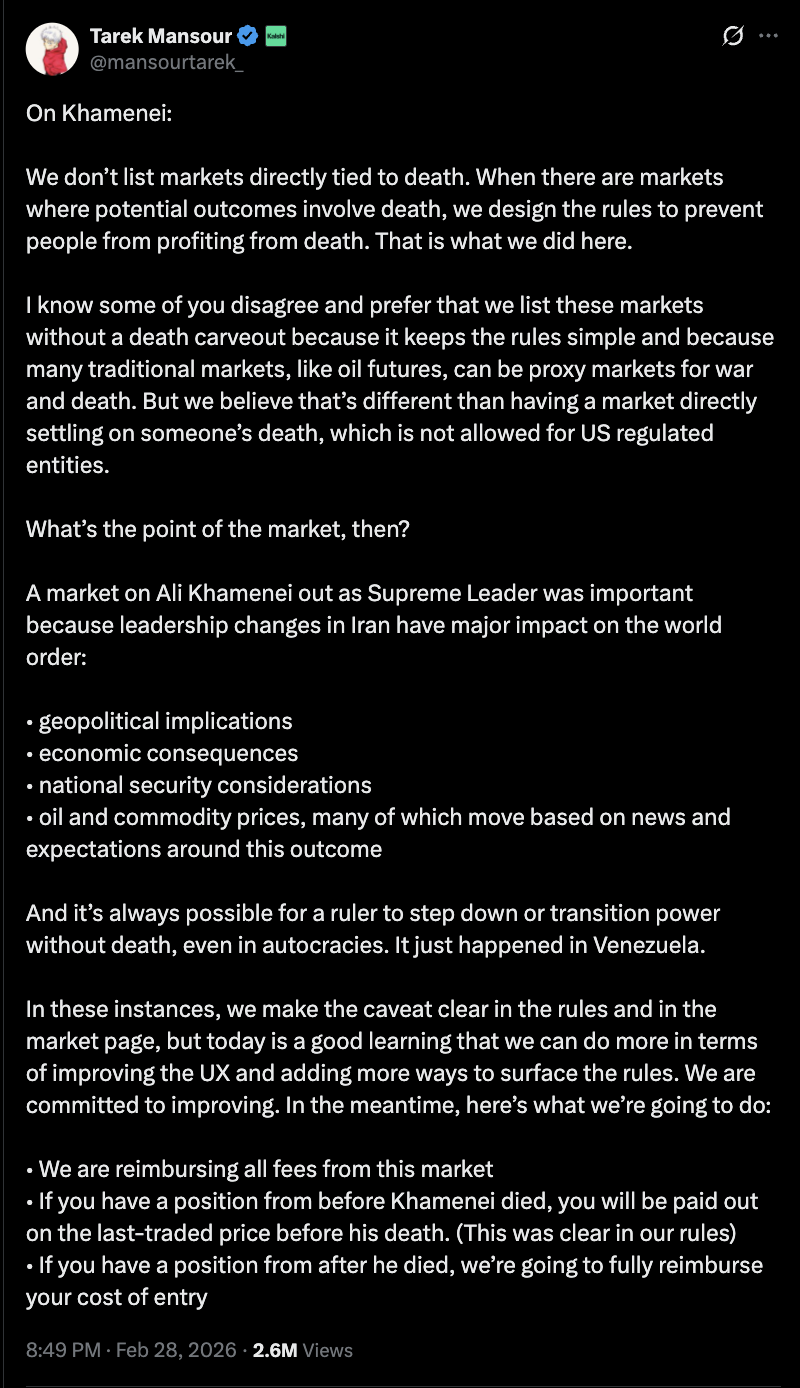

Kalshi founder provides update on Iran's Khamenei market carveout

Solana Jumps 11% as Charts Signal Key Reversal Test

XRP News: Ripple Unlocks 1B Tokens from XRP Escrow

Monday morning early forex indications: Some US dollar buying but nothing dramatic